Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

Page 44<br />

Profi t Rate Swap — Breaking New Frontiers (<strong>continued</strong>...)<br />

Once the swap is engaged and market conditions change,<br />

the market value becomes positive for one party and<br />

negative for the other. The party holding the positive value<br />

thus assumes credit risk. The counterparty could declare<br />

bankruptcy, leaving the party holding the positive value<br />

swap with a claim that is subject to the legal process of<br />

bankruptcy.<br />

In most swap arrangements, netting is legally recognized, so<br />

the claim has a value based on the net amount. This credit<br />

mitigation feature is achieved by the new profi t rate swap<br />

structure developed by The <strong>Islamic</strong> Bank of Asia, which is in<br />

contrast to the higher credit risk inherent in the 2 parallel<br />

Murabahah profi t rate swap structure. This is a signifi cant<br />

milestone in the product development of Shariah compliant<br />

profi t rate swap.<br />

However, as we move into the life of the swap, the market<br />

value to a given party can change from positive to negative<br />

or vice-versa. Hence the party not facing the credit risk at a<br />

given moment is not entirely free of risk because the swap<br />

value could turn positive for it later.<br />

Further, the credit risk in a swap varies during its life. A profi t<br />

rate swap or an interest rate swap has no fi nal principal<br />

payments. The credit risk is therefore greater in the middle<br />

of the life of a swap. This occurs because near the end of<br />

the life of the swap, not many payments remain, so there is<br />

not much money at risk, and at the beginning of the life of<br />

the swap, the credit risk is usually low because the parties<br />

would probably not engage in the swap if a great deal of<br />

credit risk were already present at the start.<br />

Swap rate and credit quality — Incongruent<br />

The parties that engage in swaps are generally of good credit<br />

quality but the fear of default is still a signifi cant concern.<br />

www.islamicfi nancenews.com<br />

Yet surprisingly, the rate that all parties pay on swaps is the<br />

same, regardless of their credit quality. In a plain-vanilla<br />

swap, the fi xed rate is determined by reference to the term<br />

structure for the underlying rate. Therefore, if a party wanted<br />

to engage in a swap to pay LIBOR and receive a fi xed rate, it<br />

would get the fi xed rate based on the LIBOR term structure,<br />

regardless of its credit quality or that of the counterparty.<br />

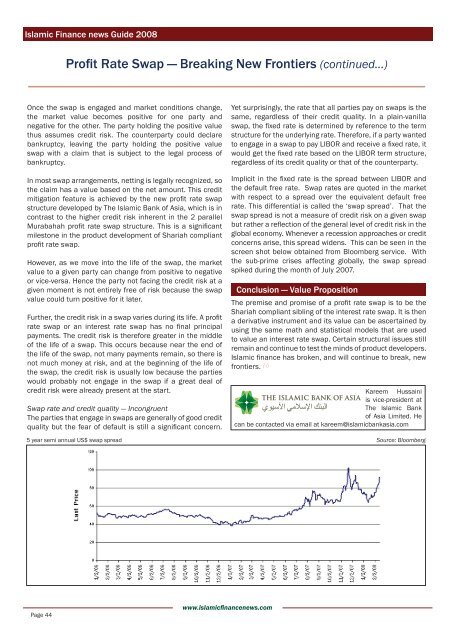

Implicit in the fi xed rate is the spread between LIBOR and<br />

the default free rate. Swap rates are quoted in the market<br />

with respect to a spread over the equivalent default free<br />

rate. This differential is called the ‘swap spread’. That the<br />

swap spread is not a measure of credit risk on a given swap<br />

but rather a refl ection of the general level of credit risk in the<br />

global economy. Whenever a recession approaches or credit<br />

concerns arise, this spread widens. This can be seen in the<br />

screen shot below obtained from Bloomberg service. With<br />

the sub-prime crises affecting globally, the swap spread<br />

spiked during the month of July 2007.<br />

Conclusion — Value Proposition<br />

The premise and promise of a profi t rate swap is to be the<br />

Shariah compliant sibling of the interest rate swap. It is then<br />

a derivative instrument and its value can be ascertained by<br />

using the same math and statistical models that are used<br />

to value an interest rate swap. Certain structural issues still<br />

remain and continue to test the minds of product developers.<br />

<strong>Islamic</strong> fi nance has broken, and will continue to break, new<br />

frontiers.<br />

Kareem Hussaini<br />

is vice-president at<br />

The <strong>Islamic</strong> Bank<br />

of Asia Limited. He<br />

can be contacted via email at kareem@islamicbankasia.com<br />

5 year semi annual US$ swap spread Source: Bloomberg