You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.islamicfi nancenews.com<br />

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

<strong>Islamic</strong> Banking in the United Arab Emirates (<strong>continued</strong>...)<br />

National Bonds is the UAE Shariah compliant savings scheme<br />

based on the Mudarabah structure. The organization is jointly<br />

owned by the government of Dubai, Dubai Holdings, Emmar<br />

Properties and Dubai Bank. Its main mission is to raise<br />

Shariah compliant fi nance. A saver can buy any number of<br />

bonds to join the monthly draw to win a prize. The scheme<br />

offers up to 260,000 prizes ranging from AED100 to AED1<br />

million (US$27.23 to US$272,331) every year, including one<br />

top prize for AED1 million. The scheme invests the money in<br />

Shariah compliant earning assets (mainly properties) and<br />

distributes 2% of the profi ts to savers.<br />

“Comprehensive fi nancial data<br />

from the <strong>Islamic</strong> fi nance industry<br />

in the UAE is not available, either<br />

because fi nancial data is not<br />

published separately or because<br />

the institution is new”<br />

In January 2008, the fund announced Mudarabah return<br />

of 6.03%. The bond denomination is AED10 (US$2.72) and<br />

minimum purchase is AED100 (10 bonds) in order to enter<br />

the draw. No fi nancials have so far been published by the<br />

company.<br />

Are you SUBSCRIBING to<br />

<strong>Islamic</strong> <strong>Finance</strong> news?<br />

Vol. 5, Issue 4 1 st February 2008<br />

The World’s Global <strong>Islamic</strong> <strong>Finance</strong> <strong>News</strong> Provider<br />

In this issue<br />

HONG KONG<br />

<strong>Islamic</strong> Capital Markets Briefs ................ 1<br />

Tsang woos Arabs to Fragrant Harbor<br />

<strong>Islamic</strong> Ratings Briefs ..............................12<br />

In an effort to develop a market for <strong>Islamic</strong> should capitalize on their fi scal freedom. In<br />

fi nance, Hong Kong’s chief executive Donald Kuwait, he signed a letter of intent for the IFN Reports ................................................13<br />

Tsang went on a three-nation tour to Kuwait, development of bilateral trade relations<br />

Hong Kong Forging Ahead with<br />

the UAE and Saudi Arabia. Accompanied during the two countries.<br />

New Venture ..............................................15<br />

by a high-level business delegation,<br />

Tsang created deep impressions with In Saudi, he announced that all Saudi Will Hong Kong Stand Up to<br />

his persuasive words and determination citizens would have the opportunity to the Competition? ...................................... 17<br />

to explore business ties with the three receive a one-month free visa to Hong Kong<br />

Malaysian Tax Incentives for <strong>Islamic</strong><br />

countries.<br />

to encourage locals and businessmen to <strong>Finance</strong> — Trends and Issues ..................19<br />

visit the Asian business hub.<br />

In Abu Dhabi, Tsang praised UAE’s sovereign<br />

The UK Approach to Taxation of<br />

<strong>Islamic</strong> <strong>Finance</strong> .........................................21<br />

wealth funds and said that the two countries (Also see IFN Reports on page 14)<br />

Fitch on Rating it Right ............................23<br />

ASIA<br />

Meet the Head ..........................................26<br />

Zulkifl i Ishak, Prudential Fund Management<br />

Lawyers want standardized regulation<br />

Members of the International Bar Association’s focused on the latest developments of <strong>Islamic</strong> Term Sheet ................................................27<br />

who attended the recent “<strong>Islamic</strong> <strong>Finance</strong> fi nance in the Middle East. In highlighting the Hajj Terminal Financing<br />

in the Middle East” conference were nearly issue, Husam Hourani, who is partner and<br />

Takaful <strong>News</strong> Briefs..................................28<br />

unanimous about the need to apply some level head of the banking and fi nance department<br />

of consistency in <strong>Islamic</strong> fi nance laws across the at Al Tamimi & Company, said: “There is an Takaful Report ..........................................29<br />

GCC countries in order to establish regionally- urgent need to deepen our understanding Different Models of Takaful in the Global Market<br />

accepted regulatory standards.<br />

and awareness of <strong>Islamic</strong> fi nance and<br />

Moves .........................................................32<br />

ensure that sound regulatory frameworks<br />

The conference, which was attended by 70 are implemented on the ground for effi cient Deal Tracker ..............................................33<br />

banking professionals and legal experts, fi nancial intermediation.”<br />

<strong>Islamic</strong> Funds Tables ................................34<br />

Dow Jones <strong>Islamic</strong> Indexes .....................35<br />

QATAR/UK<br />

Malaysian Sukuk Update .........................36<br />

Qataris own 80% of London Bridge Quarter<br />

A consortium of Qatari investors has designed by the award-winning international <strong>Islamic</strong> League Tables .............................37<br />

acquired 80% of the building of the London architect, Renzo Piano.<br />

Bridge Quarter, which includes the famous<br />

Events Diary...............................................40<br />

“Shard of Glass” new London Bridge Tower. The consortium members will each hold Subscriptions Form .................................. 41<br />

The four Qatari institutions — QInvest, Sellar 20% in the newly formed London Bridge<br />

Property Group, Qatar National Bank, Qatari Quarter Holdings Ltd. Sellar Properties of Country Index ............................................ 41<br />

<strong>Islamic</strong> Bank and Barwa — are to undertake London will retain the remaining 20% of the<br />

Company Index ......................................... 41<br />

the £2 billion (US$4 billion) development deal.<br />

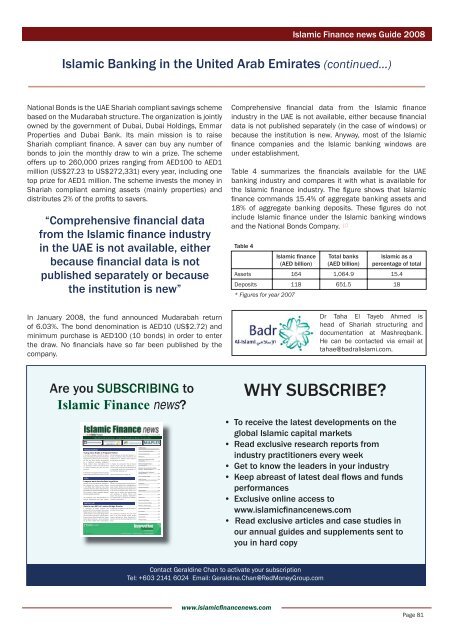

Comprehensive fi nancial data from the <strong>Islamic</strong> fi nance<br />

industry in the UAE is not available, either because fi nancial<br />

data is not published separately (in the case of windows) or<br />

because the institution is new. Anyway, most of the <strong>Islamic</strong><br />

fi nance companies and the <strong>Islamic</strong> banking windows are<br />

under establishment.<br />

Table 4 summarizes the fi nancials available for the UAE<br />

banking industry and compares it with what is available for<br />

the <strong>Islamic</strong> fi nance industry. The fi gure shows that <strong>Islamic</strong><br />

fi nance commands 15.4% of aggregate banking assets and<br />

18% of aggregate banking deposits. These fi gures do not<br />

include <strong>Islamic</strong> fi nance under the <strong>Islamic</strong> banking windows<br />

and the National Bonds Company.<br />

Table 4<br />

<strong>Islamic</strong> fi nance<br />

(AED billion)<br />

Total banks<br />

(AED billion)<br />

<strong>Islamic</strong> as a<br />

percentage of total<br />

Assets 164 1,064.9 15.4<br />

Deposits 118 651.5 18<br />

* Figures for year 2007<br />

Dr Taha El Tayeb Ahmed is<br />

head of Shariah structuring and<br />

documentation at Mashreqbank.<br />

He can be contacted via email at<br />

tahae@badralislami.com.<br />

WHY SUBSCRIBE?<br />

• To receive the latest developments on the<br />

global <strong>Islamic</strong> capital markets<br />

• Read exclusive research reports from<br />

industry practitioners every week<br />

• Get to know the leaders in your industry<br />

• Keep abreast of latest deal fl ows and funds<br />

performances<br />

• Exclusive online access to<br />

www.islamicfi nancenews.com<br />

• Read exclusive articles and case studies in<br />

our annual guides and supplements sent to<br />

you in hard copy<br />

Contact Geraldine Chan to activate your subscription<br />

Tel: +603 2141 6024 Email: Geraldine.Chan@RedMoneyGroup.com<br />

Page 81