You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

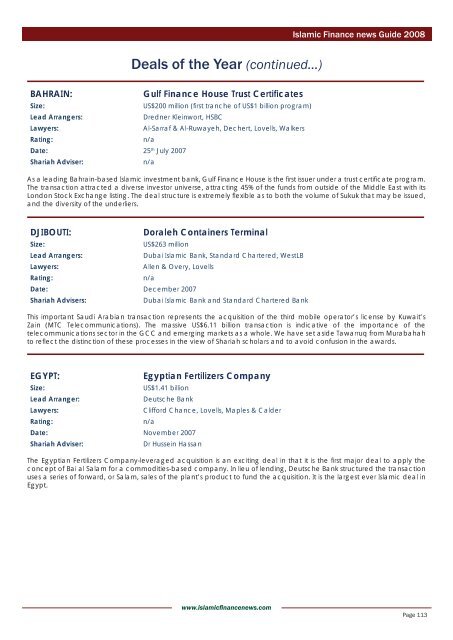

Deals of the Year (<strong>continued</strong>...)<br />

BAHRAIN: Gulf <strong>Finance</strong> House Trust Certifi cates<br />

Size: US$200 million (fi rst tranche of US$1 billion program)<br />

Lead Arrangers: Dredner Kleinwort, HSBC<br />

Lawyers: Al-Sarraf & Al-Ruwayeh, Dechert, Lovells, Walkers<br />

Rating: n/a<br />

Date: 25th July 2007<br />

Shariah Adviser: n/a<br />

www.islamicfi nancenews.com<br />

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

As a leading Bahrain-based <strong>Islamic</strong> investment bank, Gulf <strong>Finance</strong> House is the fi rst issuer under a trust certifi cate program.<br />

The transaction attracted a diverse investor universe, attracting 45% of the funds from outside of the Middle East with its<br />

London Stock Exchange listing. The deal structure is extremely fl exible as to both the volume of Sukuk that may be issued,<br />

and the diversity of the underliers.<br />

DJIBOUTI: Doraleh Containers Terminal<br />

Size: US$263 million<br />

Lead Arrangers: Dubai <strong>Islamic</strong> Bank, Standard Chartered, WestLB<br />

Lawyers: Allen & Overy, Lovells<br />

Rating: n/a<br />

Date: December 2007<br />

Shariah Advisers: Dubai <strong>Islamic</strong> Bank and Standard Chartered Bank<br />

This important Saudi Arabian transaction represents the acquisition of the third mobile operator’s license by Kuwait’s<br />

Zain (MTC Telecommunications). The massive US$6.11 billion transaction is indicative of the importance of the<br />

telecommunications sector in the GCC and emerging markets as a whole. We have set aside Tawarruq from Murabahah<br />

to refl ect the distinction of these processes in the view of Shariah scholars and to avoid confusion in the awards.<br />

EGYPT: Egyptian Fertilizers Company<br />

Size: US$1.41 billion<br />

Lead Arranger: Deutsche Bank<br />

Lawyers: Clifford Chance, Lovells, Maples & Calder<br />

Rating: n/a<br />

Date: November 2007<br />

Shariah Adviser: Dr Hussein Hassan<br />

The Egyptian Fertilizers Company-leveraged acquisition is an exciting deal in that it is the fi rst major deal to apply the<br />

concept of Bai al Salam for a commodities-based company. In lieu of lending, Deutsche Bank structured the transaction<br />

uses a series of forward, or Salam, sales of the plant’s product to fund the acquisition. It is the largest ever <strong>Islamic</strong> deal in<br />

Egypt.<br />

Page 113