You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

Page 42<br />

Profi t Rate Swap — Breaking New Frontiers (<strong>continued</strong>...)<br />

assumptions in place, only one undertaking should be in the<br />

money. In our example, the Murabahah to be executed under<br />

Undertaking A will have a profi t rate of Libor – Fixed Rate: 5%–<br />

6% = -1%. Undertaking A is “out of money”. Consequently, the<br />

Murabahah to be executed under undertaking B will be “in<br />

the money” having a profi t rate of 1% (6% – 5%).<br />

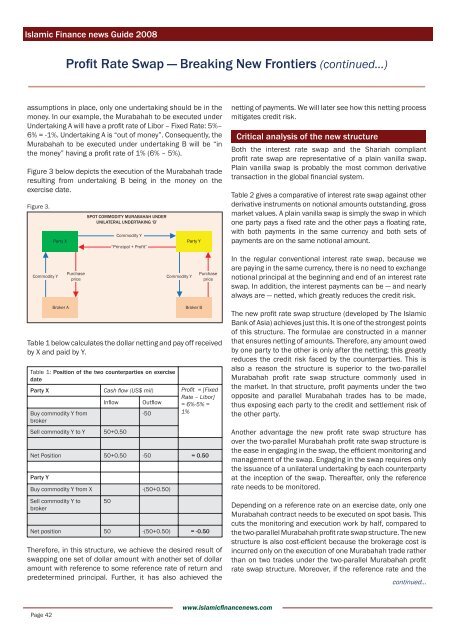

Figure 3 below depicts the execution of the Murabahah trade<br />

resulting from undertaking B being in the money on the<br />

exercise date.<br />

Figure 3.<br />

Commodity Y<br />

Commodity Y<br />

Party X Party Y<br />

“Principal + Profit”<br />

Purchase<br />

price<br />

Table 1 below calculates the dollar netting and pay off received<br />

by X and paid by Y.<br />

Table 1: Position of the two counterparties on exercise<br />

date<br />

Party X Cash fl ow (US$ mil) Profi t = [Fixed<br />

Buy commodity Y from<br />

broker<br />

Sell commodity Y to Y 50+0.50<br />

SPOT COMMODITY MURABAHAH UNDER<br />

UNILATERAL UNDERTAKING ‘B’<br />

Infl ow Outfl ow<br />

-50<br />

Rate – Libor]<br />

= 6%-5% =<br />

1%<br />

Net Position 50+0.50 -50 = 0.50<br />

Party Y<br />

Buy commodity Y from X -(50+0.50)<br />

Sell commodity Y to<br />

broker<br />

50<br />

Commodity Y<br />

Broker A Broker B<br />

Purchase<br />

price<br />

Net position 50 -(50+0.50) = -0.50<br />

Therefore, in this structure, we achieve the desired result of<br />

swapping one set of dollar amount with another set of dollar<br />

amount with reference to some reference rate of return and<br />

predetermined principal. Further, it has also achieved the<br />

www.islamicfi nancenews.com<br />

netting of payments. We will later see how this netting process<br />

mitigates credit risk.<br />

Critical analysis of the new structure<br />

Both the interest rate swap and the Shariah compliant<br />

profi t rate swap are representative of a plain vanilla swap.<br />

Plain vanilla swap is probably the most common derivative<br />

transaction in the global fi nancial system.<br />

Table 2 gives a comparative of interest rate swap against other<br />

derivative instruments on notional amounts outstanding, gross<br />

market values. A plain vanilla swap is simply the swap in which<br />

one party pays a fi xed rate and the other pays a fl oating rate,<br />

with both payments in the same currency and both sets of<br />

payments are on the same notional amount.<br />

In the regular conventional interest rate swap, because we<br />

are paying in the same currency, there is no need to exchange<br />

notional principal at the beginning and end of an interest rate<br />

swap. In addition, the interest payments can be — and nearly<br />

always are — netted, which greatly reduces the credit risk.<br />

The new profi t rate swap structure (developed by The <strong>Islamic</strong><br />

Bank of Asia) achieves just this. It is one of the strongest points<br />

of this structure. The formulae are constructed in a manner<br />

that ensures netting of amounts. Therefore, any amount owed<br />

by one party to the other is only after the netting; this greatly<br />

reduces the credit risk faced by the counterparties. This is<br />

also a reason the structure is superior to the two-parallel<br />

Murabahah profi t rate swap structure commonly used in<br />

the market. In that structure, profi t payments under the two<br />

opposite and parallel Murabahah trades has to be made,<br />

thus exposing each party to the credit and settlement risk of<br />

the other party.<br />

Another advantage the new profi t rate swap structure has<br />

over the two-parallel Murabahah profi t rate swap structure is<br />

the ease in engaging in the swap, the effi cient monitoring and<br />

management of the swap. Engaging in the swap requires only<br />

the issuance of a unilateral undertaking by each counterparty<br />

at the inception of the swap. Thereafter, only the reference<br />

rate needs to be monitored.<br />

Depending on a reference rate on an exercise date, only one<br />

Murabahah contract needs to be executed on spot basis. This<br />

cuts the monitoring and execution work by half, compared to<br />

the two-parallel Murabahah profi t rate swap structure. The new<br />

structure is also cost-effi cient because the brokerage cost is<br />

incurred only on the execution of one Murabahah trade rather<br />

than on two trades under the two-parallel Murabahah profi t<br />

rate swap structure. Moreover, if the reference rate and the<br />

<strong>continued</strong>...