You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

Page 102<br />

Accelerating <strong>Islamic</strong> Banking Growth in Indonesia (<strong>continued</strong>...)<br />

with growth of 40.44% y-o-y, and for a while, the fi nancing<br />

expansion of BUS recorded a lower rate of 24.5%, although<br />

the banks have striven to do their best as refl ected by the<br />

FDR from 93.6% in 2006 to 97.6%. Attempts by the <strong>Islamic</strong><br />

banking industry to optimally distribute the fund to various<br />

production factors at a time when national banking was facing<br />

diffi culties in distributing funds should be noted in relation to<br />

the functioning of banks as intermediary institutions. Besides,<br />

the expansion raised the fi nancing share of <strong>Islamic</strong> banking<br />

from 2.6% in 2006 to 2.8%.<br />

Figure 2: Structure of unrestricted investment<br />

12 Month<br />

6 Month<br />

3 Month<br />

1 Month<br />

0.0%<br />

20.3% 18.8%<br />

11.6% 8.8%<br />

18.6% 9.5%<br />

49.5% 62.9%<br />

20.0% 40.0% 60.0% 80.0% 100.0% 120.0%<br />

2006<br />

2007<br />

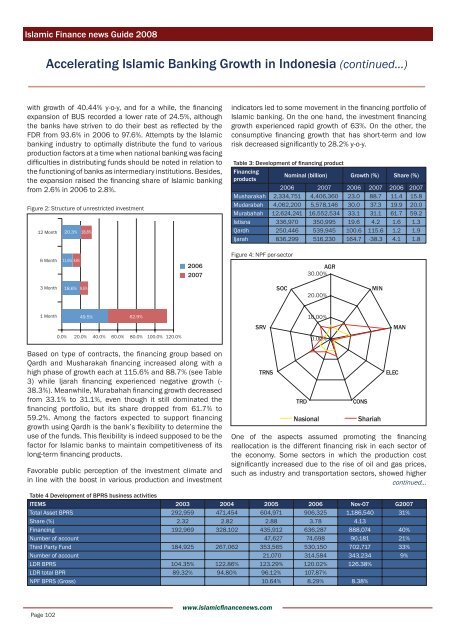

Based on type of contracts, the fi nancing group based on<br />

Qardh and Musharakah fi nancing increased along with a<br />

high phase of growth each at 115.6% and 88.7% (see Table<br />

3) while Ijarah fi nancing experienced negative growth (-<br />

38.3%). Meanwhile, Murabahah fi nancing growth decreased<br />

from 33.1% to 31.1%, even though it still dominated the<br />

fi nancing portfolio, but its share dropped from 61.7% to<br />

59.2%. Among the factors expected to support fi nancing<br />

growth using Qardh is the bank’s fl exibility to determine the<br />

use of the funds. This fl exibility is indeed supposed to be the<br />

factor for <strong>Islamic</strong> banks to maintain competitiveness of its<br />

long-term fi nancing products.<br />

Favorable public perception of the investment climate and<br />

in line with the boost in various production and investment<br />

www.islamicfi nancenews.com<br />

indicators led to some movement in the fi nancing portfolio of<br />

<strong>Islamic</strong> banking. On the one hand, the investment fi nancing<br />

growth experienced rapid growth of 63%. On the other, the<br />

consumptive fi nancing growth that has short-term and low<br />

risk decreased signifi cantly to 28.2% y-o-y.<br />

Table 3: Development of fi nancing product<br />

Financing<br />

products<br />

Nominal (billion) Growth (%) Share (%)<br />

2006 2007 2006 2007 2006 2007<br />

Musharakah 2,334,751 4,406,360 23.0 88.7 11.4 15.8<br />

Mudarabah 4,062,200 5,578,146 30.0 37.3 19.9 20.0<br />

Murabahah 12,624,241 16,552,534 33.1 31.1 61.7 59.2<br />

Istisna 336,970 350,995 19.6 4.2 1.6 1.3<br />

Qardh 250,446 539,945 100.6 115.6 1.2 1.9<br />

Ijarah 836,299 516,230 164.7 -38.3 4.1 1.8<br />

Figure 4: NPF per-sector<br />

SRV<br />

TRNS<br />

SOC<br />

TRD<br />

AGR<br />

30.00%<br />

20.00%<br />

10.00%<br />

0.00%<br />

CONS<br />

MIN<br />

Nasional Shariah<br />

ELEC<br />

MAN<br />

One of the aspects assumed promoting the fi nancing<br />

reallocation is the different fi nancing risk in each sector of<br />

the economy. Some sectors in which the production cost<br />

signifi cantly increased due to the rise of oil and gas prices,<br />

such as industry and transportation sectors, showed higher<br />

<strong>continued</strong>...<br />

Table 4 Development of BPRS business activities<br />

ITEMS 2003 2004 2005 2006 Nov-07 G2007<br />

Total Asset BPRS 292,959 471,454 604,971 906,325 1,186,540 31%<br />

Share (%) 2.32 2.82 2.88 3.78 4.13<br />

Financing 192,969 328,102 435,912 636,287 888,074 40%<br />

Number of account 47,627 74,698 90,181 21%<br />

Third Party Fund 184,925 267,062 353,565 530,150 702,717 33%<br />

Number of account 21,070 314,584 343,234 9%<br />

LDR BPRS 104.35% 122.86% 123.29% 120.02% 126.38%<br />

LDR total BPR 89.32% 94.80% 96.12% 107.87%<br />

NPF BPRS (Gross) 10.64% 8.29% 8.38%