You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.islamicfi nancenews.com<br />

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

<strong>Islamic</strong> <strong>Finance</strong> — The Offshore Connection<br />

By Tahir Jawed<br />

As <strong>Islamic</strong> fi nance has grown over recent years into<br />

a substantial fi nancial industry in itself, some of the<br />

unexpected benefi ciaries have been the offshore<br />

centers dotted around the world. Often the home<br />

of hedge funds, securitizations and holding companies,<br />

offshore fi nancial centers such as the Cayman<br />

Islands and Jersey now provide a convenient domicile<br />

for popular <strong>Islamic</strong> fi nance structures.<br />

Prior to the boom, most Middle East and Asian jurisdictions<br />

already had strong links with certain offshore centers; for<br />

example, Malaysia favored Labuan while the GCC preferred<br />

Bahrain and certain Caribbean centers. Historically, the<br />

offshore centers were used to organize investments and<br />

structure personal wealth. When practitioners, particularly<br />

lawyers, were presented with the challenges of structuring<br />

Shariah compliant transactions, most were already familiar<br />

with the uses of the offshore jurisdictions and utilized the<br />

effi ciency of these centers to structure the new wave of<br />

<strong>Islamic</strong> fi nance products.<br />

In return, the offshore centers have kept a keen eye on the<br />

<strong>Islamic</strong> fi nance market and have been quick to market their<br />

value in structuring complex fi nancial structures, removing<br />

many of the concerns regarding tax, regulation and cost when<br />

compared to using onshore structures.<br />

Sukuk transactions<br />

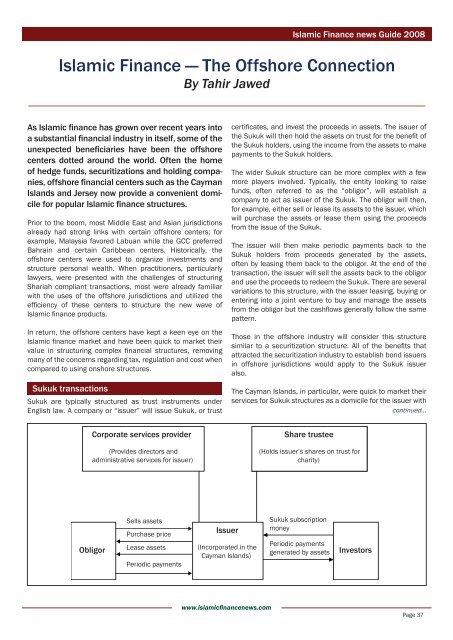

Sukuk are typically structured as trust instruments under<br />

English law. A company or “issuer” will issue Sukuk, or trust<br />

Corporate services provider<br />

(Provides directors and<br />

administrative services for issuer)<br />

certifi cates, and invest the proceeds in assets. The issuer of<br />

the Sukuk will then hold the assets on trust for the benefi t of<br />

the Sukuk holders, using the income from the assets to make<br />

payments to the Sukuk holders.<br />

The wider Sukuk structure can be more complex with a few<br />

more players involved. Typically, the entity looking to raise<br />

funds, often referred to as the “obligor”, will establish a<br />

company to act as issuer of the Sukuk. The obligor will then,<br />

for example, either sell or lease its assets to the issuer, which<br />

will purchase the assets or lease them using the proceeds<br />

from the issue of the Sukuk.<br />

The issuer will then make periodic payments back to the<br />

Sukuk holders from proceeds generated by the assets,<br />

often by leasing them back to the obligor. At the end of the<br />

transaction, the issuer will sell the assets back to the obligor<br />

and use the proceeds to redeem the Sukuk. There are several<br />

variations to this structure, with the issuer leasing, buying or<br />

entering into a joint venture to buy and manage the assets<br />

from the obligor but the cashfl ows generally follow the same<br />

pattern.<br />

Those in the offshore industry will consider this structure<br />

similar to a securitization structure. All of the benefi ts that<br />

attracted the securitization industry to establish bond issuers<br />

in offshore jurisdictions would apply to the Sukuk issuer<br />

also.<br />

The Cayman Islands, in particular, were quick to market their<br />

services for Sukuk structures as a domicile for the issuer with<br />

<strong>continued</strong>...<br />

Share trustee<br />

(Holds issuer’s shares on trust for<br />

charity)<br />

Sells assets<br />

Sukuk subscription<br />

Purchase price<br />

Issuer money<br />

Obligor Lease assets<br />

Periodic payments<br />

(Incorporated in the<br />

Cayman Islands)<br />

Periodic payments<br />

generated by assets Investors<br />

Page 37