Sisal Annual Report 2011 - Permira

Sisal Annual Report 2011 - Permira

Sisal Annual Report 2011 - Permira

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

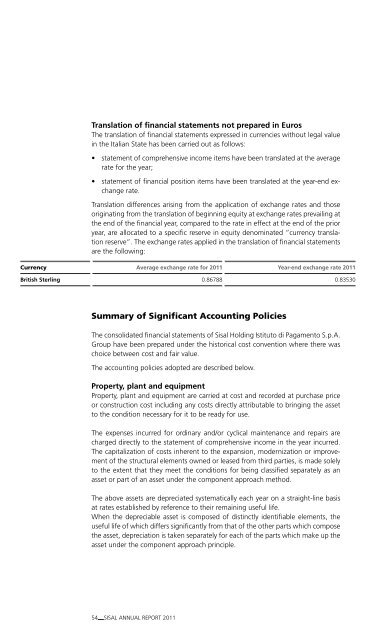

Translation of financial statements not prepared in EurosThe translation of financial statements expressed in currencies without legal valuein the Italian State has been carried out as follows:• statement of comprehensive income items have been translated at the averagerate for the year;• statement of financial position items have been translated at the year-end exchangerate.Translation differences arising from the application of exchange rates and thoseoriginating from the translation of beginning equity at exchange rates prevailing atthe end of the financial year, compared to the rate in effect at the end of the prioryear, are allocated to a specific reserve in equity denominated “currency translationreserve”. The exchange rates applied in the translation of financial statementsare the following:Currency Average exchange rate for <strong>2011</strong> Year-end exchange rate <strong>2011</strong>British Sterling 0.86788 0.83530Summary of Significant Accounting PoliciesThe consolidated financial statements of <strong>Sisal</strong> Holding Istituto di Pagamento S.p.A.Group have been prepared under the historical cost convention where there waschoice between cost and fair value.The accounting policies adopted are described below.Property, plant and equipmentProperty, plant and equipment are carried at cost and recorded at purchase priceor construction cost including any costs directly attributable to bringing the assetto the condition necessary for it to be ready for use.The expenses incurred for ordinary and/or cyclical maintenance and repairs arecharged directly to the statement of comprehensive income in the year incurred.The capitalization of costs inherent to the expansion, modernization or improvementof the structural elements owned or leased from third parties, is made solelyto the extent that they meet the conditions for being classified separately as anasset or part of an asset under the component approach method.The above assets are depreciated systematically each year on a straight-line basisat rates established by reference to their remaining useful life.When the depreciable asset is composed of distinctly identifiable elements, theuseful life of which differs significantly from that of the other parts which composethe asset, depreciation is taken separately for each of the parts which make up theasset under the component approach principle.54 SISAL ANNUAL REPORT <strong>2011</strong>