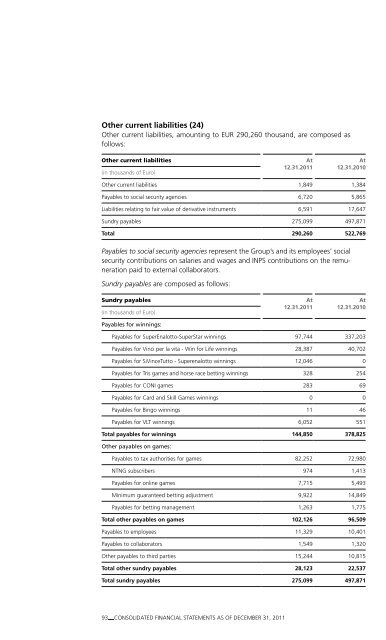

Other current liabilities (24)Other current liabilities, amounting to EUR 290,260 thousand, are composed asfollows:Other current liabilities(in thousands of Euro)At12.31.<strong>2011</strong>At12.31.2010Other current liabilities 1,849 1,384Payables to social security agencies 6,720 5,865Liabilities relating to fair value of derivative instruments 6,591 17,647Sundry payables 275,099 497,871Total 290,260 522,769Payables to social security agencies represent the Group’s and its employees’ socialsecurity contributions on salaries and wages and INPS contributions on the remunerationpaid to external collaborators.Sundry payables are composed as follows:Sundry payables(in thousands of Euro)Payables for winnings:At12.31.<strong>2011</strong>At12.31.2010Payables for SuperEnalotto-SuperStar winnings 97,744 337,203Payables for Vinci per la vita - Win for Life winnings 28,387 40,702Payables for SiVinceTutto - Superenalotto winnings 12,046 0Payables for Tris games and horse race betting winnings 328 254Payables for CONI games 283 69Payables for Card and Skill Games winnings 0 0Payables for Bingo winnings 11 46Payables for VLT winnings 6,052 551Total payables for winnings 144,850 378,825Other payables on games:Payables to tax authorities for games 82,252 72,980NTNG subscribers 974 1,413Payables for online games 7,715 5,493Minimum guaranteed betting adjustment 9,922 14,849Payables for betting management 1,263 1,775Total other payables on games 102,126 96,509Payables to employees 11,329 10,401Payables to collaborators 1,549 1,320Other payables to third parties 15,244 10,815Total other sundry payables 28,123 22,537Total sundry payables 275,099 497,87193 CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, <strong>2011</strong>

Payables for winnings include jackpots payable by the Group to winners of poolgames, bets and VLTs as of December 31, <strong>2011</strong>; these liabilities are covered mainlyby the dedicated bank accounts included in the statement of financial positionunder assets. The decrease in these payables compared to the end of the prioryear is about EUR 234 million and mainly relates to the first category SuperEnalottoprize payouts assigned, and already paid at the end of the year, a lower amountin the jackpot accounts mostly due to a contraction in game volumes as well asa reduction in the Superstar Reserve Fund owing to higher winnings payable in<strong>2011</strong> compared to the jackpots accrued for each contest. This is partly compensated,compared to the year-end 2010, by a higher SuperEnalotto Jackpot carriedforward to the first game of the following year and the recognition of payablesfor SiVinceTutto SuperEnalotto, the new NTNG game introduced at the beginningof April <strong>2011</strong>.Other payables on games are composed mainly of the game taxes on the lastNTNG games of the year for about EUR 44 million, payables for the PREU singletax, concession fees for about EUR 28 million and the single tax on sports bets andskill games duly paid in January 2012.Minimum guaranteed betting adjustment, for EUR 9,922 thousand, includes thepresent value of the residual short-term amount payable to concession authoritiesfor the additional guaranteed minimum amount payable under the concessioncontracts for horse racing and sports betting for EUR 9,469 thousand. In 2009,<strong>Sisal</strong> Match Point S.p.A. did not pay, in agreement with the concession authority,the instalment due for 2009 relating to the guaranteed minimum adjustmentfor horse race betting equal to EUR 4,365 thousand. This was because of thereceivable awarded by the Arbitration Board on May 26, 2003 which involved171 companies against the Concession grantor Unire and which, by decision ofthe arbitration board was resolved in favour of the companies, confirming, interalia, the existence of the receivable equal to EUR 4,425 thousand in favour of theconcessions held by <strong>Sisal</strong> Match Point S.p.A. following the acquisition of the businesssegments and mergers which took place in prior years. The decision by theArbitration Board is still subject to appeal by AAMS. The line item also includes thepayable for the additional minimum guaranteed adjustments accrued for the year2008 of EUR 3,260 thousand, for which the company is waiting for a new recalculationby AAMS, which takes into account the taxes duly paid on national horseracing bets, and the payable for the additional minimum guaranteed adjustmentsaccrued for 2009 of EUR 1,819 thousand, in conformity with AAMS’ requisites butnot yet paid since it is in the process of being checked and conflicts with AAMS.Payables for online games reports the sums deposited by players in order to playonline.94 SISAL ANNUAL REPORT <strong>2011</strong>

- Page 2 and 3:

Sisal Annual Report 2011

- Page 6:

Finally, we focused on expanding ou

- Page 9 and 10:

Group CompaniesSisal Holding Istitu

- Page 12 and 13:

Ugo Nespolo, Polvere e basalto (det

- Page 15 and 16:

(in million of Euro) 2007 2008 2009

- Page 17 and 18:

ne10.3%4,4004,0183,9093,8492,596-16

- Page 19 and 20:

co-In the context of a market which

- Page 21 and 22:

Within the Group, the aforementione

- Page 23 and 24:

• The “convenience services bus

- Page 25 and 26:

The excellent level of operating pr

- Page 27 and 28:

• In Director’s Decree of Augus

- Page 29 and 30:

The Court therefore wished to clari

- Page 31 and 32:

Equally dubious and untrue is AAMS

- Page 33 and 34:

If the national Court of Auditors s

- Page 35 and 36:

Principal risks and uncertainties t

- Page 37 and 38:

At the same time the above inspecti

- Page 39 and 40:

In December 2011, a general tax ins

- Page 41 and 42:

As we know, the tenders for the awa

- Page 43 and 44: Number and nominal value of treasur

- Page 45 and 46: • issue of bank guarantees by the

- Page 47 and 48: Statement of Financial Position - E

- Page 49 and 50: Statement of Changes in EquityATTRI

- Page 51 and 52: Explanatory Notes to the Consolidat

- Page 53 and 54: The second refers to the finalisati

- Page 55 and 56: Translation of financial statements

- Page 57 and 58: Intangible assetsThe intangible ass

- Page 59 and 60: Financial assetsFinancial assets ar

- Page 61 and 62: InventoriesInventories of playslips

- Page 63 and 64: The severance indemnity cost in the

- Page 65 and 66: Any charges related to disputes wit

- Page 67 and 68: Changes in accounting standards ado

- Page 69 and 70: Liquidity riskLiquidity risk is the

- Page 71 and 72: Other informationAs part of a proce

- Page 73 and 74: Property, plant and equipment, as d

- Page 75 and 76: During the course of the year, the

- Page 77 and 78: Intangible assets (3)Intangible ass

- Page 79 and 80: Deferred tax assets (5)The informat

- Page 81 and 82: Inventories of finished goods and m

- Page 83 and 84: Current financial assets (10)Curren

- Page 85 and 86: Cash and cash equivalents (13)Cash

- Page 87 and 88: The plans thus structured co-exist

- Page 89 and 90: Sisal S.p.A.Amortisation PlanResidu

- Page 91 and 92: Deferred tax liabilities (17)The in

- Page 93: C) Current LiabilitiesTrade and oth

- Page 97 and 98: Taxation payable (25)Taxation payab

- Page 99 and 100: Categories of financial assets and

- Page 101 and 102: ReclassificationThe Group has not c

- Page 103 and 104: • Other receivables include insur

- Page 105 and 106: Market riskMarket risk is the risk

- Page 107 and 108: Notes to the Statementof Comprehens

- Page 109 and 110: Purchases of materials, consumables

- Page 111 and 112: Lease and rent expenses (32)These e

- Page 113 and 114: Finance income and similar (36)Fina

- Page 115 and 116: Annex 1List of Companies Included i

- Page 117 and 118: 116 SISAL ANNUAL REPORT 2011

- Page 119 and 120: Sisal Holding Istituto di Pagamento

- Page 121: Printed by Arti Grafiche MeroniLiss