Sisal Annual Report 2011 - Permira

Sisal Annual Report 2011 - Permira

Sisal Annual Report 2011 - Permira

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

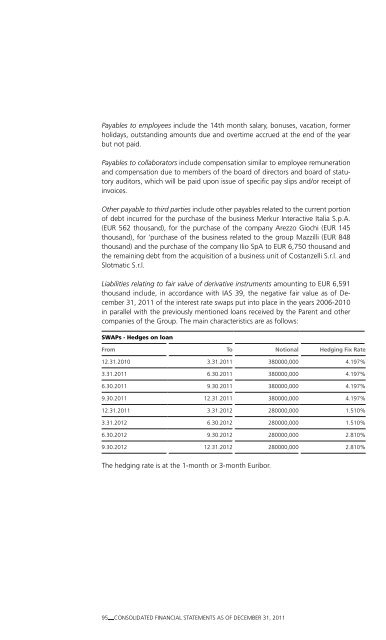

Payables to employees include the 14th month salary, bonuses, vacation, formerholidays, outstanding amounts due and overtime accrued at the end of the yearbut not paid.Payables to collaborators include compensation similar to employee remunerationand compensation due to members of the board of directors and board of statutoryauditors, which will be paid upon issue of specific pay slips and/or receipt ofinvoices.Other payable to third parties include other payables related to the current portionof debt incurred for the purchase of the business Merkur Interactive Italia S.p.A.(EUR 562 thousand), for the purchase of the company Arezzo Giochi (EUR 145thousand), for ‘purchase of the business related to the group Mazzilli (EUR 848thousand) and the purchase of the company Ilio SpA to EUR 6,750 thousand andthe remaining debt from the acquisition of a business unit of Costanzelli S.r.l. andSlotmatic S.r.l.Liabilities relating to fair value of derivative instruments amounting to EUR 6,591thousand include, in accordance with IAS 39, the negative fair value as of December31, <strong>2011</strong> of the interest rate swaps put into place in the years 2006-2010in parallel with the previously mentioned loans received by the Parent and othercompanies of the Group. The main characteristics are as follows:SWAPs - Hedges on loanFrom To Notional Hedging Fix Rate12.31.2010 3.31.<strong>2011</strong> 380000,000 4.197%3.31.<strong>2011</strong> 6.30.<strong>2011</strong> 380000,000 4.197%6.30.<strong>2011</strong> 9.30.<strong>2011</strong> 380000,000 4.197%9.30.<strong>2011</strong> 12.31.<strong>2011</strong> 380000,000 4.197%12.31.<strong>2011</strong> 3.31.2012 280000,000 1.510%3.31.2012 6.30.2012 280000,000 1.510%6.30.2012 9.30.2012 280000,000 2.810%9.30.2012 12.31.2012 280000,000 2.810%The hedging rate is at the 1-month or 3-month Euribor.95 CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, <strong>2011</strong>