Equity and LiabilitiesEquity (14)Total consolidated equity amounts to EUR 84,907 thousand.The following table sets out the composition of equity while the changes in equityare presented in the relative statement:Equity At 12.31.<strong>2011</strong> At 12.31.<strong>2011</strong>(in thousands of Euro)Equity attributable to owners of the Parent:Share capital 102,500 102,500Share premium reserve 94,484 94,484Legal reserve 200 200Other reserves (83,558) (70,658)Total comprehensive loss for the year (29,358) (13,384)Total equity attributable to owners of the Parent 84,268 113,143Equity attributable to non-controlling interests 639 682Total equity attributable to non-controlling interests 639 682Total equity 84,907 113,824Share capitalThe share capital of the company as of December 31, <strong>2011</strong>, fully subscribed andpaid-in, is composed of 102,500,000 ordinary shares.With reference to Other reserves, in order to allow participation in an effectivesystem of managerial co-investment plans, some first-level managers of the Grouphave been granted the possibility of taking part in co-investment plans of the ultimateparent, Gaming Invest S.à r.l. In particular, the co-investment plans providefor the subscription, as employees of the Group, to equity instruments and debtinstruments issued by Gaming Invest S.à r.l. under a system that is more favourablethan those granted to the shareholders of reference. The investment is structuredas an equity-settled share-based payment transaction under IFRS 2 and consequentlyis reflected as such in the financial statements of the Group. For purposesof the determination of the fair value of the plan, the return differential that willbe paid to the managers as compared to the shareholders of reference was measuredat the grant date of the plan. Various assumptions for the realization of theinvestment were considered and on that basis a cost referring to the year of EUR483 thousand was recorded in the statement of comprehensive income with acontra-entry to other reserves.New managers were added to the co-investment plan during the year and, as partof the rationalization of the equity instruments and debt instruments issued bythe parent, a reorganisation was carried out of the securities previously allocated,without any substantial incremental benefit to the manager beneficiaries.85 CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, <strong>2011</strong>

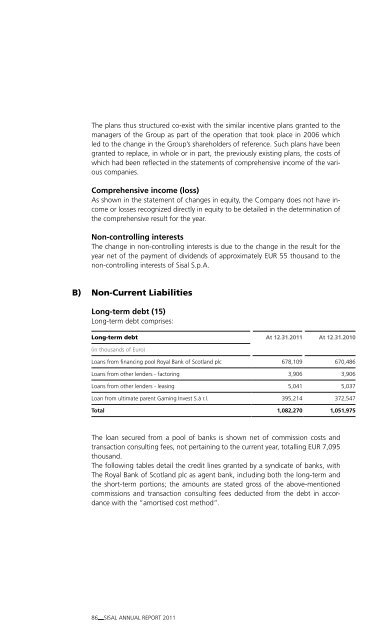

The plans thus structured co-exist with the similar incentive plans granted to themanagers of the Group as part of the operation that took place in 2006 whichled to the change in the Group’s shareholders of reference. Such plans have beengranted to replace, in whole or in part, the previously existing plans, the costs ofwhich had been reflected in the statements of comprehensive income of the variouscompanies.Comprehensive income (loss)As shown in the statement of changes in equity, the Company does not have incomeor losses recognized directly in equity to be detailed in the determination ofthe comprehensive result for the year.Non-controlling interestsThe change in non-controlling interests is due to the change in the result for theyear net of the payment of dividends of approximately EUR 55 thousand to thenon-controlling interests of <strong>Sisal</strong> S.p.A.B) Non-Current LiabilitiesLong-term debt (15)Long-term debt comprises:Long-term debt At 12.31.<strong>2011</strong> At 12.31.2010(in thousands of Euro)Loans from financing pool Royal Bank of Scotland plc 678,109 670,486Loans from other lenders - factoring 3,906 3,906Loans from other lenders - leasing 5,041 5,037Loan from ultimate parent Gaming Invest S.à r.l. 395,214 372,547Total 1,082,270 1,051,975The loan secured from a pool of banks is shown net of commission costs andtransaction consulting fees, not pertaining to the current year, totalling EUR 7,095thousand.The following tables detail the credit lines granted by a syndicate of banks, withThe Royal Bank of Scotland plc as agent bank, including both the long-term andthe short-term portions; the amounts are stated gross of the above-mentionedcommissions and transaction consulting fees deducted from the debt in accordancewith the “amortised cost method”.86 SISAL ANNUAL REPORT <strong>2011</strong>

- Page 2 and 3:

Sisal Annual Report 2011

- Page 6:

Finally, we focused on expanding ou

- Page 9 and 10:

Group CompaniesSisal Holding Istitu

- Page 12 and 13:

Ugo Nespolo, Polvere e basalto (det

- Page 15 and 16:

(in million of Euro) 2007 2008 2009

- Page 17 and 18:

ne10.3%4,4004,0183,9093,8492,596-16

- Page 19 and 20:

co-In the context of a market which

- Page 21 and 22:

Within the Group, the aforementione

- Page 23 and 24:

• The “convenience services bus

- Page 25 and 26:

The excellent level of operating pr

- Page 27 and 28:

• In Director’s Decree of Augus

- Page 29 and 30:

The Court therefore wished to clari

- Page 31 and 32:

Equally dubious and untrue is AAMS

- Page 33 and 34:

If the national Court of Auditors s

- Page 35 and 36: Principal risks and uncertainties t

- Page 37 and 38: At the same time the above inspecti

- Page 39 and 40: In December 2011, a general tax ins

- Page 41 and 42: As we know, the tenders for the awa

- Page 43 and 44: Number and nominal value of treasur

- Page 45 and 46: • issue of bank guarantees by the

- Page 47 and 48: Statement of Financial Position - E

- Page 49 and 50: Statement of Changes in EquityATTRI

- Page 51 and 52: Explanatory Notes to the Consolidat

- Page 53 and 54: The second refers to the finalisati

- Page 55 and 56: Translation of financial statements

- Page 57 and 58: Intangible assetsThe intangible ass

- Page 59 and 60: Financial assetsFinancial assets ar

- Page 61 and 62: InventoriesInventories of playslips

- Page 63 and 64: The severance indemnity cost in the

- Page 65 and 66: Any charges related to disputes wit

- Page 67 and 68: Changes in accounting standards ado

- Page 69 and 70: Liquidity riskLiquidity risk is the

- Page 71 and 72: Other informationAs part of a proce

- Page 73 and 74: Property, plant and equipment, as d

- Page 75 and 76: During the course of the year, the

- Page 77 and 78: Intangible assets (3)Intangible ass

- Page 79 and 80: Deferred tax assets (5)The informat

- Page 81 and 82: Inventories of finished goods and m

- Page 83 and 84: Current financial assets (10)Curren

- Page 85: Cash and cash equivalents (13)Cash

- Page 89 and 90: Sisal S.p.A.Amortisation PlanResidu

- Page 91 and 92: Deferred tax liabilities (17)The in

- Page 93 and 94: C) Current LiabilitiesTrade and oth

- Page 95 and 96: Payables for winnings include jackp

- Page 97 and 98: Taxation payable (25)Taxation payab

- Page 99 and 100: Categories of financial assets and

- Page 101 and 102: ReclassificationThe Group has not c

- Page 103 and 104: • Other receivables include insur

- Page 105 and 106: Market riskMarket risk is the risk

- Page 107 and 108: Notes to the Statementof Comprehens

- Page 109 and 110: Purchases of materials, consumables

- Page 111 and 112: Lease and rent expenses (32)These e

- Page 113 and 114: Finance income and similar (36)Fina

- Page 115 and 116: Annex 1List of Companies Included i

- Page 117 and 118: 116 SISAL ANNUAL REPORT 2011

- Page 119 and 120: Sisal Holding Istituto di Pagamento

- Page 121: Printed by Arti Grafiche MeroniLiss