October - December 2012 - National Institute of Rural Development

October - December 2012 - National Institute of Rural Development

October - December 2012 - National Institute of Rural Development

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

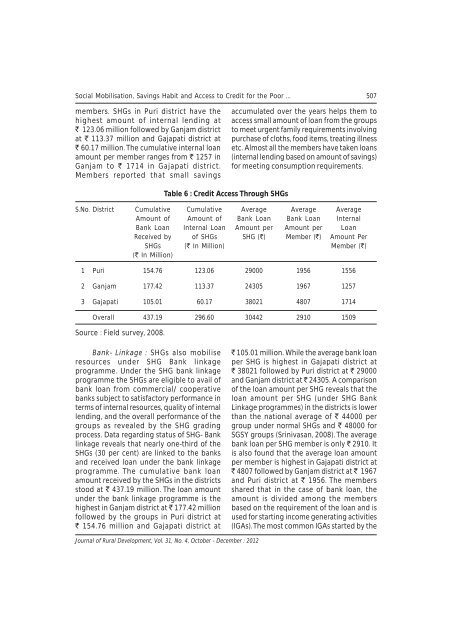

Social Mobilisation, Savings Habit and Access to Credit for the Poor ... 507members. SHGs in Puri district have thehighest amount <strong>of</strong> internal lending at` 123.06 million followed by Ganjam districtat ` 113.37 million and Gajapati district at` 60.17 million. The cumulative internal loanamount per member ranges from ` 1257 inGanjam to ` 1714 in Gajapati district.Members reported that small savingsaccumulated over the years helps them toaccess small amount <strong>of</strong> loan from the groupsto meet urgent family requirements involvingpurchase <strong>of</strong> cloths, food items, treating illnessetc. Almost all the members have taken loans(internal lending based on amount <strong>of</strong> savings)for meeting consumption requirements.Table 6 : Credit Access Through SHGsS.No. District Cumulative Cumulative Average Average AverageAmount <strong>of</strong> Amount <strong>of</strong> Bank Loan Bank Loan InternalBank Loan Internal Loan Amount per Amount per LoanReceived by <strong>of</strong> SHGs SHG (`) Member (`) Amount PerSHGs (` In Million) Member (`)(` In Million)1 Puri 154.76 123.06 29000 1956 15562 Ganjam 177.42 113.37 24305 1967 12573 Gajapati 105.01 60.17 38021 4807 1714Overall 437.19 296.60 30442 2910 1509Source : Field survey, 2008.Bank- Linkage : SHGs also mobiliseresources under SHG Bank linkageprogramme. Under the SHG bank linkageprogramme the SHGs are eligible to avail <strong>of</strong>bank loan from commercial/ cooperativebanks subject to satisfactory performance interms <strong>of</strong> internal resources, quality <strong>of</strong> internallending, and the overall performance <strong>of</strong> thegroups as revealed by the SHG gradingprocess. Data regarding status <strong>of</strong> SHG- Banklinkage reveals that nearly one-third <strong>of</strong> theSHGs (30 per cent) are linked to the banksand received loan under the bank linkageprogramme. The cumulative bank loanamount received by the SHGs in the districtsstood at ` 437.19 million. The loan amountunder the bank linkage programme is thehighest in Ganjam district at ` 177.42 millionfollowed by the groups in Puri district at` 154.76 million and Gajapati district at` 105.01 million. While the average bank loanper SHG is highest in Gajapati district at` 38021 followed by Puri district at ` 29000and Ganjam district at ` 24305. A comparison<strong>of</strong> the loan amount per SHG reveals that theloan amount per SHG (under SHG BankLinkage programmes) in the districts is lowerthan the national average <strong>of</strong> ` 44000 pergroup under normal SHGs and ` 48000 forSGSY groups (Srinivasan, 2008). The averagebank loan per SHG member is only ` 2910. Itis also found that the average loan amountper member is highest in Gajapati district at` 4807 followed by Ganjam district at ` 1967and Puri district at ` 1956. The membersshared that in the case <strong>of</strong> bank loan, theamount is divided among the membersbased on the requirement <strong>of</strong> the loan and isused for starting income generating activities(IGAs). The most common IGAs started by theJournal <strong>of</strong> <strong>Rural</strong> <strong>Development</strong>, Vol. 31, No. 4, <strong>October</strong> - <strong>December</strong> : <strong>2012</strong>