Valuation for Financial Reporting : Fair Value Measurements and ...

Valuation for Financial Reporting : Fair Value Measurements and ...

Valuation for Financial Reporting : Fair Value Measurements and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

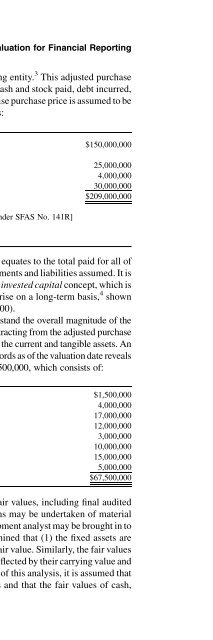

144 <strong>Valuation</strong> <strong>for</strong> <strong>Financial</strong> <strong>Reporting</strong>TABLE OF CONTENTSPurpose of EngagementScope of ServicesCertification of the AppraiserExecutive Summary—Identifiable Intangible Assets Recognized Apart From GoodwillIntroduction—Transaction OverviewCompany OverviewsEconomic OverviewIndustry Overview<strong>Valuation</strong> MethodologyDetermination of Discount Rate<strong>Valuation</strong> of Identified Intangible AssetsAcquired Computer SoftwareAssembled Work<strong>for</strong>ceTrade NameNoncompete AgreementTechnology (Construction Accounting Software)In-process Research <strong>and</strong> DevelopmentCustomer BaseAllocation of Purchase Price <strong>and</strong> the <strong>Value</strong> of Residual GoodwillReconciliation of Weighted Average Cost of Capitalto the Weighted Average Rate of ReturnExhibitsAppendicesPURPOSE OF ENGAGEMENTAccording to the <strong>Financial</strong> Accounting St<strong>and</strong>ards Board (FASB) Statement of <strong>Financial</strong>Accounting St<strong>and</strong>ards (SFAS) No. 141, Business Combinations, all business combinationscompleted on or after June 30, 2001, are to be accounted <strong>for</strong> exclusively by the purchasemethod. Under purchase accounting, all assets acquired, including goodwill <strong>and</strong> otherintangible assets, should be stated on the financial statements at fair value (see ‘‘St<strong>and</strong>ardof <strong>Value</strong>’’ discussion below).FASB Statement No. 141 requires that intangible assets be recognized as assets apart fromgoodwill if they meet one of two criteria: (1) the contractual-legal criterion or (2) theseparability criterion. The Statement also requires the allocation of the purchase price paidto the assets acquired <strong>and</strong> the liabilities assumed by major balance-sheet caption.An intangible asset shall be recognized as an asset apart from goodwill if it arises fromcontractual or other legal rights (regardless of whether those rights are transferable orseparable from the acquired entity or from other rights <strong>and</strong> obligations). If an intangibleasset does not arise from contractual or other legal rights, it shall be recognized as an assetapart from goodwill only if it is separable; that is, it is capable of being separated ordivided from the acquired entity <strong>and</strong> sold, transferred, licensed, rented, or exchanged(regardless of whether there is an intent to do so). An intangible asset that cannot be sold,transferred, licensed, rented, or exchanged individually is considered separable if it can besold, transferred, licensed, rented, or exchanged in combination with a related contract,asset, or liability.(continued )