Valuation for Financial Reporting : Fair Value Measurements and ...

Valuation for Financial Reporting : Fair Value Measurements and ...

Valuation for Financial Reporting : Fair Value Measurements and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

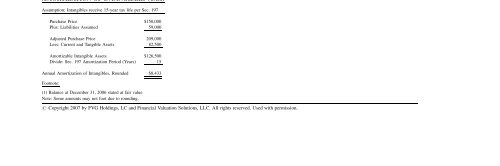

160 <strong>Valuation</strong> <strong>for</strong> <strong>Financial</strong> <strong>Reporting</strong> We determined the indicated cash flow of the company, making changes to the initialprojections based on management’s indications as to how the projections would differif the noncompete agreement did not exist <strong>and</strong> the seller were able to compete. We determined the difference in the cash flows with <strong>and</strong> without the noncompeteagreement in place. We calculated the annual implied differential <strong>and</strong> discounted those cash flows topresent value at the estimated rate of return of the noncompete agreement. Next, we determined the probability that the seller would compete, based on conversationswith management <strong>and</strong> economic <strong>and</strong> industry factors. The present value of the noncompete agreement was reduced by the probability thatthe seller would not compete. Finally, we added the amortization benefit factor.Major AssumptionsWe relied on a cash flow <strong>for</strong>ecast as provided by management Forecast We utilized initial projections provided by management as described in the analysisof the transaction section of the determination of the WACC. Management has projected that if the seller were free to compete, he would be ableto take a total of approximately 10% of revenue in 2007, 20% in 2008, <strong>and</strong> 10% thenext year. Management believes that after the third year, the seller would not takeany of the company’s projected revenues. Expense percentages <strong>for</strong> COGS <strong>and</strong> operating expense percentages would not beaffected by competition <strong>for</strong> the seller. Other We utilized a discount rate of 16%.Conclusion of <strong>Fair</strong> <strong>Value</strong> of Asset See Exhibits 4.10a, 4.10b <strong>and</strong> 4.10c <strong>for</strong> detailed calculations. Concluded value was $2,720,000.VALUATION ANALYSIS–TECHNOLOGY (CONSTRUCTIONACCOUNTING SOFTWARE)Description Construction accounting software providing state-of-the-art real-time access.<strong>Valuation</strong> Methodology Income Approach—Multiperiod excess earnings method We used the business enterprise value as a starting point. We relied on pretax earningsattributable to the technology that existed at the valuation date. We applied contributory charges to the technology cash flow to represent the use ofcontributory assets employed to support the technology-based <strong>and</strong> customer basedassets <strong>and</strong> help generate revenue (Exhibit 4.11). We discounted the surviving residual cash flow to present value using the discountrate of the asset. Finally, we deducted an income tax charge <strong>and</strong> added the amortization benefitfactor.(continued )