PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

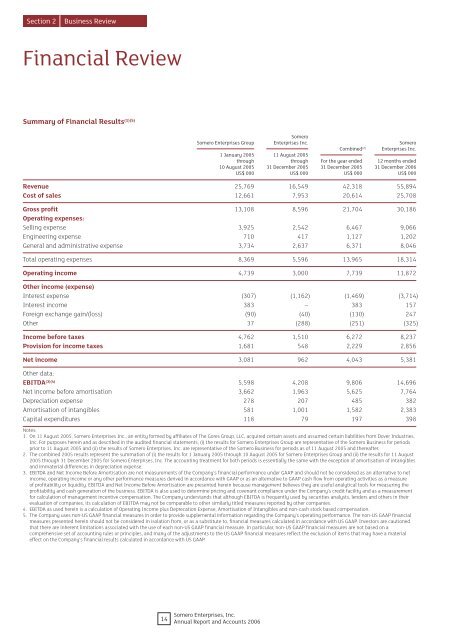

Section 2Business ReviewFinancial ReviewSummary of Financial Results (1)(5)<strong>Somero</strong><strong>Somero</strong> <strong>Enterprises</strong> Group <strong>Enterprises</strong> Inc. <strong>Somero</strong>Combined (2) <strong>Enterprises</strong> Inc.1 January 2005 11 August 2005through through For the year ended 12 months ended10 August 2005 31 December 2005 31 December 2005 31 December 2006US$ 000 US$ 000 US$ 000 US$ 000Revenue 25,769 16,549 42,318 55,894Cost of sales 12,661 7,953 20,614 25,708Gross profit 13,108 8,596 21,704 30,186Operating expenses:Selling expense 3,925 2,542 6,467 9,066Engineering expense 710 417 1,127 1,202General and administrative expense 3,734 2,637 6,371 8,046Total operating expenses 8,369 5,596 13,965 18,314Operating income 4,739 3,000 7,739 11,872Other income (expense)Interest expense (307) (1,162) (1,469) (3,714)Interest income 383 – 383 157Foreign exchange gain/(loss) (90) (40) (130) 247Other 37 (288) (251) (325)Income before taxes 4,762 1,510 6,272 8,237Provision for income taxes 1,681 548 2,229 2,856Net income 3,081 962 4,043 5,381Other data:EBITDA (3)(4) 5,598 4,208 9,806 14,696Net income before amortisation 3,662 1,963 5,625 7,764Depreciation expense 278 207 485 382Amortisation of intangibles 581 1,001 1,582 2,383Capital expenditures 118 79 197 398Notes:1. On 11 August 2005, <strong>Somero</strong> <strong>Enterprises</strong> Inc., an entity formed by affiliates of The Gores Group, LLC, acquired certain assets and assumed certain liabilities from Dover Industries,Inc. For purposes herein and as described in the audited financial statements, (i) the results for <strong>Somero</strong> <strong>Enterprises</strong> Group are representative of the <strong>Somero</strong> Business for periodsprior to 11 August 2005 and (ii) the results of <strong>Somero</strong> <strong>Enterprises</strong>, Inc. are representative of the <strong>Somero</strong> Business for periods as of 11 August 2005 and thereafter.2. The combined 2005 results represent the summation of (i) the results for 1 January 2005 through 10 August 2005 for <strong>Somero</strong> <strong>Enterprises</strong> Group and (ii) the results for 11 August2005 through 31 December 2005 for <strong>Somero</strong> <strong>Enterprises</strong>, Inc. The accounting treatment for both periods is essentially the same with the exception of amortisation of intangiblesand immaterial differences in depreciation expense.3. EBITDA and Net Income Before Amortisation are not measurements of the Company’s financial performance under GAAP and should not be considered as an alternative to netincome, operating income or any other performance measures derived in accordance with GAAP or as an alternative to GAAP cash flow from operating activities as a measureof profitability or liquidity. EBITDA and Net Income Before Amortisation are presented herein because management believes they are useful analytical tools for measuring theprofitability and cash generation of the business. EBITDA is also used to determine pricing and covenant compliance under the Company’s credit facility and as a measurementfor calculation of management incentive compensation. The Company understands that although EBITDA is frequently used by securities analysts, lenders and others in theirevaluation of companies, its calculation of EBITDA may not be comparable to other similarly titled measures reported by other companies.4. EBITDA as used herein is a calculation of Operating Income plus Deprecation Expense, Amortisation of Intangibles and non-cash stock based compensation.5. The Company uses non-US GAAP financial measures in order to provide supplemental information regarding the Company’s operating performance. The non-US GAAP financialmeasures presented herein should not be considered in isolation from, or as a substitute to, financial measures calculated in accordance with US GAAP. Investors are cautionedthat there are inherent limitations associated with the use of each non-US GAAP financial measure. In particular, non-US GAAP financial measures are not based on acomprehensive set of accounting rules or principles, and many of the adjustments to the US GAAP financial measures reflect the exclusion of items that may have a materialeffect on the Company’s financial results calculated in accordance with US GAAP.14<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006