PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

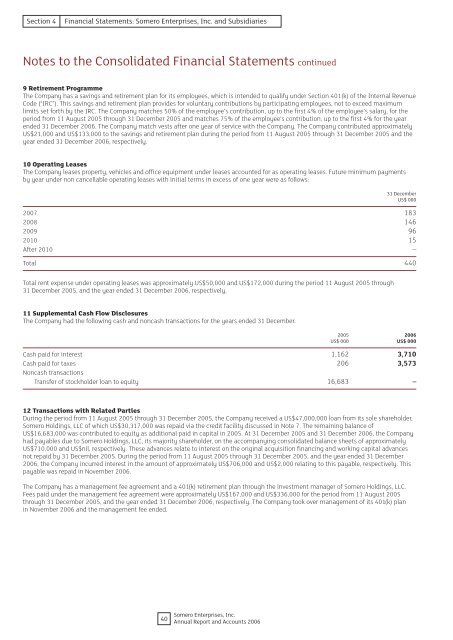

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong>, Inc. and SubsidiariesNotes to the Consolidated Financial Statements continued9 Retirement ProgrammeThe Company has a savings and retirement plan for its employees, which is intended to qualify under Section 401(k) of the Internal RevenueCode (“IRC”). This savings and retirement plan provides for voluntary contributions by participating employees, not to exceed maximumlimits set forth by the IRC. The Company matches 50% of the employee’s contribution, up to the first 4% of the employee’s salary, for theperiod from 11 August 2005 through 31 December 2005 and matches 75% of the employee’s contribution, up to the first 4% for the yearended 31 December 2006. The Company match vests after one year of service with the Company. The Company contributed approximatelyUS$21,000 and US$133,000 to the savings and retirement plan during the period from 11 August 2005 through 31 December 2005 and theyear ended 31 December 2006, respectively.10 Operating LeasesThe Company leases property, vehicles and office equipment under leases accounted for as operating leases. Future minimum paymentsby year under non cancellable operating leases with initial terms in excess of one year were as follows:31 DecemberUS$ 0002007 1832008 1462009 962010 15After 2010 –Total 440Total rent expense under operating leases was approximately US$50,000 and US$172,000 during the period 11 August 2005 through31 December 2005, and the year ended 31 December 2006, respectively.11 Supplemental Cash Flow DisclosuresThe Company had the following cash and noncash transactions for the years ended 31 December.2005 2006US$ 000 US$ 000Cash paid for interest 1,162 3,710Cash paid for taxes 206 3,573Noncash transactionsTransfer of stockholder loan to equity 16,683 –12 Transactions with Related PartiesDuring the period from 11 August 2005 through 31 December 2005, the Company received a US$47,000,000 loan from its sole shareholder,<strong>Somero</strong> Holdings, LLC of which US$30,317,000 was repaid via the credit facility discussed in Note 7. The remaining balance ofUS$16,683,000 was contributed to equity as additional paid in capital in 2005. At 31 December 2005 and 31 December 2006, the Companyhad payables due to <strong>Somero</strong> Holdings, LLC, its majority shareholder, on the accompanying consolidated balance sheets of approximatelyUS$710,000 and US$nil, respectively. These advances relate to interest on the original acquisition financing and working capital advancesnot repaid by 31 December 2005. During the period from 11 August 2005 through 31 December 2005, and the year ended 31 December2006, the Company incurred interest in the amount of approximately US$706,000 and US$2,000 relating to this payable, respectively. Thispayable was repaid in November 2006.The Company has a management fee agreement and a 401(k) retirement plan through the investment manager of <strong>Somero</strong> Holdings, LLC.Fees paid under the management fee agreement were approximately US$167,000 and US$336,000 for the period from 11 August 2005through 31 December 2005, and the year ended 31 December 2006, respectively. The Company took over management of its 401(k) planin November 2006 and the management fee ended.40<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006