PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

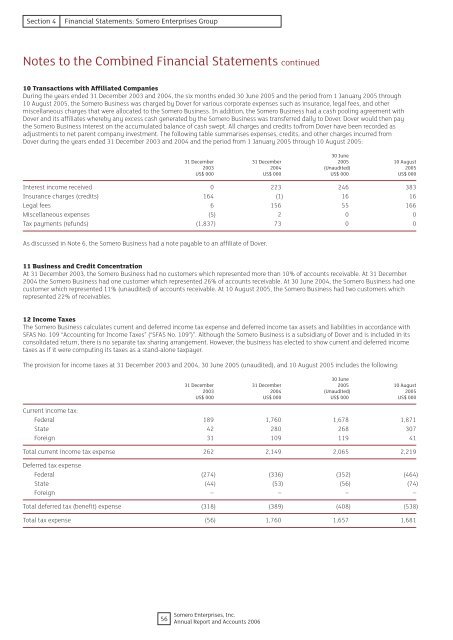

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong> GroupNotes to the Combined Financial Statements continued10 Transactions with Affiliated CompaniesDuring the years ended 31 December 2003 and 2004, the six months ended 30 June 2005 and the period from 1 January 2005 through10 August 2005, the <strong>Somero</strong> Business was charged by Dover for various corporate expenses such as insurance, legal fees, and othermiscellaneous charges that were allocated to the <strong>Somero</strong> Business. In addition, the <strong>Somero</strong> Business had a cash pooling agreement withDover and its affiliates whereby any excess cash generated by the <strong>Somero</strong> Business was transferred daily to Dover. Dover would then paythe <strong>Somero</strong> Business interest on the accumulated balance of cash swept. All charges and credits to/from Dover have been recorded asadjustments to net parent company investment. The following table summarises expenses, credits, and other charges incurred fromDover during the years ended 31 December 2003 and 2004 and the period from 1 January 2005 through 10 August 2005:30 June31 December 31 December 2005 10 August2003 2004 (Unaudited) 2005US$ 000 US$ 000 US$ 000 US$ 000Interest income received 0 223 246 383Insurance charges (credits) 164 (1) 16 16Legal fees 6 156 55 166Miscellaneous expenses (5) 2 0 0Tax payments (refunds) (1,837) 73 0 0As discussed in Note 6, the <strong>Somero</strong> Business had a note payable to an affiliate of Dover.11 Business and Credit ConcentrationAt 31 December 2003, the <strong>Somero</strong> Business had no customers which represented more than 10% of accounts receivable. At 31 December2004 the <strong>Somero</strong> Business had one customer which represented 26% of accounts receivable. At 30 June 2004, the <strong>Somero</strong> Business had onecustomer which represented 11% (unaudited) of accounts receivable. At 10 August 2005, the <strong>Somero</strong> Business had two customers whichrepresented 22% of receivables.12 Income TaxesThe <strong>Somero</strong> Business calculates current and deferred income tax expense and deferred income tax assets and liabilities in accordance withSFAS No. 109 “Accounting for Income Taxes” (“SFAS No. 109”)”. Although the <strong>Somero</strong> Business is a subsidiary of Dover and is included in itsconsolidated return, there is no separate tax sharing arrangement. However, the business has elected to show current and deferred incometaxes as if it were computing its taxes as a stand-alone taxpayer.The provision for income taxes at 31 December 2003 and 2004, 30 June 2005 (unaudited), and 10 August 2005 includes the following:30 June31 December 31 December 2005 10 August2003 2004 (Unaudited) 2005US$ 000 US$ 000 US$ 000 US$ 000Current income tax:Federal 189 1,760 1,678 1,871State 42 280 268 307Foreign 31 109 119 41Total current income tax expense 262 2,149 2,065 2,219Deferred tax expenseFederal (274) (336) (352) (464)State (44) (53) (56) (74)Foreign – – – –Total deferred tax (benefit) expense (318) (389) (408) (538)Total tax expense (56) 1,760 1,657 1,68156<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006