PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

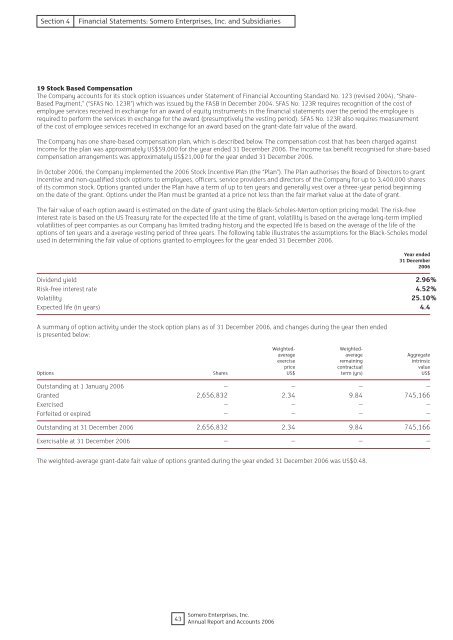

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong>, Inc. and Subsidiaries19 Stock Based CompensationThe Company accounts for its stock option issuances under Statement of Financial Accounting Standard No. 123 (revised 2004), “Share-Based Payment,” (“SFAS No. 123R”) which was issued by the FASB in December 2004. SFAS No. 123R requires recognition of the cost ofemployee services received in exchange for an award of equity instruments in the financial statements over the period the employee isrequired to perform the services in exchange for the award (presumptively the vesting period). SFAS No. 123R also requires measurementof the cost of employee services received in exchange for an award based on the grant-date fair value of the award.The Company has one share-based compensation plan, which is described below. The compensation cost that has been charged againstincome for the plan was approximately US$59,000 for the year ended 31 December 2006. The income tax benefit recognised for share-basedcompensation arrangements was approximately US$21,000 for the year ended 31 December 2006.In October 2006, the Company implemented the 2006 Stock Incentive Plan (the “Plan”). The Plan authorises the Board of Directors to grantincentive and non-qualified stock options to employees, officers, service providers and directors of the Company for up to 3,400,000 sharesof its common stock. Options granted under the Plan have a term of up to ten years and generally vest over a three-year period beginningon the date of the grant. Options under the Plan must be granted at a price not less than the fair market value at the date of grant.The fair value of each option award is estimated on the date of grant using the Black-Scholes-Merton option pricing model. The risk-freeinterest rate is based on the US Treasury rate for the expected life at the time of grant, volatility is based on the average long-term impliedvolatilities of peer companies as our Company has limited trading history and the expected life is based on the average of the life of theoptions of ten years and a average vesting period of three years. The following table illustrates the assumptions for the Black-Scholes modelused in determining the fair value of options granted to employees for the year ended 31 December 2006.Year ended31 December2006Dividend yield 2.96%Risk-free interest rate 4.52%Volatility 25.10%Expected life (in years) 4.4A summary of option activity under the stock option plans as of 31 December 2006, and changes during the year then endedis presented below:Weighted-Weightedaverageaverage Aggregateexercise remaining intrinsicprice contractual valueOptions Shares US$ term (yrs) US$Outstanding at 1 January 2006 – – – –Granted 2,656,832 2.34 9.84 745,166Exercised – – – –Forfeited or expired – – – –Outstanding at 31 December 2006 2,656,832 2.34 9.84 745,166Exercisable at 31 December 2006 – – – –The weighted-average grant-date fair value of options granted during the year ended 31 December 2006 was US$0.48.43<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006