Section 2Business ReviewFinancial ReviewSummary of Financial Results (1)(5)<strong>Somero</strong><strong>Somero</strong> <strong>Enterprises</strong> Group <strong>Enterprises</strong> Inc. <strong>Somero</strong>Combined (2) <strong>Enterprises</strong> Inc.1 January 2005 11 August 2005through through For the year ended 12 months ended10 August 2005 31 December 2005 31 December 2005 31 December 2006US$ 000 US$ 000 US$ 000 US$ 000Revenue 25,769 16,549 42,318 55,894Cost of sales 12,661 7,953 20,614 25,708Gross profit 13,108 8,596 21,704 30,186Operating expenses:Selling expense 3,925 2,542 6,467 9,066Engineering expense 710 417 1,127 1,202General and administrative expense 3,734 2,637 6,371 8,046Total operating expenses 8,369 5,596 13,965 18,314Operating income 4,739 3,000 7,739 11,872Other income (expense)Interest expense (307) (1,162) (1,469) (3,714)Interest income 383 – 383 157Foreign exchange gain/(loss) (90) (40) (130) 247Other 37 (288) (251) (325)Income before taxes 4,762 1,510 6,272 8,237Provision for income taxes 1,681 548 2,229 2,856Net income 3,081 962 4,043 5,381Other data:EBITDA (3)(4) 5,598 4,208 9,806 14,696Net income before amortisation 3,662 1,963 5,625 7,764Depreciation expense 278 207 485 382Amortisation of intangibles 581 1,001 1,582 2,383Capital expenditures 118 79 197 398Notes:1. On 11 August 2005, <strong>Somero</strong> <strong>Enterprises</strong> Inc., an entity formed by affiliates of The Gores Group, LLC, acquired certain assets and assumed certain liabilities from Dover Industries,Inc. For purposes herein and as described in the audited financial statements, (i) the results for <strong>Somero</strong> <strong>Enterprises</strong> Group are representative of the <strong>Somero</strong> Business for periodsprior to 11 August 2005 and (ii) the results of <strong>Somero</strong> <strong>Enterprises</strong>, Inc. are representative of the <strong>Somero</strong> Business for periods as of 11 August 2005 and thereafter.2. The combined 2005 results represent the summation of (i) the results for 1 January 2005 through 10 August 2005 for <strong>Somero</strong> <strong>Enterprises</strong> Group and (ii) the results for 11 August2005 through 31 December 2005 for <strong>Somero</strong> <strong>Enterprises</strong>, Inc. The accounting treatment for both periods is essentially the same with the exception of amortisation of intangiblesand immaterial differences in depreciation expense.3. EBITDA and Net Income Before Amortisation are not measurements of the Company’s financial performance under GAAP and should not be considered as an alternative to netincome, operating income or any other performance measures derived in accordance with GAAP or as an alternative to GAAP cash flow from operating activities as a measureof profitability or liquidity. EBITDA and Net Income Before Amortisation are presented herein because management believes they are useful analytical tools for measuring theprofitability and cash generation of the business. EBITDA is also used to determine pricing and covenant compliance under the Company’s credit facility and as a measurementfor calculation of management incentive compensation. The Company understands that although EBITDA is frequently used by securities analysts, lenders and others in theirevaluation of companies, its calculation of EBITDA may not be comparable to other similarly titled measures reported by other companies.4. EBITDA as used herein is a calculation of Operating Income plus Deprecation Expense, Amortisation of Intangibles and non-cash stock based compensation.5. The Company uses non-US GAAP financial measures in order to provide supplemental information regarding the Company’s operating performance. The non-US GAAP financialmeasures presented herein should not be considered in isolation from, or as a substitute to, financial measures calculated in accordance with US GAAP. Investors are cautionedthat there are inherent limitations associated with the use of each non-US GAAP financial measure. In particular, non-US GAAP financial measures are not based on acomprehensive set of accounting rules or principles, and many of the adjustments to the US GAAP financial measures reflect the exclusion of items that may have a materialeffect on the Company’s financial results calculated in accordance with US GAAP.14<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006

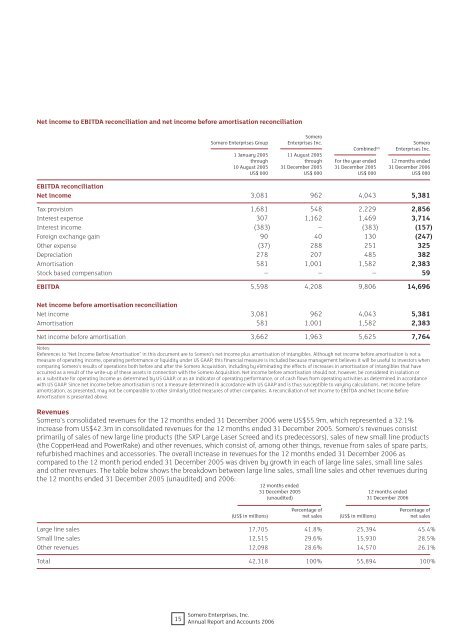

Net income to EBITDA reconciliation and net income before amortisation reconciliation<strong>Somero</strong><strong>Somero</strong> <strong>Enterprises</strong> Group <strong>Enterprises</strong> Inc. <strong>Somero</strong>Combined (2) <strong>Enterprises</strong> Inc.1 January 2005 11 August 2005through through For the year ended 12 months ended10 August 2005 31 December 2005 31 December 2005 31 December 2006US$ 000 US$ 000 US$ 000 US$ 000EBITDA reconciliationNet income 3,081 962 4,043 5,381Tax provision 1,681 548 2,229 2,856Interest expense 307 1,162 1,469 3,714Interest income (383) – (383) (157)Foreign exchange gain 90 40 130 (247)Other expense (37) 288 251 325Depreciation 278 207 485 382Amortisation 581 1,001 1,582 2,383Stock based compensation – – – 59EBITDA 5,598 4,208 9,806 14,696Net income before amortisation reconciliationNet income 3,081 962 4,043 5,381Amortisation 581 1,001 1,582 2,383Net income before amortisation 3,662 1,963 5,625 7,764Notes:References to “Net Income Before Amortisation” in this document are to <strong>Somero</strong>’s net income plus amortisation of intangibles. Although net income before amortisation is not ameasure of operating income, operating performance or liquidity under US GAAP, this financial measure is included because management believes it will be useful to investors whencomparing <strong>Somero</strong>’s results of operations both before and after the <strong>Somero</strong> Acquisition, including by eliminating the effects of increases in amortisation of intangibles that haveoccurred as a result of the write-up of these assets in connection with the <strong>Somero</strong> Acquisition. Net income before amortisation should not, however, be considered in isolation oras a substitute for operating income as determined by US GAAP, or as an indicator of operating performance, or of cash flows from operating activities as determined in accordancewith US GAAP. Since net income before amortisation is not a measure determined in accordance with US GAAP and is thus susceptible to varying calculations, net income beforeamortisation, as presented, may not be comparable to other similarly titled measures of other companies. A reconciliation of net income to EBITDA and Net Income BeforeAmortisation is presented above.Revenues<strong>Somero</strong>’s consolidated revenues for the 12 months ended 31 December 2006 were US$55.9m, which represented a 32.1%increase from US$42.3m in consolidated revenues for the 12 months ended 31 December 2005. <strong>Somero</strong>’s revenues consistprimarily of sales of new large line products (the SXP Large Laser Screed and its predecessors), sales of new small line products(the CopperHead and PowerRake) and other revenues, which consist of, among other things, revenue from sales of spare parts,refurbished machines and accessories. The overall increase in revenues for the 12 months ended 31 December 2006 ascompared to the 12 month period ended 31 December 2005 was driven by growth in each of large line sales, small line salesand other revenues. The table below shows the breakdown between large line sales, small line sales and other revenues duringthe 12 months ended 31 December 2005 (unaudited) and 2006:12 months ended31 December 2005 12 months ended(unaudited) 31 December 2006Percentage ofPercentage of(US$ in millions) net sales (US$ in millions) net salesLarge line sales 17,705 41.8% 25,394 45.4%Small line sales 12,515 29.6% 15,930 28.5%Other revenues 12,098 28.6% 14,570 26.1%Total 42,318 100% 55,894 100%15<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006