PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

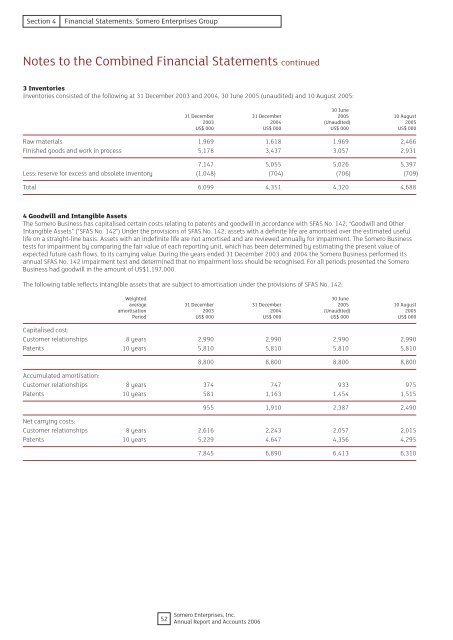

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong> GroupNotes to the Combined Financial Statements continued3 InventoriesInventories consisted of the following at 31 December 2003 and 2004, 30 June 2005 (unaudited) and 10 August 2005:30 June31 December 31 December 2005 10 August2003 2004 (Unaudited) 2005US$ 000 US$ 000 US$ 000 US$ 000Raw materials 1,969 1,618 1,969 2,466Finished goods and work in process 5,178 3,437 3,057 2,9317,147 5,055 5,026 5,397Less: reserve for excess and obsolete inventory (1,048) (704) (706) (709)Total 6,099 4,351 4,320 4,6884 Goodwill and Intangible AssetsThe <strong>Somero</strong> Business has capitalised certain costs relating to patents and goodwill in accordance with SFAS No. 142, “Goodwill and OtherIntangible Assets” (“SFAS No. 142”) Under the provisions of SFAS No. 142, assets with a definite life are amortised over the estimated usefullife on a straight-line basis. Assets with an indefinite life are not amortised and are reviewed annually for impairment. The <strong>Somero</strong> Businesstests for impairment by comparing the fair value of each reporting unit, which has been determined by estimating the present value ofexpected future cash flows, to its carrying value. During the years ended 31 December 2003 and 2004 the <strong>Somero</strong> Business performed itsannual SFAS No. 142 impairment test and determined that no impairment loss should be recognised. For all periods presented the <strong>Somero</strong>Business had goodwill in the amount of US$1,197,000.The following table reflects intangible assets that are subject to amortisation under the provisions of SFAS No. 142:Weighted30 Juneaverage 31 December 31 December 2005 10 Augustamortisation 2003 2004 (Unaudited) 2005Period US$ 000 US$ 000 US$ 000 US$ 000Capitalised cost:Customer relationships 8 years 2,990 2,990 2,990 2,990Patents 10 years 5,810 5,810 5,810 5,8108,800 8,800 8,800 8,800Accumulated amortisation:Customer relationships 8 years 374 747 933 975Patents 10 years 581 1,163 1,454 1,515955 1,910 2,387 2,490Net carrying costs:Customer relationships 8 years 2,616 2,243 2,057 2,015Patents 10 years 5,229 4,647 4,356 4,2957,845 6,890 6,413 6,31052<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006