PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

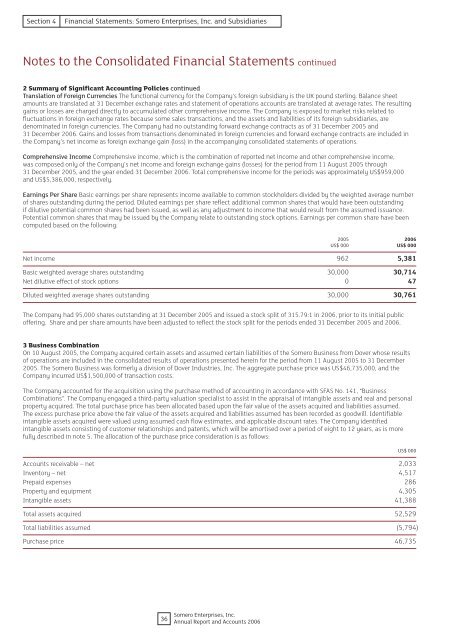

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong>, Inc. and SubsidiariesNotes to the Consolidated Financial Statements continued2 Summary of Significant Accounting Policies continuedTranslation of Foreign Currencies The functional currency for the Company’s foreign subsidiary is the UK pound sterling. Balance sheetamounts are translated at 31 December exchange rates and statement of operations accounts are translated at average rates. The resultinggains or losses are charged directly to accumulated other comprehensive income. The Company is exposed to market risks related tofluctuations in foreign exchange rates because some sales transactions, and the assets and liabilities of its foreign subsidiaries, aredenominated in foreign currencies. The Company had no outstanding forward exchange contracts as of 31 December 2005 and31 December 2006. Gains and losses from transactions denominated in foreign currencies and forward exchange contracts are included inthe Company’s net income as foreign exchange gain (loss) in the accompanying consolidated statements of operations.Comprehensive Income Comprehensive income, which is the combination of reported net income and other comprehensive income,was composed only of the Company’s net income and foreign exchange gains (losses) for the period from 11 August 2005 through31 December 2005, and the year ended 31 December 2006. Total comprehensive income for the periods was approximately US$959,000and US$5,386,000, respectively.Earnings Per Share Basic earnings per share represents income available to common stockholders divided by the weighted average numberof shares outstanding during the period. Diluted earnings per share reflect additional common shares that would have been outstandingif dilutive potential common shares had been issued, as well as any adjustment to income that would result from the assumed issuance.Potential common shares that may be issued by the Company relate to outstanding stock options. Earnings per common share have beencomputed based on the following:2005 2006US$ 000 US$ 000Net income 962 5,381Basic weighted average shares outstanding 30,000 30,714Net dilutive effect of stock options 0 47Diluted weighted average shares outstanding 30,000 30,761The Company had 95,000 shares outstanding at 31 December 2005 and issued a stock split of 315.79:1 in 2006, prior to its initial publicoffering. Share and per share amounts have been adjusted to reflect the stock split for the periods ended 31 December 2005 and 2006.3 Business CombinationOn 10 August 2005, the Company acquired certain assets and assumed certain liabilities of the <strong>Somero</strong> Business from Dover whose resultsof operations are included in the consolidated results of operations presented herein for the period from 11 August 2005 to 31 December2005. The <strong>Somero</strong> Business was formerly a division of Dover Industries, Inc. The aggregate purchase price was US$46,735,000, and theCompany incurred US$1,500,000 of transaction costs.The Company accounted for the acquisition using the purchase method of accounting in accordance with SFAS No. 141, “BusinessCombinations”. The Company engaged a third-party valuation specialist to assist in the appraisal of intangible assets and real and personalproperty acquired. The total purchase price has been allocated based upon the fair value of the assets acquired and liabilities assumed.The excess purchase price above the fair value of the assets acquired and liabilities assumed has been recorded as goodwill. Identifiableintangible assets acquired were valued using assumed cash flow estimates, and applicable discount rates. The Company identifiedintangible assets consisting of customer relationships and patents, which will be amortised over a period of eight to 12 years, as is morefully described in note 5. The allocation of the purchase price consideration is as follows:Accounts receivable – net 2,033Inventory – net 4,517Prepaid expenses 286Property and equipment 4,305Intangible assets 41,388Total assets acquired 52,529Total liabilities assumed (5,794)Purchase price 46,735US$ 00036<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006