PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

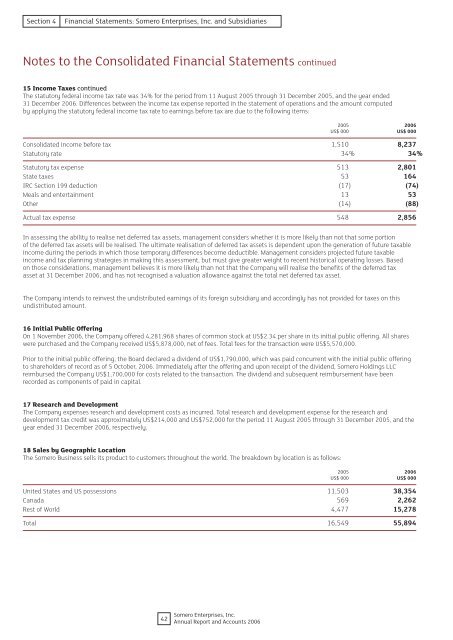

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong>, Inc. and SubsidiariesNotes to the Consolidated Financial Statements continued15 Income Taxes continuedThe statutory federal income tax rate was 34% for the period from 11 August 2005 through 31 December 2005, and the year ended31 December 2006. Differences between the income tax expense reported in the statement of operations and the amount computedby applying the statutory federal income tax rate to earnings before tax are due to the following items:2005 2006US$ 000 US$ 000Consolidated income before tax 1,510 8,237Statutory rate 34% 34%Statutory tax expense 513 2,801State taxes 53 164IRC Section 199 deduction (17) (74)Meals and entertainment 13 53Other (14) (88)Actual tax expense 548 2,856In assessing the ability to realise net deferred tax assets, management considers whether it is more likely than not that some portionof the deferred tax assets will be realised. The ultimate realisation of deferred tax assets is dependent upon the generation of future taxableincome during the periods in which those temporary differences become deductible. Management considers projected future taxableincome and tax planning strategies in making this assessment, but must give greater weight to recent historical operating losses. Basedon those considerations, management believes it is more likely than not that the Company will realise the benefits of the deferred taxasset at 31 December 2006, and has not recognised a valuation allowance against the total net deferred tax asset.The Company intends to reinvest the undistributed earnings of its foreign subsidiary and accordingly has not provided for taxes on thisundistributed amount.16 Initial Public OfferingOn 1 November 2006, the Company offered 4,281,968 shares of common stock at US$2.34 per share in its initial public offering. All shareswere purchased and the Company received US$5,878,000, net of fees. Total fees for the transaction were US$5,570,000.Prior to the initial public offering, the Board declared a dividend of US$1,790,000, which was paid concurrent with the initial public offeringto shareholders of record as of 5 October, 2006. Immediately after the offering and upon receipt of the dividend, <strong>Somero</strong> Holdings LLCreimbursed the Company US$1,700,000 for costs related to the transaction. The dividend and subsequent reimbursement have beenrecorded as components of paid in capital.17 Research and DevelopmentThe Company expenses research and development costs as incurred. Total research and development expense for the research anddevelopment tax credit was approximately US$214,000 and US$752,000 for the period 11 August 2005 through 31 December 2005, and theyear ended 31 December 2006, respectively.18 Sales by Geographic LocationThe <strong>Somero</strong> Business sells its product to customers throughout the world. The breakdown by location is as follows:2005 2006US$ 000 US$ 000United States and US possessions 11,503 38,354Canada 569 2,262Rest of World 4,477 15,278Total 16,549 55,89442<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006