PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

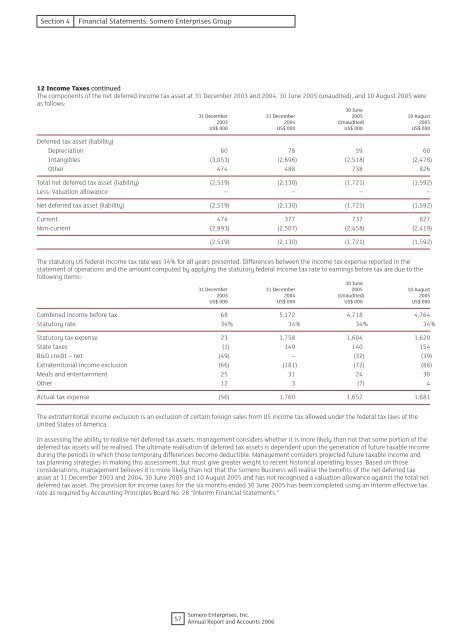

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong> Group12 Income Taxes continuedThe components of the net deferred income tax asset at 31 December 2003 and 2004, 30 June 2005 (unaudited), and 10 August 2005 wereas follows:30 June31 December 31 December 2005 10 August2003 2004 (Unaudited) 2005US$ 000 US$ 000 US$ 000 US$ 000Deferred tax asset (liability)Depreciation 60 78 59 60Intangibles (3,053) (2,696) (2,518) (2,478)Other 474 488 738 826Total net deferred tax asset (liability) (2,519) (2,130) (1,721) (1,592)Less: Valuation allowance – – – –Net deferred tax asset (liability) (2,519) (2,130) (1,721) (1,592)Current 474 377 737 827Non-current (2,993) (2,507) (2,458) (2,419)(2,519) (2,130) (1,721) (1,592)The statutory US federal income tax rate was 34% for all years presented. Differences between the income tax expense reported in thestatement of operations and the amount computed by applying the statutory federal income tax rate to earnings before tax are due to thefollowing items:30 June31 December 31 December 2005 10 August2003 2004 (Unaudited) 2005US$ 000 US$ 000 US$ 000 US$ 000Combined income before tax 68 5,172 4,718 4,764Statutory rate 34% 34% 34% 34%Statutory tax expense 23 1,758 1,604 1,620State taxes (1) 149 140 154R&D credit – net (49) – (32) (39)Extraterritorial income exclusion (66) (181) (72) (88)Meals and entertainment 25 31 24 30Other 12 3 (7) 4Actual tax expense (56) 1,760 1,657 1,681The extraterritorial income exclusion is an exclusion of certain foreign sales from US income tax allowed under the federal tax laws of theUnited States of America.In assessing the ability to realise net deferred tax assets, management considers whether it is more likely than not that some portion of thedeferred tax assets will be realised. The ultimate realisation of deferred tax assets is dependent upon the generation of future taxable incomeduring the periods in which those temporary differences become deductible. Management considers projected future taxable income andtax planning strategies in making this assessment, but must give greater weight to recent historical operating losses. Based on thoseconsiderations, management believes it is more likely than not that the <strong>Somero</strong> Business will realise the benefits of the net deferred taxasset at 31 December 2003 and 2004, 30 June 2005 and 10 August 2005 and has not recognised a valuation allowance against the total netdeferred tax asset. The provision for income taxes for the six months ended 30 June 2005 has been completed using an interim effective taxrate as required by Accounting Principles Board No. 28 “Interim Financial Statements.”57<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006