PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

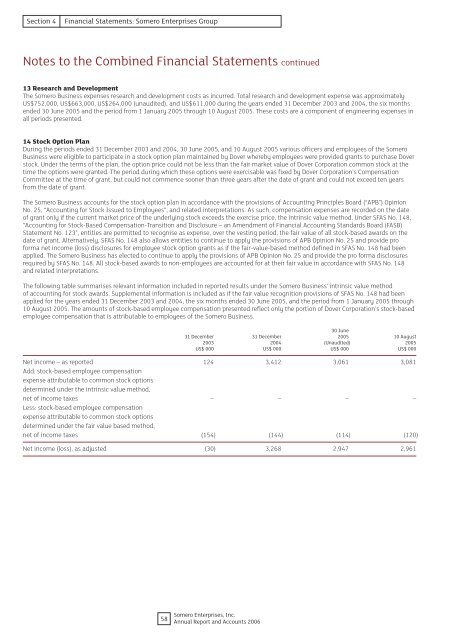

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong> GroupNotes to the Combined Financial Statements continued13 Research and DevelopmentThe <strong>Somero</strong> Business expenses research and development costs as incurred. Total research and development expense was approximatelyUS$752,000, US$663,000, US$264,000 (unaudited), and US$611,000 during the years ended 31 December 2003 and 2004, the six monthsended 30 June 2005 and the period from 1 January 2005 through 10 August 2005. These costs are a component of engineering expenses inall periods presented.14 Stock Option PlanDuring the periods ended 31 December 2003 and 2004, 30 June 2005, and 10 August 2005 various officers and employees of the <strong>Somero</strong>Business were eligible to participate in a stock option plan maintained by Dover whereby employees were provided grants to purchase Doverstock. Under the terms of the plan, the option price could not be less than the fair market value of Dover Corporation common stock at thetime the options were granted. The period during which these options were exercisable was fixed by Dover Corporation’s CompensationCommittee at the time of grant, but could not commence sooner than three years after the date of grant and could not exceed ten yearsfrom the date of grant.The <strong>Somero</strong> Business accounts for the stock option plan in accordance with the provisions of Accounting Principles Board (“APB”) OpinionNo. 25, “Accounting for Stock Issued to Employees”, and related interpretations. As such, compensation expenses are recorded on the dateof grant only if the current market price of the underlying stock exceeds the exercise price, the intrinsic value method. Under SFAS No. 148,“Accounting for Stock-Based Compensation-Transition and Disclosure – an Amendment of Financial Accounting Standards Board (FASB)Statement No. 123”, entities are permitted to recognise as expense, over the vesting period, the fair value of all stock-based awards on thedate of grant. Alternatively, SFAS No. 148 also allows entities to continue to apply the provisions of APB Opinion No. 25 and provide proforma net income (loss) disclosures for employee stock option grants as if the fair-value-based method defined in SFAS No. 148 had beenapplied. The <strong>Somero</strong> Business has elected to continue to apply the provisions of APB Opinion No. 25 and provide the pro forma disclosuresrequired by SFAS No. 148. All stock-based awards to non-employees are accounted for at their fair value in accordance with SFAS No. 148and related interpretations.The following table summarises relevant information included in reported results under the <strong>Somero</strong> Business’ intrinsic value methodof accounting for stock awards. Supplemental information is included as if the fair value recognition provisions of SFAS No. 148 had beenapplied for the years ended 31 December 2003 and 2004, the six months ended 30 June 2005, and the period from 1 January 2005 through10 August 2005. The amounts of stock-based employee compensation presented reflect only the portion of Dover Corporation’s stock-basedemployee compensation that is attributable to employees of the <strong>Somero</strong> Business.30 June31 December 31 December 2005 10 August2003 2004 (Unaudited) 2005US$ 000 US$ 000 US$ 000 US$ 000Net income – as reported 124 3,412 3,061 3,081Add: stock-based employee compensationexpense attributable to common stock optionsdetermined under the intrinsic value method,net of income taxes – – – –Less: stock-based employee compensationexpense attributable to common stock optionsdetermined under the fair value based method,net of income taxes (154) (144) (114) (120)Net income (loss), as adjusted (30) 3,268 2,947 2,96158<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006