PDF - Somero Enterprises

PDF - Somero Enterprises

PDF - Somero Enterprises

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

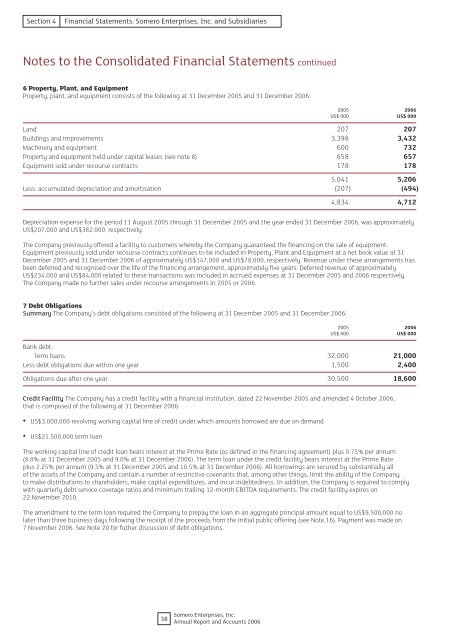

Section 4Financial Statements: <strong>Somero</strong> <strong>Enterprises</strong>, Inc. and SubsidiariesNotes to the Consolidated Financial Statements continued6 Property, Plant, and EquipmentProperty, plant, and equipment consists of the following at 31 December 2005 and 31 December 2006:2005 2006US$ 000 US$ 000Land 207 207Buildings and improvements 3,398 3,432Machinery and equipment 600 732Property and equipment held under capital leases (see note 8) 658 657Equipment sold under recourse contracts 178 1785,041 5,206Less: accumulated depreciation and amortisation (207) (494)4,834 4,712Depreciation expense for the period 11 August 2005 through 31 December 2005 and the year ended 31 December 2006, was approximatelyUS$207,000 and US$382,000, respectively.The Company previously offered a facility to customers whereby the Company guaranteed the financing on the sale of equipment.Equipment previously sold under recourse contracts continues to be included in Property, Plant and Equipment at a net book value at 31December 2005 and 31 December 2006 of approximately US$147,000 and US$78,000, respectively. Revenue under these arrangements hasbeen deferred and recognised over the life of the financing arrangement, approximately five years. Deferred revenue of approximatelyUS$234,000 and US$84,000 related to these transactions was included in accrued expenses at 31 December 2005 and 2006 respectively.The Company made no further sales under recourse arrangements in 2005 or 2006.7 Debt ObligationsSummary The Company’s debt obligations consisted of the following at 31 December 2005 and 31 December 2006:2005 2006US$ 000 US$ 000Bank debt:Term loans 32,000 21,000Less debt obligations due within one year 1,500 2,400Obligations due after one year 30,500 18,600Credit Facility The Company has a credit facility with a financial institution, dated 22 November 2005 and amended 4 October 2006,that is composed of the following at 31 December 2006:• US$3,000,000 revolving working capital line of credit under which amounts borrowed are due on demand• US$21,500,000 term loanThe working capital line of credit loan bears interest at the Prime Rate (as defined in the financing agreement) plus 0.75% per annum(8.0% at 31 December 2005 and 9.0% at 31 December 2006). The term loan under the credit facility bears interest at the Prime Rateplus 2.25% per annum (9.5% at 31 December 2005 and 10.5% at 31 December 2006). All borrowings are secured by substantially allof the assets of the Company and contain a number of restrictive covenants that, among other things, limit the ability of the Companyto make distributions to shareholders, make capital expenditures, and incur indebtedness. In addition, the Company is required to complywith quarterly debt service coverage ratios and minimum trailing 12-month EBITDA requirements. The credit facility expires on22 November 2010.The amendment to the term loan required the Company to prepay the loan in an aggregate principal amount equal to US$9,500,000 nolater than three business days following the receipt of the proceeds from the initial public offering (see Note 16). Payment was made on7 November 2006. See Note 20 for futher discussion of debt obligations.38<strong>Somero</strong> <strong>Enterprises</strong>, Inc.Annual Report and Accounts 2006