Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

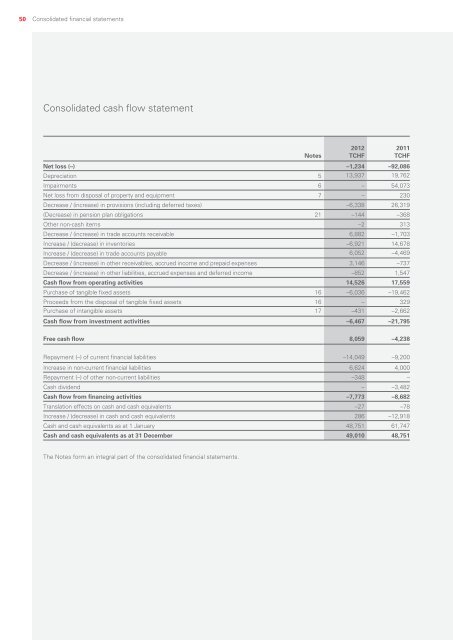

50Consolidated financial statementsConsolidated cash flow statementNotes<strong>2012</strong>TCHFNet loss (–) –1,234 –92,086Depreciation 5 13,937 19,762Impairments 6 – 54,073Net loss from disposal of property and equipment 7 – 230Decrease / (increase) in provisions (including deferred taxes) –6,338 26,319(Decrease) in pension plan obligations 21 –144 –368Other non-cash items –2 313Decrease / (increase) in trade accounts receivable 6,882 –1,703Increase / (decrease) in inventories –6,921 14,678Increase / (decrease) in trade accounts payable 6,052 –4,469Decrease / (increase) in other receivables, accrued income and prepaid expenses 3,146 –737Decrease / (increase) in other liabilities, accrued expenses and deferred income –852 1,547Cash flow from operating activities 14,526 17,559Purchase of tangible fixed assets 16 –6,036 –19,4622011TCHFProceeds from the disposal of tangible fixed assets 16 – 329Purchase of intangible assets 17 –431 –2,662Cash flow from investment activities –6,467 –21,795Free cash flow 8,059 –4,238Repayment (–) of current financial liabilities –14,049 –9,200Increase in non-current financial liabilities 6,624 4,000Repayment (–) of other non-current liabilities –348 –Cash dividend – –3,482Cash flow from financing activities –7,773 –8,682Translation effects on cash and cash equivalents –27 –78Increase / (decrease) in cash and cash equivalents 286 –12,918Cash and cash equivalents as at 1 January 48,751 61,747Cash and cash equivalents as at 31 December 49,010 48,751The Notes form an integral part of the consolidated financial statements.