Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

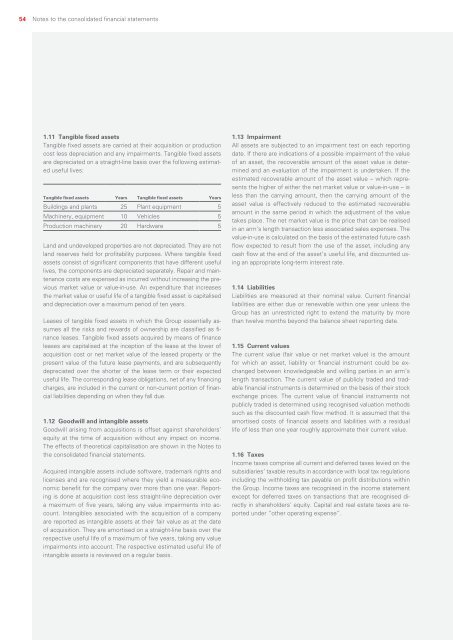

54Notes to the consolidated financial statements1.11 Tangible fixed assetsTangible fixed assets are carried at their acquisition or productioncost less depreciation and any impairments. Tangible fixed assetsare depreciated on a straight-line basis over the following estimateduseful lives:Tangible fixed assets Years Tangible fixed assets YearsBuildings and plants 25 Plant equipment 5Machinery, equipment 10 Vehicles 5Production machinery 20 Hardware 5Land and undeveloped properties are not depreciated. They are notland reserves held for profitability purposes. Where tangible fixedassets consist of significant components that have different usefullives, the components are depreciated separately. Repair and maintenancecosts are expensed as incurred without increasing the previousmarket value or value-in-use. An expenditure that increasesthe market value or useful life of a tangible fixed asset is capitalisedand depreciation over a maximum period of ten years.Leases of tangible fixed assets in which the Group essentially assumesall the risks and rewards of ownership are classified as financeleases. Tangible fixed assets acquired by means of financeleases are capitalised at the inception of the lease at the lower ofacquisition cost or net market value of the leased property or thepresent value of the future lease payments, and are subsequentlydepreciated over the shorter of the lease term or their expecteduseful life. The corresponding lease obligations, net of any financingcharges, are included in the current or non-current portion of financialliabilities depending on when they fall due.1.12 Goodwill and intangible assetsGoodwill arising from acquisitions is offset against shareholders’equity at the time of acquisition without any impact on income.The effects of theoretical capitalisation are shown in the Notes tothe consolidated financial statements.Acquired intangible assets include software, trademark rights andlicenses and are recognised where they yield a measurable economicbenefit for the company over more than one year. <strong>Report</strong>ingis done at acquisition cost less straight-line depreciation overa maximum of five years, taking any value impairments into account.Intangibles associated with the acquisition of a companyare reported as intangible assets at their fair value as at the dateof acquisition. They are amortised on a straight-line basis over therespective useful life of a maximum of five years, taking any valueimpairments into account. The respective estimated useful life ofintangible assets is reviewed on a regular basis.1.13 ImpairmentAll assets are subjected to an impairment test on each reportingdate. If there are indications of a possible impairment of the valueof an asset, the recoverable amount of the asset value is determinedand an evaluation of the impairment is undertaken. If theestimated recoverable amount of the asset value – which representsthe higher of either the net market value or value-in-use – isless than the carrying amount, then the carrying amount of theasset value is effectively reduced to the estimated recoverableamount in the same period in which the adjustment of the valuetakes place. The net market value is the price that can be realisedin an arm’s length transaction less associated sales expenses. Thevalue-in-use is calculated on the basis of the estimated future cashflow expected to result from the use of the asset, including anycash flow at the end of the asset’s useful life, and discounted usingan appropriate long-term interest rate.1.14 LiabilitiesLiabilities are measured at their nominal value. Current financialliabilities are either due or renewable within one year unless theGroup has an unrestricted right to extend the maturity by morethan twelve months beyond the balance sheet reporting date.1.15 Current valuesThe current value (fair value or net market value) is the amountfor which an asset, liability or financial instrument could be exchangedbetween knowledgeable and willing parties in an arm’slength transaction. The current value of publicly traded and tradablefinancial instruments is determined on the basis of their stockexchange prices. The current value of financial instruments notpublicly traded is determined using recognised valuation methodssuch as the discounted cash flow method. It is assumed that theamortised costs of financial assets and liabilities with a residuallife of less than one year roughly approximate their current value.1.16 TaxesIncome taxes comprise all current and deferred taxes levied on thesubsidiaries’ taxable results in accordance with local tax regulationsincluding the withholding tax payable on profit distributions withinthe Group. Income taxes are recognised in the income statementexcept for deferred taxes on transactions that are recognised directlyin shareholders’ equity. Capital and real estate taxes are reportedunder “other operating expense”.