Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

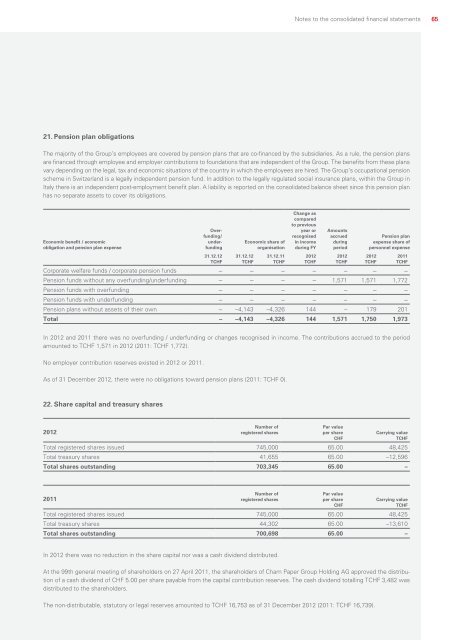

Notes to the consolidated financial statements6521. Pension plan obligationsThe majority of the Group’s employees are covered by pension plans that are co-financed by the subsidiaries. As a rule, the pension plansare financed through employee and employer contributions to foundations that are independent of the Group. The benefits from these plansvary depending on the legal, tax and economic situations of the country in which the employees are hired. The Group’s occupational pensionscheme in Switzerland is a legally independent pension fund. In addition to the legally regulated social insurance plans, within the Group inItaly there is an independent post-employment benefit plan. A liability is reported on the consolidated balance sheet since this pension planhas no separate assets to cover its obligations.Economic benefit / economicobligation and pension plan expenseOverfunding/underfunding31.12.12TCHFEconomic share oforganisation31.12.12TCHF31.12.11TCHFChange ascomparedto previousyear orrecognisedin incomeduring FY<strong>2012</strong>TCHFAmountsaccruedduringperiod<strong>2012</strong>TCHFPension planexpense share ofpersonnel expenseCorporate welfare funds / corporate pension funds – – – – – – –Pension funds without any overfunding/underfunding – – – – 1,571 1,571 1,772Pension funds with overfunding – – – – – – –Pension funds with underfunding – – – – – – –Pension plans without assets of their own – –4,143 –4,326 144 – 179 201Total – –4,143 –4,326 144 1,571 1,750 1,973<strong>2012</strong>TCHF2011TCHFIn <strong>2012</strong> and 2011 there was no overfunding / underfunding or changes recognised in income. The contributions accrued to the periodamounted to TCHF 1,571 in <strong>2012</strong> (2011: TCHF 1,772).No employer contribution reserves existed in <strong>2012</strong> or 2011.As of 31 December <strong>2012</strong>, there were no obligations toward pension plans (2011: TCHF 0).22. Share capital and treasury shares<strong>2012</strong>Number ofregistered sharesPar valueper shareCHFCarrying valueTCHFTotal registered shares issued 745,000 65.00 48,425Total treasury shares 41,655 65.00 –12,596Total shares outstanding 703,345 65.00 –2011Number ofregistered sharesPar valueper shareCHFCarrying valueTCHFTotal registered shares issued 745,000 65.00 48,425Total treasury shares 44,302 65.00 –13,610Total shares outstanding 700,698 65.00 –In <strong>2012</strong> there was no reduction in the share capital nor was a cash dividend distributed.At the 99th general meeting of shareholders on 27 April 2011, the shareholders of Cham Paper Group Holding AG approved the distributionof a cash dividend of CHF 5.00 per share payable from the capital contribution reserves. The cash dividend totalling TCHF 3,482 wasdistributed to the shareholders.The non-distributable, statutory or legal reserves amounted to TCHF 16,753 as of 31 December <strong>2012</strong> (2011: TCHF 16,739).