Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

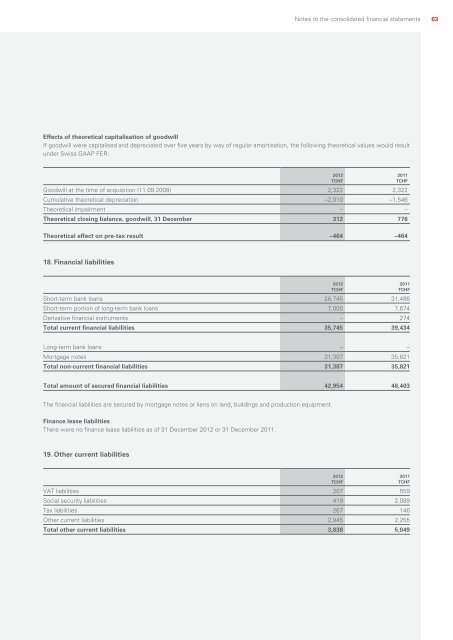

Notes to the consolidated financial statements63Effects of theoretical capitalisation of goodwillIf goodwill were capitalised and depreciated over five years by way of regular amortisation, the following theoretical values would resultunder Swiss GAAP FER:Goodwill at the time of acquisition (11.09.2008) 2,322 2,322Cumulative theoretical depreciation –2,010 –1,546Theoretical impairment – –Theoretical closing balance, goodwill, 31 December 312 776<strong>2012</strong>TCHF2011TCHFTheoretical effect on pre-tax result –464 –46418. Financial liabilitiesShort-term bank loans 28,745 31,486Short-term portion of long-term bank loans 7,000 7,674Derivative financial instruments – 274Total current financial liabilities 35,745 39,434<strong>2012</strong>TCHF2011TCHFLong-term bank loans – –Mortgage notes 31,307 35,821Total non-current financial liabilities 31,307 35,821Total amount of secured financial liabilities 42,954 48,403The financial liabilities are secured by mortgage notes or liens on land, buildings and production equipment.Finance lease liabilitiesThere were no finance lease liabilities as of 31 December <strong>2012</strong> or 31 December 2011.19. Other current liabilitiesVAT liabilities 207 559Social security liabilities 419 2,089Tax liabilities 267 146Other current liabilities 2,945 2,255Total other current liabilities 3,838 5,049<strong>2012</strong>TCHF2011TCHF