Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

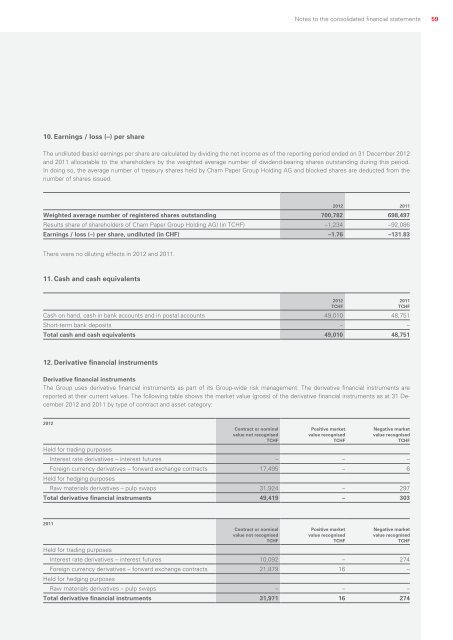

Notes to the consolidated financial statements5910. Earnings / loss (–) per shareThe undiluted (basic) earnings per share are calculated by dividing the net income as of the reporting period ended on 31 December <strong>2012</strong>and 2011 allocatable to the shareholders by the weighted average number of dividend-bearing shares outstanding during this period.In doing so, the average number of treasury shares held by Cham Paper Group Holding AG and blocked shares are deducted from thenumber of shares issued.<strong>2012</strong> 2011Weighted average number of registered shares outstanding 700,782 698,497Results share of shareholders of Cham Paper Group Holding AG) (in TCHF) –1,234 –92,086Earnings / loss (–) per share, undiluted (in CHF) –1.76 –131.83There were no diluting effects in <strong>2012</strong> and 2011.11. Cash and cash equivalentsCash on hand, cash in bank accounts and in postal accounts 49,010 48,751Short-term bank deposits – –Total cash and cash equivalents 49,010 48,751<strong>2012</strong>TCHF2011TCHF12. Derivative financial instrumentsDerivative financial instrumentsThe Group uses derivative financial instruments as part of its Group-wide risk management. The derivative financial instruments arereported at their current values. The following table shows the market value (gross) of the derivative financial instruments as at 31 December<strong>2012</strong> and 2011 by type of contract and asset category:<strong>2012</strong>Contract or nominalvalue not recognisedTCHFPositive marketvalue recognisedTCHFNegative marketvalue recognisedTCHFHeld for trading purposesInterest rate derivatives – interest futures – – –Foreign currency derivatives – forward exchange contracts 17,495 – 6Held for hedging purposesRaw materials derivatives – pulp swaps 31,924 – 297Total derivative financial instruments 49,419 – 3032011Contract or nominalvalue not recognisedTCHFPositive marketvalue recognisedTCHFNegative marketvalue recognisedTCHFHeld for trading purposesInterest rate derivatives – interest futures 10,092 – 274Foreign currency derivatives – forward exchange contracts 21,879 16 –Held for hedging purposesRaw materials derivatives – pulp swaps – – –Total derivative financial instruments 31,971 16 274