Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

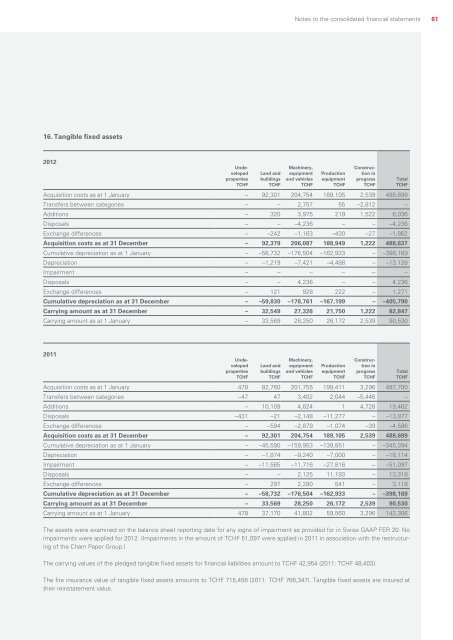

Notes to the consolidated financial statements6116. Tangible fixed assets<strong>2012</strong>UndevelopedpropertiesTCHFLand andbuildingsTCHFMachinery,equipmentand vehiclesTCHFProductionequipmentTCHFConstructioninprogressTCHFAcquisition costs as at 1 January – 92,301 204,754 189,105 2,539 488,699Transfers between categories – – 2,757 55 –2,812 –Additions – 320 3,975 219 1,522 6,036Disposals – – –4,236 – – –4,236Exchange differences – –242 –1,163 –430 –27 –1,862Acquisition costs as at 31 December – 92,379 206,087 188,949 1,222 488,637Cumulative depreciation as at 1 January – –58,732 –176,504 –162,933 – –398,169Depreciation – –1,219 –7,421 –4,488 – –13,128Impairment – – – – – –Disposals – – 4,236 – – 4,236Exchange differences – 121 928 222 – 1,271Cumulative depreciation as at 31 December – –59,830 –178,761 –167,199 – –405,790Carrying amount as at 31 December – 32,549 27,326 21,750 1,222 82,847Carrying amount as at 1 January – 33,569 28,250 26,172 2,539 90,530TotalTCHF2011UndevelopedpropertiesTCHFLand andbuildingsTCHFMachinery,equipmentand vehiclesTCHFProductionequipmentTCHFConstructioninprogressTCHFAcquisition costs as at 1 January 478 82,760 201,755 199,411 3,296 487,700Transfers between categories –47 47 3,402 2,044 –5,446 –Additions – 10,109 4,624 1 4,728 19,462Disposals –431 –21 –2,148 –11,277 – –13,877Exchange differences – –594 –2,879 –1,074 –39 –4,586Acquisition costs as at 31 December – 92,301 204,754 189,105 2,539 488,699Cumulative depreciation as at 1 January – –45,590 –159,953 –139,851 – –345,394Depreciation – –1,874 –9,240 –7,000 – –18,114Impairment – –11,565 –11,716 –27,816 – –51,097Disposals – – 2,125 11,193 – 13,318Exchange differences – 297 2,280 541 – 3,118Cumulative depreciation as at 31 December – –58,732 –176,504 –162,933 – –398,169Carrying amount as at 31 December – 33,569 28,250 26,172 2,539 90,530Carrying amount as at 1 January 478 37,170 41,802 59,560 3,296 142,306The assets were examined on the balance sheet reporting date for any signs of impairment as provided for in Swiss GAAP FER 20. Noimpairments were applied for <strong>2012</strong>. (Impairments in the amount of TCHF 51,097 were applied in 2011 in association with the restructuringof the Cham Paper Group.)TotalTCHFThe carrying values of the pledged tangible fixed assets for financial liabilities amount to TCHF 42,954 (2011: TCHF 48,403).The fire insurance value of tangible fixed assets amounts to TCHF 715,458 (2011: TCHF 766,347). Tangible fixed assets are insured attheir reinstatement value.