Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

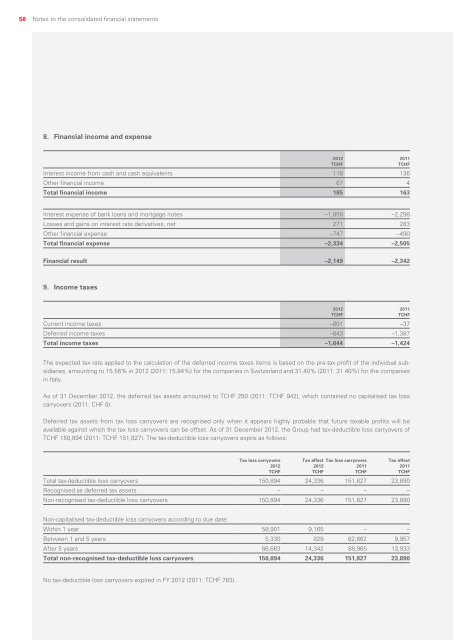

58Notes to the consolidated financial statements8. Financial income and expenseInterest income from cash and cash equivalents 118 136Other financial income 67 4Total financial income 185 163<strong>2012</strong>TCHF2011TCHFInterest expense of bank loans and mortgage notes –1,858 –2,298Losses and gains on interest rate derivatives, net 271 283Other financial expense –747 –490Total financial expense –2,334 –2,505Financial result –2,149 –2,3429. Income taxesCurrent income taxes –801 –37Deferred income taxes –843 –1,387Total income taxes –1,644 –1,424<strong>2012</strong>TCHF2011TCHFThe expected tax rate applied to the calculation of the deferred income taxes items is based on the pre-tax profit of the individual subsidiaries,amounting to 15.56% in <strong>2012</strong> (2011: 15.84%) for the companies in Switzerland and 31.40% (2011: 31.40%) for the companiesin Italy.As of 31 December <strong>2012</strong>, the deferred tax assets amounted to TCHF 250 (2011: TCHF 942), which contained no capitalised tax losscarryovers (2011: CHF 0).Deferred tax assets from tax loss carryovers are recognised only when it appears highly probable that future taxable profits will beavailable against which the tax loss carryovers can be offset. As of 31 December <strong>2012</strong>, the Group had tax-deductible loss carryovers ofTCHF 150,894 (2011: TCHF 151,827). The tax-deductible loss carryovers expire as follows:Tax loss carryovers<strong>2012</strong>TCHFTax effect<strong>2012</strong>TCHFTax loss carryovers2011TCHFTax effect2011TCHFTotal tax-deductible loss carryovers 150,894 24,336 151,827 23,890Recognised as deferred tax assets – – – –Non-recognised tax-deductible loss carryovers 150,894 24,336 151,827 23,890Non-capitalised tax-deductible loss carryovers according to due date:Within 1 year 58,901 9,165 – –Between 1 and 5 years 5,330 829 62,862 9,957After 5 years 86,663 14,342 88,965 13,933Total non-recognised tax-deductible loss carryovers 150,894 24,336 151,827 23,890No tax-deductible loss carryovers expired in FY <strong>2012</strong> (2011: TCHF 783).