Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

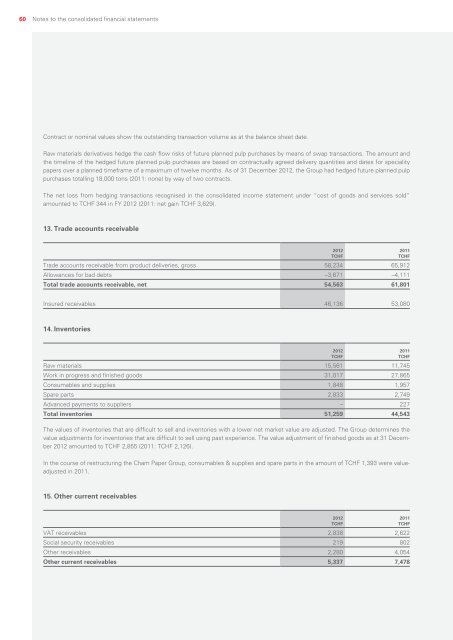

60Notes to the consolidated financial statementsContract or nominal values show the outstanding transaction volume as at the balance sheet date.Raw materials derivatives hedge the cash flow risks of future planned pulp purchases by means of swap transactions. The amount andthe timeline of the hedged future planned pulp purchases are based on contractually agreed delivery quantities and dates for specialitypapers over a planned timeframe of a maximum of twelve months. As of 31 December <strong>2012</strong>, the Group had hedged future planned pulppurchases totalling 18,000 tons (2011: none) by way of two contracts.The net loss from hedging transactions recognised in the consolidated income statement under “cost of goods and services sold”amounted to TCHF 344 in FY <strong>2012</strong> (2011: net gain TCHF 3,629).13. Trade accounts receivableTrade accounts receivable from product deliveries, gross 58,234 65,912Allowances for bad debts –3,671 –4,111Total trade accounts receivable, net 54,563 61,801<strong>2012</strong>TCHF2011TCHFInsured receivables 46,136 53,08014. InventoriesRaw materials 15,561 11,745Work in progress and finished goods 31,017 27,865Consumables and supplies 1,848 1,957Spare parts 2,833 2,749Advanced payments to suppliers – 227Total inventories 51,259 44,543The values of inventories that are difficult to sell and inventories with a lower net market value are adjusted. The Group determines thevalue adjustments for inventories that are difficult to sell using past experience. The value adjustment of finished goods as at 31 December<strong>2012</strong> amounted to TCHF 2,855 (2011: TCHF 2,126).<strong>2012</strong>TCHF2011TCHFIn the course of restructuring the Cham Paper Group, consumables & supplies and spare parts in the amount of TCHF 1,393 were valueadjustedin 2011.15. Other current receivablesVAT receivables 2,838 2,622Social security receivables 219 802Other receivables 2,280 4,054Other current receivables 5,337 7,478<strong>2012</strong>TCHF2011TCHF