Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

Annual Report 2012 - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

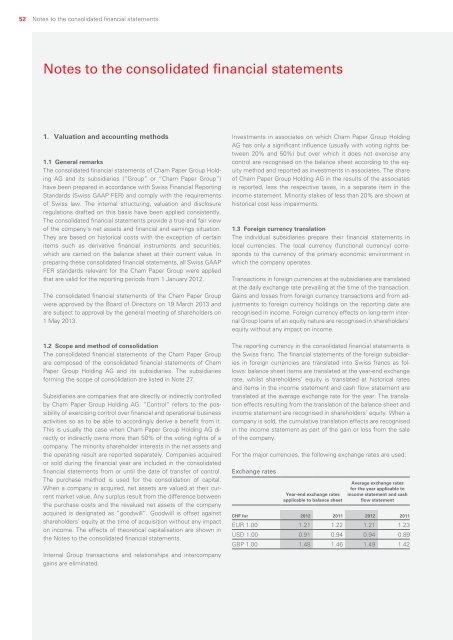

52Notes to the consolidated financial statementsNotes to the consolidated financial statements1. Valuation and accounting methods1.1 General remarksThe consolidated financial statements of Cham Paper Group HoldingAG and its subsidiaries (“Group” or “Cham Paper Group”)have been prepared in accordance with Swiss Financial <strong>Report</strong>ingStandards (Swiss GAAP FER) and comply with the requirementsof Swiss law. The internal structuring, valuation and disclosureregulations drafted on this basis have been applied consistently.The consolidated financial statements provide a true and fair viewof the company’s net assets and financial and earnings situation.They are based on historical costs with the exception of certainitems such as derivative financial instruments and securities,which are carried on the balance sheet at their current value. Inpreparing these consolidated financial statements, all Swiss GAAPFER standards relevant for the Cham Paper Group were appliedthat are valid for the reporting periods from 1 January <strong>2012</strong>.The consolidated financial statements of the Cham Paper Groupwere approved by the Board of Directors on 19 March 2013 andare subject to approval by the general meeting of shareholders on1 May 2013.1.2 Scope and method of consolidationThe consolidated financial statements of the Cham Paper Groupare composed of the consolidated financial statements of ChamPaper Group Holding AG and its subsidiaries. The subsidiariesforming the scope of consolidation are listed in Note 27.Subsidiaries are companies that are directly or indirectly controlledby Cham Paper Group Holding AG. “Control” refers to the possibilityof exercising control over financial and operational businessactivities so as to be able to accordingly derive a benefit from it.This is usually the case when Cham Paper Group Holding AG directlyor indirectly owns more than 50% of the voting rights of acompany. The minority shareholder interests in the net assets andthe operating result are reported separately. Companies acquiredor sold during the financial year are included in the consolidatedfinancial statements from or until the date of transfer of control.The purchase method is used for the consolidation of capital.When a company is acquired, net assets are valued at their currentmarket value. Any surplus result from the difference betweenthe purchase costs and the revalued net assets of the companyacquired is designated as “goodwill”. Goodwill is offset againstshareholders’ equity at the time of acquisition without any impacton income. The effects of theoretical capitalisation are shown inthe Notes to the consolidated financial statements.Internal Group transactions and relationships and intercompanygains are eliminated.Investments in associates on which Cham Paper Group HoldingAG has only a significant influence (usually with voting rights between20% and 50%) but over which it does not exercise anycontrol are recognised on the balance sheet according to the equitymethod and reported as investments in associates. The shareof Cham Paper Group Holding AG in the results of the associatesis reported, less the respective taxes, in a separate item in theincome statement. Minority stakes of less than 20% are shown athistorical cost less impairments.1.3 Foreign currency translationThe individual subsidiaries prepare their financial statements inlocal currencies. The local currency (functional currency) correspondsto the currency of the primary economic environment inwhich the company operates.Transactions in foreign currencies at the subsidiaries are translatedat the daily exchange rate prevailing at the time of the transaction.Gains and losses from foreign currency transactions and from adjustmentsto foreign currency holdings on the reporting date arerecognised in income. Foreign currency effects on long-term internalGroup loans of an equity nature are recognised in shareholders’equity without any impact on income.The reporting currency in the consolidated financial statements isthe Swiss franc. The financial statements of the foreign subsidiariesin foreign currencies are translated into Swiss francs as follows:balance sheet items are translated at the year-end exchangerate, whilst shareholders’ equity is translated at historical ratesand items in the income statement and cash flow statement aretranslated at the average exchange rate for the year. The translationeffects resulting from the translation of the balance sheet andincome statement are recognised in shareholders’ equity. When acompany is sold, the cumulative translation effects are recognisedin the income statement as part of the gain or loss from the saleof the company.For the major currencies, the following exchange rates are used:Exchange ratesYear-end exchange ratesapplicable to balance sheetAverage exchange ratesfor the year applicable toincome statement and cashflow statementCHF for <strong>2012</strong> 2011 <strong>2012</strong> 2011EUR 1.00 1.21 1.22 1.21 1.23USD 1.00 0.91 0.94 0.94 0.89GBP 1.00 1.48 1.46 1.49 1.42