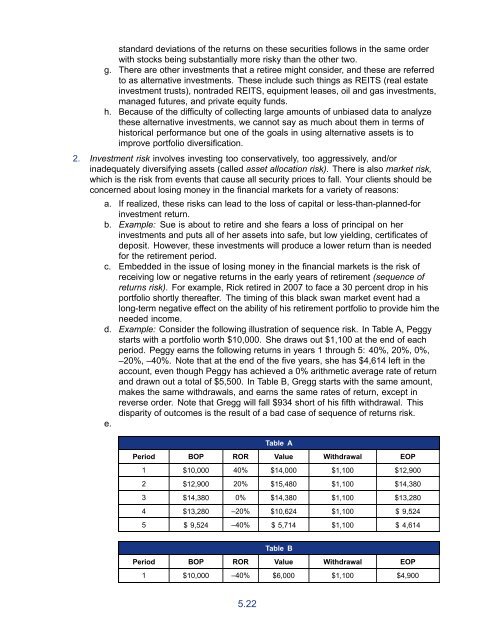

standard deviations of the returns on these securities follows in the same orderwith stocks being substantially more risky than the other two.g. <strong>The</strong>re are other investments that a retiree might consider, and these are referredto as alternative investments. <strong>The</strong>se include such things as REITS (real estateinvestment trusts), nontraded REITS, equipment leases, oil and gas investments,managed futures, and private equity funds.h. Because of the difficulty of collecting large amounts of unbiased data to analyzethese alternative investments, we cannot say as much about them in terms ofhistorical performance but one of the goals in using alternative assets is toimprove portfolio diversification.2. Investment risk involves investing too conservatively, too aggressively, and/orinadequately diversifying assets (called asset allocation risk). <strong>The</strong>re is also market risk,which is the risk from events that cause all security prices to fall. Your clients should beconcerned about losing money in the financial markets for a variety of reasons:a. If realized, these risks can lead to the loss of capital or less-than-planned-forinvestment return.b. Example: Sue is about to retire and she fears a loss of principal on herinvestments and puts all of her assets into safe, but low yielding, certificates ofdeposit. However, these investments will produce a lower return than is neededfor the retirement period.c. Embedded in the issue of losing money in the financial markets is the risk ofreceiving low or negative returns in the early years of retirement (sequence ofreturns risk). For example, Rick retired in 2007 to face a 30 percent drop in hisportfolio shortly thereafter. <strong>The</strong> timing of this black swan market event had along-term negative effect on the ability of his retirement portfolio to provide him theneeded income.d. Example: Consider the following illustration of sequence risk. In Table A, Peggystarts with a portfolio worth $10,000. She draws out $1,100 at the end of eachperiod. Peggy earns the following returns in years 1 through 5: 40%, 20%, 0%,–20%, –40%. Note that at the end of the five years, she has $4,614 left in theaccount, even though Peggy has achieved a 0% arithmetic average rate of returnand drawn out a total of $5,500. In Table B, Gregg starts with the same amount,makes the same withdrawals, and earns the same rates of return, except inreverse order. Note that Gregg will fall $934 short of his fifth withdrawal. Thisdisparity of outcomes is the result of a bad case of sequence of returns risk.e.Table APeriod BOP ROR Value Withdrawal EOP1 $10,000 40% $14,000 $1,100 $12,9002 $12,900 20% $15,480 $1,100 $14,3803 $14,380 0% $14,380 $1,100 $13,2804 $13,280 –20% $10,624 $1,100 $ 9,5245 $ 9,524 –40% $ 5,714 $1,100 $ 4,614Table BPeriod BOP ROR Value Withdrawal EOP1 $10,000 –40% $6,000 $1,100 $4,9005.22

2 $4,900 –20% $3,920 $1,100 $2,8203 $2,820 0% $2,820 $1,100 $1,7204 $1,720 –20% $1,376 $1,100 $ 2765 $ 276 –40% $ 166 $1,100 $ (934)f. Planning Point: With market risk, the most fundamental piece of investmentadvice—diversification—does not work, if by diversification one means investingin different risky assets.g. Planning Point: Market risk is avoided by holding nonrisky assets such as CDsand savings bonds. However, these investments typically provide the lowest ratesof return available in the market place.h. Planning Point: Too often, clients who suffer market setbacks pull out of equitiesto create a “buy high, sell low” scenario. Research has shown that the actual ratesof return achieved by mutual funds are typically higher than the rates of returnachieved by investors in those mutual funds. This is because many individuals,left to their own investment timing, will base their investment decisions on recentmarket movements. Thus, when stock prices have been going up, they buy, andwhen stock prices are going down, they sell. So although everyone knows thatthe simple way to make money in investments is to buy low and sell high, manyinvestors will regularly end up buying high and selling low.3. Reinvestment risk is the chance that as higher-yielding fixed income investments mature,the client may need to reinvest that principal and possibly interest payments into alower-yield fixed income investment. Your clients should be concerned about beingunable to duplicate yield on fixed investments for a variety of reasons:a. Retirees often rely on returns from fixed income investments and may not be ableto acquire the needed rate of return when they must lock in the investment.b. Example: Arthur’s investments include a substantial portion in bonds of variousmaturities. As principle and interest payments come due, some of the cash iswithdrawn to cover expenses, and the rest is reinvested into new bonds. Arthurhears that interest rates have been falling, and is pleased to note that the valueof his bond portfolio has risen from $400,000 to $425,000. However, Arthur alsonotes that when he goes to reinvest his principal and interest payments, he isno longer able to find bonds with yields comparable to what he had previouslybeen getting. He realizes that because of the lower interest payments on the newbonds, his interest income from the portfolio is falling, and he will have to liquidatemore bonds than he anticipated to meet his needed withdrawals.c. Planning Point: Zero coupon bonds, since they do not make coupon interestpayments, eliminate the reinvestment risk associated with the coupon payments.An example of a zero coupon security is U.S. Treasury strips.4. Liquidity risk is the inability to have assets available to financially support unanticipatedcash flow needs. Clients should be concerned about being able to access fundsa. Example: Fengyum’s portfolio consists solely of single premium annuities andinvestments in extended maturity certificates of deposit. When a sudden accidentforces her to remodel her house for one floor living, she is unable to obtain thecash necessary to complete the project because of the restrictions on liquidatingthe annuities and penalties on early withdrawals from the certificates.b. Example: Russ owns undeveloped real estate when he is confronted with theneed to support his daughter who is out of work because of a recession caused by5.23

- Page 1:

Huebner School SeriesHS 353 STUDY O

- Page 6:

THEAMERICANCOLLEGE.EDUThrough The A

- Page 10 and 11:

c. But it is more comprehensive bec

- Page 12 and 13:

(3) Work part-time during retiremen

- Page 14 and 15:

SECTION 2: UNDERSTANDING RETIREMENT

- Page 16:

d. Solutions(1) The model considers

- Page 19 and 20:

. Other sources of retirement incom

- Page 21 and 22:

c. Another option for solving cash

- Page 23 and 24:

(b) Net worth statements that ident

- Page 25 and 26:

d. Be ready to reengage with the cl

- Page 27 and 28:

(b) In financial planning(c) In inv

- Page 29 and 30:

j. Planning Point: Planners can use

- Page 31 and 32:

e. We also need them to have a bett

- Page 33 and 34:

Assignment 2IDENTIFY RETIREMENT INC

- Page 35 and 36:

(2) Income4. Determining risk toler

- Page 37 and 38:

collaborative experience which focu

- Page 39 and 40:

6. Asset allocation and risk tolera

- Page 41 and 42:

c. How long will the income last?d.

- Page 43 and 44:

. Durationc. Reliabilityd. Other6.

- Page 45 and 46:

c. Supplemental Security Income (SS

- Page 47 and 48:

. An unused emergency fund can supp

- Page 49 and 50:

5. Inflation(2) The expense method

- Page 51 and 52:

Assignment 3CHOOSE APPROPRIATE STRA

- Page 53 and 54:

. Save as a percentage of income an

- Page 55 and 56:

(1) Note that 38% of second income

- Page 57 and 58:

(4) The AARP website has a national

- Page 59 and 60:

4. Contributions to IRAs and Roth I

- Page 61 and 62:

carve out the nondeductible contrib

- Page 63 and 64:

(2) Plus salary deferrals (for an i

- Page 65 and 66:

a. Example:(1) Save $10,000 in 25%

- Page 67 and 68:

(a) This requires knowing four fact

- Page 69 and 70:

. Solution(1) Li and Lin Lin are bo

- Page 71 and 72:

(1) The increase in dollar amounts

- Page 73 and 74:

9. In some circumstances, an indivi

- Page 75 and 76:

2. Reverse mortgage basicsa. Almost

- Page 77 and 78:

5. Planning considerations(b) Keep

- Page 79 and 80:

(2) Some funds that are promoted as

- Page 81 and 82:

(1) Berstresser, Chalmers, and Tufa

- Page 83 and 84:

RESOURCES FOR COMPETENCY 3: CHOOSE

- Page 85 and 86:

(2) From the previous employer(s) p

- Page 87 and 88:

8. IRA funded plans (IRAs, SEPs, SI

- Page 89 and 90:

. Does the distribution election fi

- Page 91 and 92:

6. Net unrealized appreciation rule

- Page 93 and 94:

a. Tax-exempt plans include Roth IR

- Page 96 and 97: 8. Calculating required distributio

- Page 98 and 99: (2) Exception: If there are separat

- Page 100 and 101: 5. Impactc. Tax rates are low in ea

- Page 102 and 103: (7) Based on ordering rules, identi

- Page 104 and 105: 7. A married couple who file jointl

- Page 106 and 107: (1) Needed to provide the appropria

- Page 108 and 109: 13. Transfers at deatha. Wills(2) A

- Page 110 and 111: (1) The Retirement Equity Act manda

- Page 112 and 113: (2) Beneficiary designation of bene

- Page 114 and 115: 13. Overview14. Types(2) The donor

- Page 116 and 117: (1) Charity needs only to payout in

- Page 118 and 119: c. Access should be granted to an a

- Page 120 and 121: nightmare of living probate might h

- Page 122 and 123: (6) Powers to represent their princ

- Page 124 and 125: c. If the policy is term coverage w

- Page 126 and 127: e. Factoring personal and family he

- Page 128 and 129: problem. On the other hand, we can

- Page 130 and 131: d. Adding a cost of living adjustme

- Page 132 and 133: g. Planning Point: Sometimes a high

- Page 134 and 135: (2) Clients may not be able to “a

- Page 136 and 137: c. Ensure that the client is receiv

- Page 138 and 139: a. Example: Because of physical and

- Page 140 and 141: options about where to get his/her

- Page 142 and 143: (2) Facilities, monthly fees, and s

- Page 144 and 145: 8. Other strategies that help to co

- Page 148 and 149: a collapse in the real estate marke

- Page 150 and 151: a. In a later competency we will di

- Page 152 and 153: years of service with the employer)

- Page 154 and 155: a. Planning Point: Planners should

- Page 156 and 157: (2) If you have locked in food, ren

- Page 158 and 159: (4) Loss-of-spouse risk—Deferred

- Page 160 and 161: (1) Excess withdrawal risk—The us

- Page 162 and 163: (5) Frailty risk—Managing assets

- Page 164 and 165: 7. Practice good career management:

- Page 166 and 167: Assignment 6CHOOSE APPROPRIATE STRA

- Page 168 and 169: c. Example: Chuck and Sarah divide

- Page 170 and 171: e. The bucket approach can be thoug

- Page 172 and 173: 3. Understanding systematic withdra

- Page 174 and 175: (1) The time horizon used in the ca

- Page 176 and 177: 12. Four percent is not the number.

- Page 178 and 179: markets have declined by a specifie

- Page 180 and 181: (2) Annuities and long-term care an

- Page 182 and 183: anticipates ramping down her activi

- Page 184 and 185: c. Each of the three portfolios wil

- Page 186 and 187: SECTION 4: THE ESSENTIAL VERSUS DIS

- Page 188 and 189: d. Clients give up investment contr

- Page 190 and 191: geared toward long-term growth. Thi

- Page 192 and 193: . Trade-offs involve:(1) Irrevocabl

- Page 194 and 195: (1) Rate at which banks lend to the

- Page 196 and 197:

. Dollar-denominated liabilities of

- Page 198 and 199:

(a) Dividend taxed in year paid out

- Page 200 and 201:

4. Taxationtheir return generating

- Page 202 and 203:

. Close ended(1) IPO style launch(2

- Page 204 and 205:

(3) Tax control17. Conversations in

- Page 206 and 207:

(3) Mutual funds provide lower cost

- Page 208 and 209:

way to obtain increasing payments t

- Page 210 and 211:

protection from the downside risk w

- Page 212 and 213:

6. Today’s annuitization rates ar

- Page 214 and 215:

h. Planning Point: Markets are very

- Page 216 and 217:

a. The client may not be clear abou

- Page 218 and 219:

a. Problems with implementation are

- Page 220 and 221:

c. Product solutions work together

- Page 222 and 223:

(1) A problem is that if the client

- Page 224 and 225:

(b) A traditional fund company(c) A

- Page 226 and 227:

d. Evelyn is in great health and he

- Page 228:

RESOURCES FOR COMPETENCY 7: INTEGRA