section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

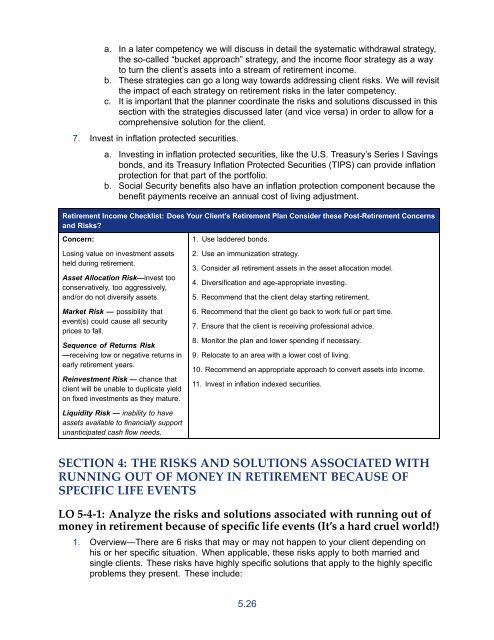

a. In a later competency we will discuss in detail the systematic withdrawal strategy,the so-called “bucket approach” strategy, and the income floor strategy as a wayto turn the client’s assets into a stream of retirement income.b. <strong>The</strong>se strategies can go a long way towards addressing client risks. We will revisitthe impact of each strategy on retirement risks in the later competency.c. It is important that the planner coordinate the risks and solutions discussed in this<strong>section</strong> with the strategies discussed later (and vice versa) in order to allow for acomprehensive solution for the client.7. Invest in inflation protected securities.a. Investing in inflation protected securities, like the U.S. Treasury’s Series I Savingsbonds, and its Treasury Inflation Protected Securities (TIPS) can provide inflationprotection for that part of the portfolio.b. Social Security benefits also have an inflation protection component because thebenefit payments receive an annual cost of living adjustment.Retirement Income Checklist: Does Your Client’s Retirement Plan Consider these Post-Retirement Concernsand Risks?Concern:Losing value on investment assetsheld during retirement.Asset Allocation Risk—invest tooconservatively, too aggressively,and/or do not diversify assets.Market Risk — possibility thatevent(s) could cause all securityprices to fall.Sequence of Returns Risk—receiving low or negative returns inearly retirement years.Reinvestment Risk — chance thatclient will be unable to duplicate yieldon fixed investments as they mature.1. Use laddered bonds.2. Use an immunization strategy.3. Consider all retirement assets in the asset allocation model.4. Diversification and age-appropriate investing.5. Recommend that the client delay starting retirement.6. Recommend that the client go back to work full or part time.7. Ensure that the client is receiving professional advice.8. Monitor the plan and lower spending if necessary.9. Relocate to an area with a lower cost of living.10. Recommend an appropriate approach to convert assets into income.11. Invest in inflation indexed securities.Liquidity Risk — inability to haveassets available to financially supportunanticipated cash flow needs.SECTION 4: THE RISKS AND SOLUTIONS ASSOCIATED WITHRUNNING OUT OF MONEY IN RETIREMENT BECAUSE OFSPECIFIC LIFE EVENTSLO 5-4-1: Analyze the risks and solutions associated with running out ofmoney in retirement because of specific life events (It’s a hard cruel world!)1. Overview—<strong>The</strong>re are 6 risks that may or may not happen to your client depending onhis or her specific situation. When applicable, these risks apply to both married andsingle clients. <strong>The</strong>se risks have highly specific solutions that apply to the highly specificproblems they present. <strong>The</strong>se include:5.26