section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

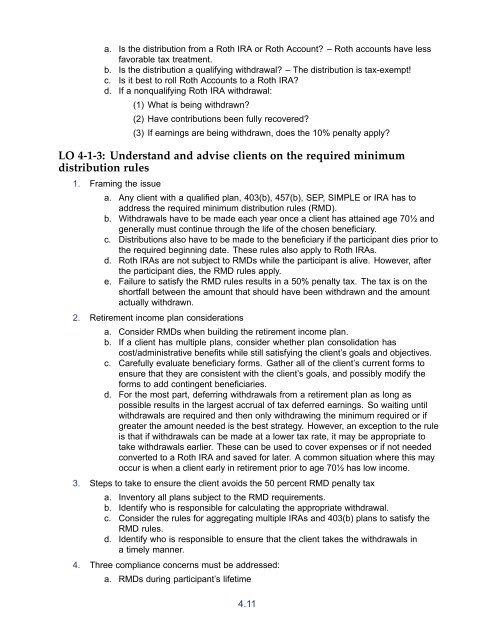

a. Is the distribution from a Roth IRA or Roth Account? – Roth accounts have lessfavorable tax treatment.b. Is the distribution a qualifying withdrawal? – <strong>The</strong> distribution is tax-exempt!c. Is it best to roll Roth Accounts to a Roth IRA?d. If a nonqualifying Roth IRA withdrawal:(1) What is being withdrawn?(2) Have contributions been fully recovered?(3) If earnings are being withdrawn, does the 10% penalty apply?LO 4-1-3: Understand and advise clients on the required minimumdistribution rules1. Framing the issuea. Any client with a qualified plan, 403(b), 457(b), SEP, SIMPLE or IRA has toaddress the required minimum distribution rules (RMD).b. Withdrawals have to be made each year once a client has attained age 70½ andgenerally must continue through the life of the chosen beneficiary.c. Distributions also have to be made to the beneficiary if the participant dies prior tothe required beginning date. <strong>The</strong>se rules also apply to Roth IRAs.d. Roth IRAs are not subject to RMDs while the participant is alive. However, afterthe participant dies, the RMD rules apply.e. Failure to satisfy the RMD rules results in a 50% penalty tax. <strong>The</strong> tax is on theshortfall between the amount that should have been withdrawn and the amountactually withdrawn.2. Retirement income plan considerationsa. Consider RMDs when building the retirement income plan.b. If a client has multiple plans, consider whether plan consolidation hascost/administrative benefits while still satisfying the client’s goals and objectives.c. Carefully evaluate beneficiary forms. Gather all of the client’s current forms toensure that they are consistent with the client’s goals, and possibly modify theforms to add contingent beneficiaries.d. For the most part, deferring withdrawals from a retirement plan as long aspossible results in the largest accrual of tax deferred earnings. So waiting untilwithdrawals are required and then only withdrawing the minimum required or ifgreater the amount needed is the best strategy. However, an exception to the ruleis that if withdrawals can be made at a lower tax rate, it may be appropriate totake withdrawals earlier. <strong>The</strong>se can be used to cover expenses or if not neededconverted to a Roth IRA and saved for later. A common situation where this mayoccur is when a client early in retirement prior to age 70½ has low income.3. Steps to take to ensure the client avoids the 50 percent RMD penalty taxa. Inventory all plans subject to the RMD requirements.b. Identify who is responsible for calculating the appropriate withdrawal.c. Consider the rules for aggregating multiple IRAs and 403(b) plans to satisfy theRMD rules.d. Identify who is responsible to ensure that the client takes the withdrawals ina timely manner.4. Three compliance concerns must be addressed:a. RMDs during participant’s lifetime4.11