section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

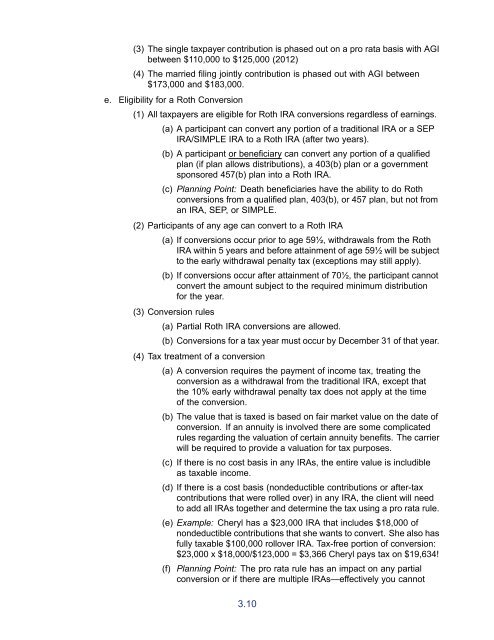

(3) <strong>The</strong> single taxpayer contribution is phased out on a pro rata basis with AGIbetween $110,000 to $125,000 (2012)(4) <strong>The</strong> married filing jointly contribution is phased out with AGI between$173,000 and $183,000.e. Eligibility for a Roth Conversion(1) All taxpayers are eligible for Roth IRA conversions regardless of earnings.(a) A participant can convert any portion of a traditional IRA or a SEPIRA/SIMPLE IRA to a Roth IRA (after two years).(b) A participant or beneficiary can convert any portion of a qualifiedplan (if plan allows distributions), a 403(b) plan or a governmentsponsored 457(b) plan into a Roth IRA.(c) Planning Point: Death beneficiaries have the ability to do Rothconversions from a qualified plan, 403(b), or 457 plan, but not froman IRA, SEP, or SIMPLE.(2) Participants of any age can convert to a Roth IRA(a) If conversions occur prior to age 59½, withdrawals from the RothIRA within 5 years and before attainment of age 59½ will be subjectto the early withdrawal penalty tax (exceptions may still apply).(b) If conversions occur after attainment of 70½, the participant cannotconvert the amount subject to the required minimum distributionfor the year.(3) Conversion rules(a) Partial Roth IRA conversions are allowed.(b) Conversions for a tax year must occur by December 31 of that year.(4) Tax treatment of a conversion(a) A conversion requires the payment of income tax, treating theconversion as a withdrawal from the traditional IRA, except thatthe 10% early withdrawal penalty tax does not apply at the timeof the conversion.(b) <strong>The</strong> value that is taxed is based on fair market value on the date ofconversion. If an annuity is involved there are some complicatedrules regarding the valuation of certain annuity benefits. <strong>The</strong> carrierwill be required to provide a valuation for tax purposes.(c) If there is no cost basis in any IRAs, the entire value is includibleas taxable income.(d) If there is a cost basis (nondeductible contributions or after-taxcontributions that were rolled over) in any IRA, the client will needto add all IRAs together and determine the tax using a pro rata rule.(e) Example: Cheryl has a $23,000 IRA that includes $18,000 ofnondeductible contributions that she wants to convert. She also hasfully taxable $100,000 rollover IRA. Tax-free portion of conversion:$23,000 x $18,000/$123,000 = $3,366 Cheryl pays tax on $19,634!(f) Planning Point: <strong>The</strong> pro rata rule has an impact on any partialconversion or if there are multiple IRAs—effectively you cannot3.10