section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

section 1 - The American College Online Learning Center

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

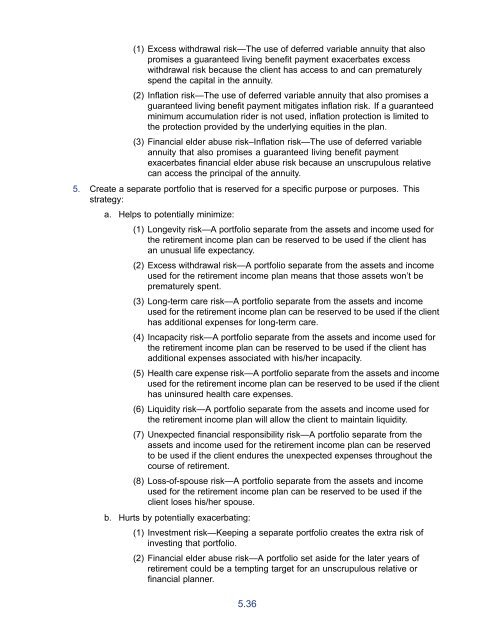

(1) Excess withdrawal risk—<strong>The</strong> use of deferred variable annuity that alsopromises a guaranteed living benefit payment exacerbates excesswithdrawal risk because the client has access to and can prematurelyspend the capital in the annuity.(2) Inflation risk—<strong>The</strong> use of deferred variable annuity that also promises aguaranteed living benefit payment mitigates inflation risk. If a guaranteedminimum accumulation rider is not used, inflation protection is limited tothe protection provided by the underlying equities in the plan.(3) Financial elder abuse risk–Inflation risk—<strong>The</strong> use of deferred variableannuity that also promises a guaranteed living benefit paymentexacerbates financial elder abuse risk because an unscrupulous relativecan access the principal of the annuity.5. Create a separate portfolio that is reserved for a specific purpose or purposes. Thisstrategy:a. Helps to potentially minimize:(1) Longevity risk—A portfolio separate from the assets and income used forthe retirement income plan can be reserved to be used if the client hasan unusual life expectancy.(2) Excess withdrawal risk—A portfolio separate from the assets and incomeused for the retirement income plan means that those assets won’t beprematurely spent.(3) Long-term care risk—A portfolio separate from the assets and incomeused for the retirement income plan can be reserved to be used if the clienthas additional expenses for long-term care.(4) Incapacity risk—A portfolio separate from the assets and income used forthe retirement income plan can be reserved to be used if the client hasadditional expenses associated with his/her incapacity.(5) Health care expense risk—A portfolio separate from the assets and incomeused for the retirement income plan can be reserved to be used if the clienthas uninsured health care expenses.(6) Liquidity risk—A portfolio separate from the assets and income used forthe retirement income plan will allow the client to maintain liquidity.(7) Unexpected financial responsibility risk—A portfolio separate from theassets and income used for the retirement income plan can be reservedto be used if the client endures the unexpected expenses throughout thecourse of retirement.(8) Loss-of-spouse risk—A portfolio separate from the assets and incomeused for the retirement income plan can be reserved to be used if theclient loses his/her spouse.b. Hurts by potentially exacerbating:(1) Investment risk—Keeping a separate portfolio creates the extra risk ofinvesting that portfolio.(2) Financial elder abuse risk—A portfolio set aside for the later years ofretirement could be a tempting target for an unscrupulous relative orfinancial planner.5.36