2013-14 Operating & Capital Budget Plan - Cornell University ...

2013-14 Operating & Capital Budget Plan - Cornell University ...

2013-14 Operating & Capital Budget Plan - Cornell University ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

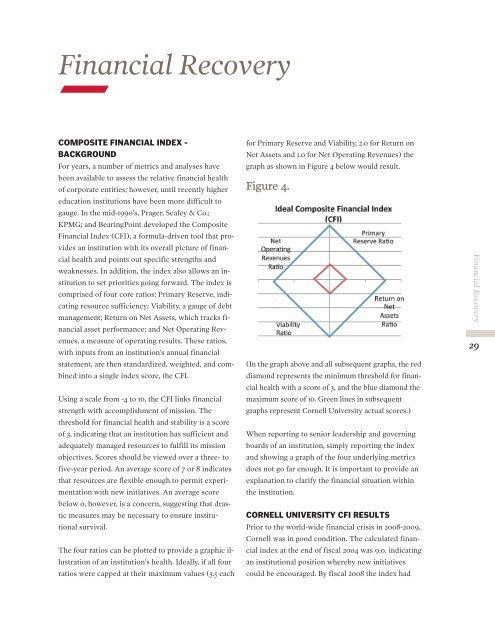

Financial RecoveryCOMPOSITE FINANCIAL INDEX -BACKGROUNDFor years, a number of metrics and analyses havebeen available to assess the relative financial healthof corporate entities; however, until recently highereducation institutions have been more difficult togauge. In the mid-1990’s, Prager, Sealey & Co.;KPMG; and BearingPoint developed the CompositeFinancial Index (CFI), a formula-driven tool that providesan institution with its overall picture of financialhealth and points out specific strengths andweaknesses. In addition, the index also allows an institutionto set priorities going forward. The index iscomprised of four core ratios: Primary Reserve, indicatingresource sufficiency; Viability, a gauge of debtmanagement; Return on Net Assets, which tracks financialasset performance; and Net <strong>Operating</strong> Revenues,a measure of operating results. These ratios,with inputs from an institution’s annual financialstatement, are then standardized, weighted, and combinedinto a single index score, the CFI.Using a scale from -4 to 10, the CFI links financialstrength with accomplishment of mission. Thethreshold for financial health and stability is a scoreof 3, indicating that an institution has sufficient andadequately managed resources to fulfill its missionobjectives. Scores should be viewed over a three- tofive-year period. An average score of 7 or 8 indicatesthat resources are flexible enough to permit experimentationwith new initiatives. An average scorebelow 0, however, is a concern, suggesting that drasticmeasures may be necessary to ensure institutionalsurvival.The four ratios can be plotted to provide a graphic illustrationof an institution’s health. Ideally, if all fourratios were capped at their maximum values (3.5 eachfor Primary Reserve and Viability, 2.0 for Return onNet Assets and 1.0 for Net <strong>Operating</strong> Revenues) thegraph as shown in Figure 4 below would result.Figure 4.(In the graph above and all subsequent graphs, the reddiamond represents the minimum threshold for financialhealth with a score of 3, and the blue diamond themaximum score of 10. Green lines in subsequentgraphs represent <strong>Cornell</strong> <strong>University</strong> actual scores.)When reporting to senior leadership and governingboards of an institution, simply reporting the indexand showing a graph of the four underlying metricsdoes not go far enough. It is important to provide anexplanation to clarify the financial situation withinthe institution.CORNELL UNIVERSITY CFI RESULTSPrior to the world-wide financial crisis in 2008-2009,<strong>Cornell</strong> was in good condition. The calculated financialindex at the end of fiscal 2004 was 9.0, indicatingan institutional position whereby new initiativescould be encouraged. By fiscal 2008 the index hadFinancial Recovery29