2013-14 Operating & Capital Budget Plan - Cornell University ...

2013-14 Operating & Capital Budget Plan - Cornell University ...

2013-14 Operating & Capital Budget Plan - Cornell University ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

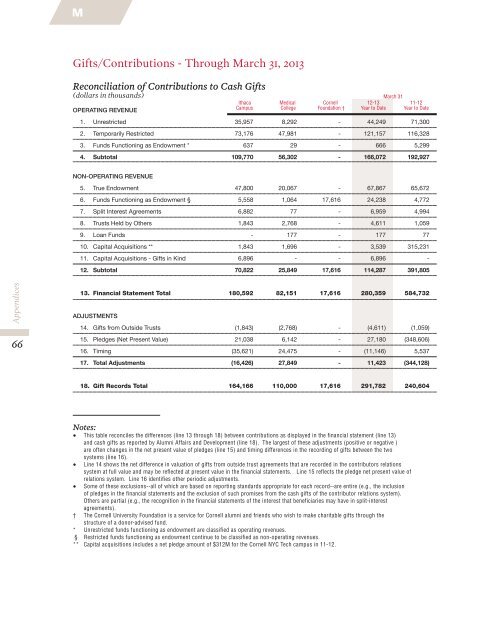

MGifts/Contributions - Through March 31, <strong>2013</strong>Reconciliation of Contributions to Cash Gifts(dollars in thousands)OPERATING REVENUEIthacaCampusMedicalCollege<strong>Cornell</strong>Foundation †March 3112-1311-12Year to Date Year to Date1. Unrestricted 35,957 8,292 - 44,249 71,3002. Temporarily Restricted 73,176 47,981 - 121,157 116,3283. Funds Functioning as Endowment * 637 29 - 666 5,2994. Subtotal 109,770 56,302 - 166,072 192,927NON-OPERATING REVENUE5. True Endowment 47,800 20,067 - 67,867 65,6726. Funds Functioning as Endowment § 5,558 1,064 17,616 24,238 4,7727. Split Interest Agreements 6,882 77 - 6,959 4,9948. Trusts Held by Others 1,843 2,768 - 4,611 1,0599. Loan Funds - 177 - 177 7710. <strong>Capital</strong> Acquisitions ** 1,843 1,696 - 3,539 315,23111. <strong>Capital</strong> Acquisitions - Gifts in Kind 6,896 - - 6,896 -12. Subtotal 70,822 25,849 17,616 1<strong>14</strong>,287 391,805Appendices6613. Financial Statement Total 180,592 82,151 17,616 280,359 584,732ADJUSTMENTS<strong>14</strong>. Gifts from Outside Trusts (1,843) (2,768) - (4,611) (1,059)15. Pledges (Net Present Value) 21,038 6,<strong>14</strong>2 - 27,180 (348,606)16. Timing (35,621) 24,475 - (11,<strong>14</strong>6) 5,53717. Total Adjustments (16,426) 27,849 - 11,423 (344,128)18. Gift Records Total 164,166 110,000 17,616 291,782 240,604Notes:● This table reconciles the differences (line 13 through 18) between contributions as displayed in the financial statement (line 13)and cash gifts as reported by Alumni Affairs and Development (line 18). The largest of these adjustments (positive or negative )are often changes in the net present value of pledges (line 15) and timing differences in the recording of gifts between the twosystems (line 16).● Line <strong>14</strong> shows the net difference in valuation of gifts from outside trust agreements that are recorded in the contributors relationssystem at full value and may be reflected at present value in the financial statements. Line 15 reflects the pledge net present value ofrelations system. Line 16 identifies other periodic adjustments.● Some of these exclusions--all of which are based on reporting standards appropriate for each record--are entire (e.g., the inclusionof pledges in the financial statements and the exclusion of such promises from the cash gifts of the contributor relations system).Others are partial (e.g., the recognition in the financial statements of the interest that beneficiaries may have in split-interestagreements).† The <strong>Cornell</strong> <strong>University</strong> Foundation is a service for <strong>Cornell</strong> alumni and friends who wish to make charitable gifts through thestructure of a donor-advised fund.* Unrestricted funds functioning as endowment are classified as operating revenues.§ Restricted funds functioning as endowment continue to be classified as non-operating revenues.** <strong>Capital</strong> acquisitions includes a net pledge amount of $312M for the <strong>Cornell</strong> NYC Tech campus in 11-12.