Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

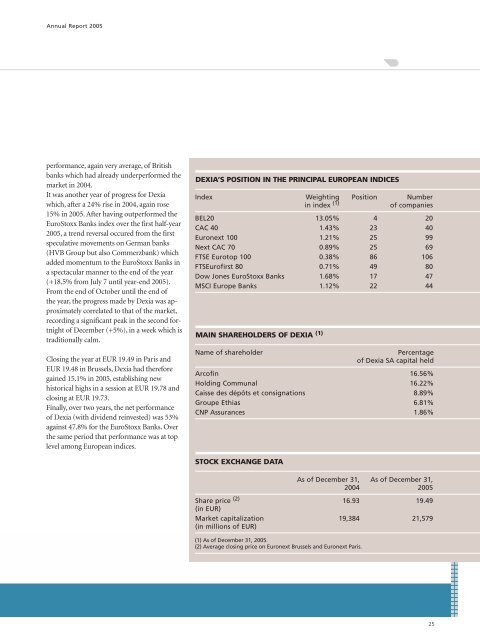

<strong>Annual</strong> Report <strong>2005</strong>performance, again very average, of Britishbanks which had already underperformed themarket in 2004.It was another year of progress for <strong>Dexia</strong>which, after a 24% rise in 2004, again rose15% in <strong>2005</strong>. After having outperformed theEuroStoxx Banks index over the first half-year<strong>2005</strong>, a trend reversal occured from the firstspeculative movements on German banks(HVB Group but also Commerzbank) whichadded momentum to the EuroStoxx Banks ina spectacular manner to the end of the year(+18.5% from July 7 until year-end <strong>2005</strong>).From the end of October until the end ofthe year, the progress made by <strong>Dexia</strong> was approximatelycorrelated to that of the market,recording a significant peak in the second fortnightof December (+5%), in a week which istraditionally calm.Closing the year at EUR 19.49 in Paris andEUR 19.48 in Brussels, <strong>Dexia</strong> had thereforegained 15.1% in <strong>2005</strong>, establishing newhistorical highs in a session at EUR 19.78 andclosing at EUR 19.73.Finally, over two years, the net performanceof <strong>Dexia</strong> (with dividend reinvested) was 53%against 47.8% for the EuroStoxx Banks. Overthe same period that performance was at toplevel among European indices.DEXIA’S POSITION IN THE PRINCIPAL EUROPEAN INDICESIndex Weighting Position Numberin index (1)of <strong>com</strong>paniesBEL20 13.05% 4 20CAC 40 1.43% 23 40Euronext 100 1.21% 25 99Next CAC 70 0.89% 25 69FTSE Eurotop 100 0.38% 86 106FTSEurofirst 80 0.71% 49 80Dow Jones EuroStoxx Banks 1.68% 17 47MSCI Europe Banks 1.12% 22 44MAIN SHAREHOLDERS OF DEXIA (1)Name of shareholderPercentageof <strong>Dexia</strong> SA capital heldArcofin 16.56%Holding Communal 16.22%Caisse des dépôts et consignations 8.89%Groupe Ethias 6.81%CNP Assurances 1.86%STOCK EXCHANGE DATAAs of December 31, As of December 31,2004 <strong>2005</strong>Share price (2) 16.93 19.49(in EUR)Market capitalization 19,384 21,579(in millions of EUR)(1) As of December 31, <strong>2005</strong>.(1) (2) Moyenne Average closing des cours price de on clôture Euronext sur Euronext Brussels and Bruxelles Euronext et Euronext Paris. Paris.25