Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

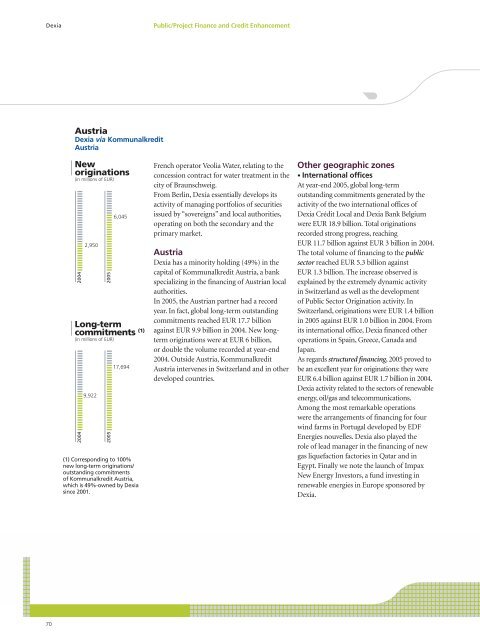

<strong>Dexia</strong>Public/Project Finance and Credit EnhancementAustria<strong>Dexia</strong> via KommunalkreditAustriaNeworiginations(in millions of EUR)l llllllllllllllllllllllllllllll ll l20042,950l llllllllllllllllllllllllllllll ll l<strong>2005</strong>6,045Long-term<strong>com</strong>mitments (1)(in millions of EUR)l llllllllllllllllllllllllllllll ll l20049,922l llllllllllllllllllllllllllllll ll l<strong>2005</strong>17,694(1) Corresponding to 100%new long-term originations/outstanding <strong>com</strong>mitmentsof Kommunalkredit Austria,which is 49%-owned by <strong>Dexia</strong>since 2001.French operator Veolia Water, relating to theconcession contract for water treatment in thecity of Braunschweig.From Berlin, <strong>Dexia</strong> essentially develops itsactivity of managing portfolios of securitiesissued by “sovereigns” and local authorities,operating on both the secondary and theprimary market.Austria<strong>Dexia</strong> has a minority holding (49%) in thecapital of Kommunalkredit Austria, a bankspecializing in the financing of Austrian localauthorities.In <strong>2005</strong>, the Austrian partner had a recordyear. In fact, global long-term outstanding<strong>com</strong>mitments reached EUR 17.7 billionagainst EUR 9.9 billion in 2004. New longtermoriginations were at EUR 6 billion,or double the volume recorded at year-end2004. Outside Austria, KommunalkreditAustria intervenes in Switzerland and in otherdeveloped countries.Other geographic zones• International officesAt year-end <strong>2005</strong>, global long-termoutstanding <strong>com</strong>mitments generated by theactivity of the two international offices of<strong>Dexia</strong> Crédit Local and <strong>Dexia</strong> Bank Belgiumwere EUR 18.9 billion. Total originationsrecorded strong progress, reachingEUR 11.7 billion against EUR 3 billion in 2004.The total volume of financing to the publicsector reached EUR 5.3 billion againstEUR 1.3 billion. The increase observed isexplained by the extremely dynamic activityin Switzerland as well as the developmentof Public Sector Origination activity. InSwitzerland, originations were EUR 1.4 billionin <strong>2005</strong> against EUR 1.0 billion in 2004. Fromits international office, <strong>Dexia</strong> financed otheroperations in Spain, Greece, Canada andJapan.As regards structured financing, <strong>2005</strong> proved tobe an excellent year for originations: they wereEUR 6.4 billion against EUR 1.7 billion in 2004.<strong>Dexia</strong> activity related to the sectors of renewableenergy, oil/gas and tele<strong>com</strong>munications.Among the most remarkable operationswere the arrangements of financing for fourwind farms in Portugal developed by EDFEnergies nouvelles. <strong>Dexia</strong> also played therole of lead manager in the financing of newgas liquefaction factories in Qatar and inEgypt. Finally we note the launch of ImpaxNew Energy Investors, a fund investing inrenewable energies in Europe sponsored by<strong>Dexia</strong>.70