Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

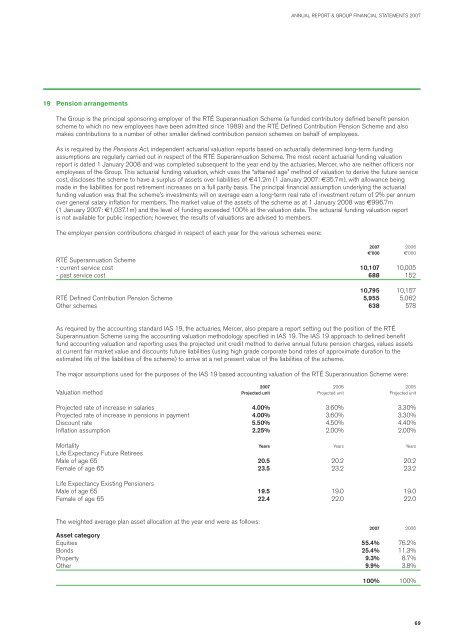

ANNUAL REPORT & GROUP FINANCIAL STATEMENTS 200719 Pension arrangementsThe Group is the principal sponsoring employer of the RTÉ Superannuation Scheme (a funded contributory defined benefit pensionscheme to which no new employees have been admitted since 1989) and the RTÉ Defined Contribution Pension Scheme and alsomakes contributions to a number of other smaller defined contribution pension schemes on behalf of employees.As is required by the Pensions Act, independent actuarial valuation reports based on actuarially determined long-term fundingassumptions are regularly carried out in respect of the RTÉ Superannuation Scheme. The most recent actuarial funding valuationreport is dated 1 January 2008 and was completed subsequent to the year end by the actuaries, Mercer, who are neither officers noremployees of the Group. This actuarial funding valuation, which uses the “attained age” method of valuation to derive the future servicecost, discloses the scheme to have a surplus of assets over liabilities of €41.2m (1 January 2007: €35.7m), with allowance beingmade in the liabilities for post retirement increases on a full parity basis. The principal financial assumption underlying the actuarialfunding valuation was that the scheme’s investments will on average earn a long-term real rate of investment return of 2% per annumover general salary inflation for members. The market value of the assets of the scheme as at 1 January 2008 was €996.7m(1 January 2007: €1,037.1m) and the level of funding exceeded 100% at the valuation date. The actuarial funding valuation reportis not available for public inspection; however, the results of valuations are advised to members.The employer pension contributions charged in respect of each year for the various schemes were:2007 2006€’000 €’000RTÉ Superannuation Scheme- current service cost 10,107 10,005- past service cost 688 15210,795 10,157RTÉ Defined Contribution Pension Scheme 5,955 5,062Other schemes 638 578As required by the accounting standard IAS 19, the actuaries, Mercer, also prepare a report setting out the position of the RTÉSuperannuation Scheme using the accounting valuation methodology specified in IAS 19. The IAS 19 approach to defined benefitfund accounting valuation and reporting uses the projected unit credit method to derive annual future pension charges, values assetsat current fair market value and discounts future liabilities (using high grade corporate bond rates of approximate duration to theestimated life of the liabilities of the scheme) to arrive at a net present value of the liabilities of the scheme.The major assumptions used for the purposes of the IAS 19 based accounting valuation of the RTÉ Superannuation Scheme were:2007 2006 2005Valuation method Projected unit Projected unit Projected unitProjected rate of increase in salaries 4.00% 3.60% 3.30%Projected rate of increase in pensions in payment 4.00% 3.60% 3.30%Discount rate 5.50% 4.50% 4.40%Inflation assumption 2.25% 2.00% 2.00%Mortality Years Years YearsLife Expectancy Future RetireesMale of age 65 20.5 20.2 20.2Female of age 65 23.5 23.2 23.2Life Expectancy Existing PensionersMale of age 65 19.5 19.0 19.0Female of age 65 22.4 22.0 22.0The weighted average plan asset allocation at the year end were as follows:2007 2006Asset categoryEquities 55.4% 76.2%Bonds 25.4% 11.3%Property 9.3% 8.7%Other 9.9% 3.8%100% 100%69