Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

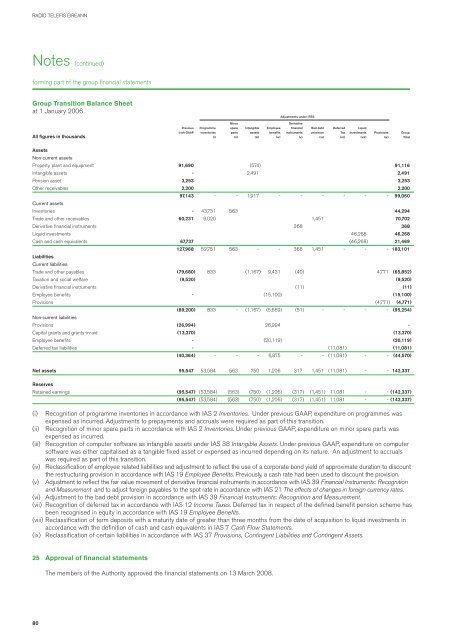

RADIO TELEFÍS ÉIREANNNotes (continued)forming part of the group financial statementsGroup Transition Balance Sheetat 1 January 2006Adjustments under IFRSMinorDerivativePrevious Programme spare Intangible Employee financial Bad debt Deferred LiquidIrish GAAP inventories parts assets benefits instruments provision Tax investments Provisions GroupAll figures in thousands (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) TotalAssetsNon-current assetsProperty, plant and equipment 91,690 (574) 91,116Intangible assets - 2,491 2,491Pension asset 3,253 3,253Other receivables 2,200 2,20097,143 - - 1,917 - - - - - - 99,060Current assetsInventories - 43,731 563 44,294Trade and other receivables 60,231 9,020 1,451 70,702Derivative financial instruments 368 368Liquid investments 46,268 46,268Cash and cash equivalents 67,737 (46,268) 21,469127,968 52,751 563 - - 368 1,451 - - - 183,101LiabilitiesCurrent liabilitiesTrade and other payables (79,680) 833 (1,167) 9,431 (40) 4,771 (65,852)Taxation and social welfare (9,520) (9,520)Derivative financial instruments (11) (11)Employee benefits - (15,100) (15,100)Provisions (4,771) (4,771)(89,200) 833 - (1,167) (5,669) (51) - - - - (95,254)Non-current liabilitiesProvisions (26,994) 26,994 -Capital grants and grants-in-aid (13,370) (13,370)Employee benefits - (20,119) (20,119)Deferred tax liabilities - (11,081) (11,081)(40,364) - - - 6,875 - - (11,081) - - (44,570)Net assets 95,547 53,584 563 750 1,206 317 1,451 (11,081) - - 142,337ReservesRetained earnings (95,547) (53,584) (563) (750) (1,206) (317) (1,451) 11,081 - - (142,337)(95,547) (53,584) (563) (750) (1,206) (317) (1,451) 11,081 - - (142,337)(i) Recognition of programme inventories in accordance with IAS 2 Inventories. Under previous GAAP, expenditure on programmes wasexpensed as incurred. Adjustments to prepayments and accruals were required as part of this transition.(ii) Recognition of minor spare parts in accordance with IAS 2 Inventories. Under previous GAAP, expenditure on minor spare parts wasexpensed as incurred.(iii) Recognition of computer software as intangible assets under IAS 38 Intangible Assets. Under previous GAAP, expenditure on computersoftware was either capitalised as a tangible fixed asset or expensed as incurred depending on its nature. An adjustment to accrualswas required as part of this transition.(iv) Reclassification of employee related liabilities and adjustment to reflect the use of a corporate bond yield of approximate duration to discountthe restructuring provision in accordance with IAS 19 Employee Benefits. Previously, a cash rate had been used to discount the provision.(v) Adjustment to reflect the fair value movement of derivative financial instruments in accordance with IAS 39 Financial Instruments: Recognitionand Measurement and to adjust foreign payables to the spot rate in accordance with IAS 21 The effects of changes in foreign currency rates.(vi) Adjustment to the bad debt provision in accordance with IAS 39 Financial Instruments: Recognition and Measurement.(vii) Recognition of deferred tax in accordance with IAS 12 Income Taxes. Deferred tax in respect of the defined benefit pension scheme hasbeen recognised in equity in accordance with IAS 19 Employee Benefits.(viii) Reclassification of term deposits with a maturity date of greater than three months from the date of acquisition to liquid investments inaccordance with the definition of cash and cash equivalents in IAS 7 Cash Flow Statements.(ix) Reclassification of certain liabilities in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.25 Approval of financial statementsThe members of the Authority approved the financial statements on 13 March 2008.80