Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

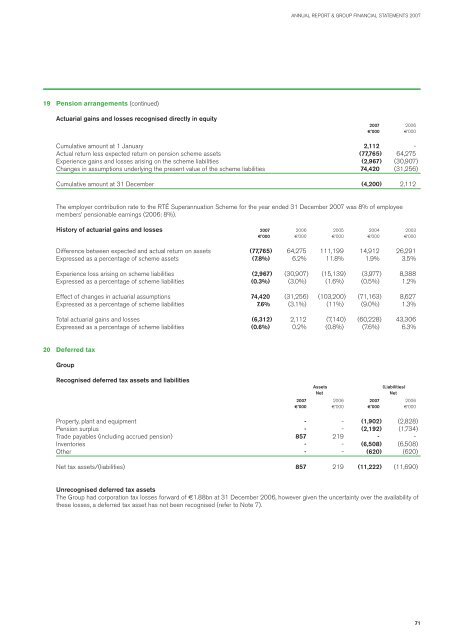

ANNUAL REPORT & GROUP FINANCIAL STATEMENTS 200719 Pension arrangements (continued)Actuarial gains and losses recognised directly in equity2007 2006€’000 €’000Cumulative amount at 1 January 2,112 -Actual return less expected return on pension scheme assets (77,765) 64,275Experience gains and losses arising on the scheme liabilities (2,967) (30,907)Changes in assumptions underlying the present value of the scheme liabilities 74,420 (31,256)Cumulative amount at 31 December (4,200) 2,112The employer contribution rate to the RTÉ Superannuation Scheme for the year ended 31 December 2007 was 8% of employeemembers’ pensionable earnings (2006: 8%).History of actuarial gains and losses 2007 2006 2005 2004 2003€’000 €’000 €’000 €’000 €’000Difference between expected and actual return on assets (77,765) 64,275 111,199 14,912 26,291Expressed as a percentage of scheme assets (7.8%) 6.2% 11.8% 1.9% 3.5%Experience loss arising on scheme liabilities (2,967) (30,907) (15,139) (3,977) 8,388Expressed as a percentage of scheme liabilities (0.3%) (3.0%) (1.6%) (0.5%) 1.2%Effect of changes in actuarial assumptions 74,420 (31,256) (103,200) (71,163) 8,627Expressed as a percentage of scheme liabilities 7.6% (3.1%) (11%) (9.0%) 1.3%Total actuarial gains and losses (6,312) 2,112 (7,140) (60,228) 43,306Expressed as a percentage of scheme liabilities (0.6%) 0.2% (0.8%) (7.6%) 6.3%20 Deferred taxGroupRecognised deferred tax assets and liabilitiesAssets(Liabilities)NetNet2007 2006 2007 2006€’000 €’000 €’000 €’000Property, plant and equipment - - (1,902) (2,828)Pension surplus - - (2,192) (1,734)Trade payables (including accrued pension) 857 219 - -Inventories - - (6,508) (6,508)Other - - (620) (620)Net tax assets/(liabilities) 857 219 (11,222) (11,690)Unrecognised deferred tax assetsThe Group had corporation tax losses forward of €1.88bn at 31 December 2006, however given the uncertainty over the availability ofthese losses, a deferred tax asset has not been recognised (refer to Note 7).71