Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

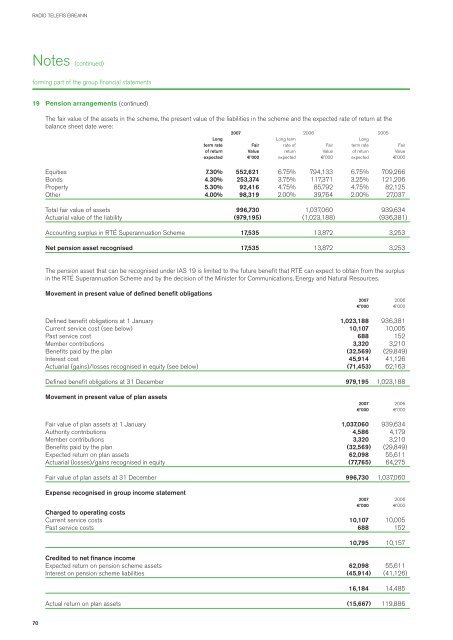

RADIO TELEFÍS ÉIREANNNotes (continued)forming part of the group financial statements19 Pension arrangements (continued)The fair value of the assets in the scheme, the present value of the liabilities in the scheme and the expected rate of return at thebalance sheet date were:2007 2006 2005Long Long term Longterm rate Fair rate of Fair term rate Fairof return Value return Value of return Valueexpected €’000 expected €’000 expected €’000Equities 7.30% 552,621 6.75% 794,133 6.75% 709,266Bonds 4.30% 253,374 3.75% 117,371 3.25% 121,206Property 5.30% 92,416 4.75% 85,792 4.75% 82,125Other 4.00% 98,319 2.00% 39,764 2.00% 27,037Total fair value of assets 996,730 1,037,060 939,634Actuarial value of the liability (979,195) (1,023,188) (936,381)Accounting surplus in RTÉ Superannuation Scheme 17,535 13,872 3,253Net pension asset recognised 17,535 13,872 3,253The pension asset that can be recognised under IAS 19 is limited to the future benefit that RTÉ can expect to obtain from the surplusin the RTÉ Superannuation Scheme and by the decision of the Minister for Communications, Energy and Natural Resources.Movement in present value of defined benefit obligations2007 2006€’000 €’000Defined benefit obligations at 1 January 1,023,188 936,381Current service cost (see below) 10,107 10,005Past service cost 688 152Member contributions 3,320 3,210Benefits paid by the plan (32,569) (29,849)Interest cost 45,914 41,126Actuarial (gains)/losses recognised in equity (see below) (71,453) 62,163Defined benefit obligations at 31 December 979,195 1,023,188Movement in present value of plan assets2007 2006€’000 €’000Fair value of plan assets at 1 January 1,037,060 939,634Authority contributions 4,586 4,179Member contributions 3,320 3,210Benefits paid by the plan (32,569) (29,849)Expected return on plan assets 62,098 55,611Actuarial (losses)/gains recognised in equity (77,765) 64,275Fair value of plan assets at 31 December 996,730 1,037,060Expense recognised in group income statement2007 2006€’000 €’000Charged to operating costsCurrent service costs 10,107 10,005Past service costs 688 15210,795 10,157Credited to net finance incomeExpected return on pension scheme assets 62,098 55,611Interest on pension scheme liabilities (45,914) (41,126)16,184 14,485Actual return on plan assets (15,667) 119,88670