Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

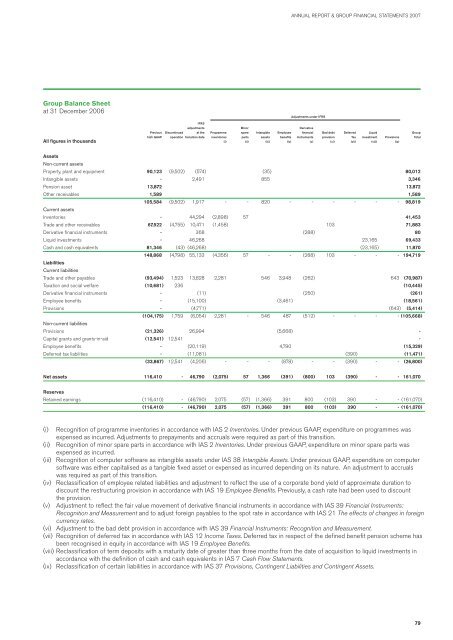

ANNUAL REPORT & GROUP FINANCIAL STATEMENTS 2007Group Balance Sheetat 31 December 2006Adjustments under IFRSIFRSadjustments Minor DerivativePrevious Discontinued at the Programme spare Intangible Employee financial Bad debt Deferred Liquid GroupIrish GAAP operation transition date inventories parts assets benefits instruments provision Tax investment Provisions TotalAll figures in thousands (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix)AssetsNon-current assetsProperty, plant and equipment 90,123 (9,502) (574) (35) 80,012Intangible assets - 2,491 855 3,346Pension asset 13,872 13,872Other receivables 1,589 1,589105,584 (9,502) 1,917 - - 820 - - - - - - 98,819Current assetsInventories - 44,294 (2,898) 57 41,453Trade and other receivables 67,522 (4,755) 10,471 (1,458) 103 71,883Derivative financial instruments - 368 (288) 80Liquid investments - 46,268 23,165 69,433Cash and cash equivalents 81,346 (43) (46,268) (23,165) 11,870148,868 (4,798) 55,133 (4,356) 57 - - (288) 103 - - - 194,719LiabilitiesCurrent liabilitiesTrade and other payables (93,494) 1,523 13,828 2,281 546 3,948 (262) 643 (70,987)Taxation and social welfare (10,681) 236 (10,445)Derivative financial instruments - (11) (250) (261)Employee benefits - (15,100) (3,461) (18,561)Provisions - (4,771) (643) (5,414)(104,175) 1,759 (6,054) 2,281 - 546 487 (512) - - - - (105,668)Non-current liabilitiesProvisions (21,326) 26,994 (5,668) -Capital grants and grants-in-aid (12,541) 12,541 -Employee benefits - (20,119) 4,790 (15,329)Deferred tax liabilities - (11,081) (390) (11,471)(33,867) 12,541 (4,206) - - - (878) - - (390) - - (26,800)Net assets 116,410 - 46,790 (2,075) 57 1,366 (391) (800) 103 (390) - - 161,070ReservesRetained earnings (116,410) - (46,790) 2,075 (57) (1,366) 391 800 (103) 390 - - (161,070)(116,410) - (46,790) 2,075 (57) (1,366) 391 800 (103) 390 - - (161,070)(i) Recognition of programme inventories in accordance with IAS 2 Inventories. Under previous GAAP, expenditure on programmes wasexpensed as incurred. Adjustments to prepayments and accruals were required as part of this transition.(ii) Recognition of minor spare parts in accordance with IAS 2 Inventories. Under previous GAAP, expenditure on minor spare parts wasexpensed as incurred.(iii) Recognition of computer software as intangible assets under IAS 38 Intangible Assets. Under previous GAAP, expenditure on computersoftware was either capitalised as a tangible fixed asset or expensed as incurred depending on its nature. An adjustment to accrualswas required as part of this transition.(iv) Reclassification of employee related liabilities and adjustment to reflect the use of a corporate bond yield of approximate duration todiscount the restructuring provision in accordance with IAS 19 Employee Benefits. Previously, a cash rate had been used to discountthe provision.(v) Adjustment to reflect the fair value movement of derivative financial instruments in accordance with IAS 39 Financial Instruments:Recognition and Measurement and to adjust foreign payables to the spot rate in accordance with IAS 21 The effects of changes in foreigncurrency rates.(vi) Adjustment to the bad debt provision in accordance with IAS 39 Financial Instruments: Recognition and Measurement.(vii) Recognition of deferred tax in accordance with IAS 12 Income Taxes. Deferred tax in respect of the defined benefit pension scheme hasbeen recognised in equity in accordance with IAS 19 Employee Benefits.(viii) Reclassification of term deposits with a maturity date of greater than three months from the date of acquisition to liquid investments inaccordance with the definition of cash and cash equivalents in IAS 7 Cash Flow Statements.(ix) Reclassification of certain liabilities in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.79