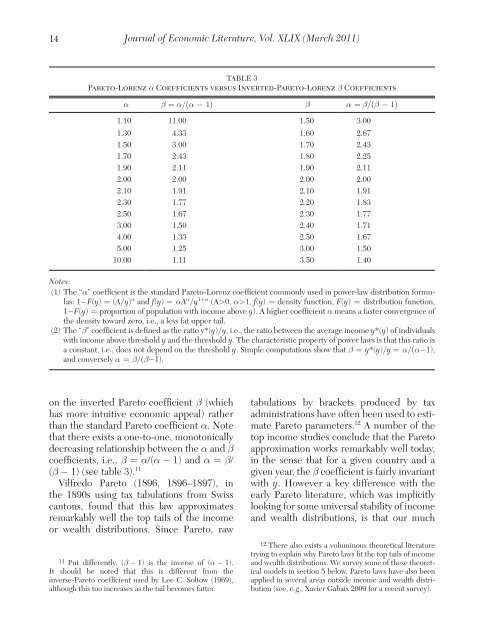

14Journal <strong>of</strong> Economic Literature, Vol. XLIX (March 2011)Table 3Pareto-Lorenz α Coefficients versus Inverted-Pareto-Lorenz β Coefficientsα β = α/(α − 1) β α = β/(β − 1)1.10 11.00 1.50 3.001.30 4.33 1.60 2.671.50 3.00 1.70 2.431.70 2.43 1.80 2.251.90 2.11 1.90 2.112.00 2.00 2.00 2.002.10 1.91 2.10 1.912.30 1.77 2.20 1.832.50 1.67 2.30 1.773.00 1.50 2.40 1.714.00 1.33 2.50 1.675.00 1.25 3.00 1.5010.00 1.11 3.50 1.40Notes:(1) The “α” coefficient is <strong>the</strong> st<strong>and</strong>ard Pareto-Lorenz coefficient commonly used <strong>in</strong> power-law distribution formulas:1−F(y) = (A/y) α <strong>and</strong> f(y) = αA α /y 1+α (A>0, α>1, f(y) = density function, F(y) = distribution function,1−F(y) = proportion <strong>of</strong> population <strong>with</strong> <strong>in</strong>come above y). A higher coefficient α means a faster convergence <strong>of</strong><strong>the</strong> density toward zero, i.e., a less fat upper tail.(2) The “β” coefficient is def<strong>in</strong>ed as <strong>the</strong> ratio y*(y)/y, i.e., <strong>the</strong> ratio between <strong>the</strong> average <strong>in</strong>come y*(y) <strong>of</strong> <strong>in</strong>dividuals<strong>with</strong> <strong>in</strong>come above threshold y <strong>and</strong> <strong>the</strong> threshold y. The characteristic property <strong>of</strong> power laws is that this ratio isa constant, i.e., does not depend on <strong>the</strong> threshold y. Simple computations show that β = y*(y)/y = α/(α−1),<strong>and</strong> conversely α = β/(β−1).on <strong>the</strong> <strong>in</strong>verted Pareto coefficient β (whichhas more <strong>in</strong>tuitive economic appeal) ra<strong>the</strong>rthan <strong>the</strong> st<strong>and</strong>ard Pareto coefficient α. Notethat <strong>the</strong>re exists a one-to-one, monotonicallydecreas<strong>in</strong>g relationship between <strong>the</strong> α <strong>and</strong> βcoefficients, i.e., β = α/(α − 1) <strong>and</strong> α = β/(β − 1) (see table 3). 11Vilfredo Pareto (1896, 1896–1897), <strong>in</strong><strong>the</strong> 1890s us<strong>in</strong>g tax tabulations from Swisscantons, found that this law approximatesremarkably well <strong>the</strong> top tails <strong>of</strong> <strong>the</strong> <strong>in</strong>comeor wealth distributions. S<strong>in</strong>ce Pareto, raw11 Put differently, (β − 1) is <strong>the</strong> <strong>in</strong>verse <strong>of</strong> (α − 1).It should be noted that this is different from <strong>the</strong><strong>in</strong>verse-Pareto coefficient used by Lee C. Soltow (1969),although this too <strong>in</strong>creases as <strong>the</strong> tail becomes fatter.tabulations by brackets produced by taxadm<strong>in</strong>istrations have <strong>of</strong>ten been used to estimatePareto parameters. 12 A number <strong>of</strong> <strong>the</strong>top <strong>in</strong>come studies conclude that <strong>the</strong> Paretoapproximation works remarkably well today,<strong>in</strong> <strong>the</strong> sense that for a given country <strong>and</strong> agiven year, <strong>the</strong> β coefficient is fairly <strong>in</strong>variant<strong>with</strong> y. However a key difference <strong>with</strong> <strong>the</strong>early Pareto literature, which was implicitlylook<strong>in</strong>g for some universal stability <strong>of</strong> <strong>in</strong>come<strong>and</strong> wealth distributions, is that our much12 There also exists a volum<strong>in</strong>ous <strong>the</strong>oretical literaturetry<strong>in</strong>g to expla<strong>in</strong> why Pareto laws fit <strong>the</strong> top tails <strong>of</strong> <strong>in</strong>come<strong>and</strong> wealth distributions. We survey some <strong>of</strong> <strong>the</strong>se <strong>the</strong>oreticalmodels <strong>in</strong> section 5 below. Pareto laws have also beenapplied <strong>in</strong> several areas outside <strong>in</strong>come <strong>and</strong> wealth distribution(see, e.g., Xavier Gabaix 2009 for a recent survey).

Atk<strong>in</strong>son, Piketty, <strong>and</strong> Saez: <strong>Top</strong> <strong>Incomes</strong> <strong>in</strong> <strong>the</strong> <strong>Long</strong> <strong>Run</strong> <strong>of</strong> History15larger time span <strong>and</strong> geographical scopeallows us to document <strong>the</strong> fact that Paretocoefficients vary substantially over time <strong>and</strong>across countries.From this viewpo<strong>in</strong>t, one additionaladvantage <strong>of</strong> us<strong>in</strong>g <strong>the</strong> β coefficient is thata higher β coefficient generally meanslarger top <strong>in</strong>come shares <strong>and</strong> higher <strong>in</strong>come<strong>in</strong>equality (while <strong>the</strong> reverse is true <strong>with</strong><strong>the</strong> more commonly used α coefficient).For <strong>in</strong>stance, <strong>in</strong> <strong>the</strong> United States, <strong>the</strong> βcoefficient (estimated at <strong>the</strong> top percentilethreshold <strong>and</strong> exclud<strong>in</strong>g capital ga<strong>in</strong>s)<strong>in</strong>creased gradually from 1.69 <strong>in</strong> 1976 to2.89 <strong>in</strong> 2007 as top percentile <strong>in</strong>come sharesurged from 7.9 percent to 18.9 percent. 13In a country like France, where <strong>the</strong> β coefficienthas been stable around 1.65–1.75s<strong>in</strong>ce <strong>the</strong> 1970s, <strong>the</strong> top percentile <strong>in</strong>comeshare has also been stable around 7.5 percent–8.5percent, except at <strong>the</strong> very end <strong>of</strong><strong>the</strong> period. 14 In practice, we shall see that βcoefficients typically vary between 1.5 <strong>and</strong> 3:values around 1.5–1.8 <strong>in</strong>dicate low <strong>in</strong>equalityby historical st<strong>and</strong>ards (<strong>with</strong> top 1 percent<strong>in</strong>come shares typically between 5 percent<strong>and</strong> 10 percent), while values around orabove 2.5 <strong>in</strong>dicate very high <strong>in</strong>equality (<strong>with</strong>top 1 percent <strong>in</strong>come shares typically around15 percent–20 percent or higher). In <strong>the</strong>case <strong>of</strong> <strong>the</strong> United K<strong>in</strong>gdom <strong>in</strong> 1911–12, ahigh <strong>in</strong>equality country, one can easily computefrom table 2 that <strong>the</strong> average <strong>in</strong>come <strong>of</strong>taxpayers above £5,000 was £12,390, i.e., <strong>the</strong>β coefficient was equal to 2.48. 15In practice, it is possible to verify whe<strong>the</strong>rPareto (or split histogram) <strong>in</strong>terpolations areaccurate when large micro tax return data<strong>with</strong> over-sampl<strong>in</strong>g at <strong>the</strong> top are available asis <strong>the</strong> case <strong>in</strong> <strong>the</strong> United States s<strong>in</strong>ce 1960.Those direct comparisons show that errorsdue to <strong>in</strong>terpolations are typically very smallif <strong>the</strong> number <strong>of</strong> brackets is sufficiently large<strong>and</strong> if <strong>in</strong>come amounts are also reported. In<strong>the</strong> end, <strong>the</strong> error due to Pareto <strong>in</strong>terpolationis likely to be dwarfed by various adjustments<strong>and</strong> imputations required for mak<strong>in</strong>gseries homogeneous, or errors <strong>in</strong> <strong>the</strong> estimation<strong>of</strong> <strong>the</strong> <strong>in</strong>come control total (see below).3.1.2 Control Total for PopulationIn some countries, such as Canada, NewZeal<strong>and</strong> from 1963, or <strong>the</strong> United K<strong>in</strong>gdomfrom 1990, <strong>the</strong> tax unit is <strong>the</strong> <strong>in</strong>dividual.In that case, <strong>the</strong> natural control total is <strong>the</strong>adult population def<strong>in</strong>ed as all residents ator above a certa<strong>in</strong> age cut<strong>of</strong>f, <strong>and</strong> <strong>the</strong> toppercentile share will measure <strong>the</strong> share <strong>of</strong>total <strong>in</strong>come accru<strong>in</strong>g to <strong>the</strong> top percentile<strong>of</strong> adult <strong>in</strong>dividuals. In o<strong>the</strong>r countries, taxunits are families. In <strong>the</strong> United K<strong>in</strong>gdom,for example, <strong>the</strong> tax unit until 1990 wasdef<strong>in</strong>ed as a married couple liv<strong>in</strong>g toge<strong>the</strong>r,<strong>with</strong> dependent children (<strong>with</strong>out <strong>in</strong>dependent<strong>in</strong>come), or as a s<strong>in</strong>gle adult, <strong>with</strong>dependent children, or as a child <strong>with</strong> <strong>in</strong>dependent<strong>in</strong>come. The control total used byAtk<strong>in</strong>son (2005) for <strong>the</strong> U.K. population forthis period is <strong>the</strong> total number <strong>of</strong> peopleaged 15 <strong>and</strong> over m<strong>in</strong>us <strong>the</strong> number <strong>of</strong> marriedfemales. In <strong>the</strong> United States, marriedwomen can file tax separate returns, but <strong>the</strong>number is “fairly small (about 1 percent <strong>of</strong>all returns <strong>in</strong> 1998)” (Piketty <strong>and</strong> Saez 2003).Piketty <strong>and</strong> Saez <strong>the</strong>refore treat <strong>the</strong> data as13 When we <strong>in</strong>clude capital ga<strong>in</strong>s, <strong>the</strong> rise <strong>of</strong> <strong>the</strong> β coefficientis even more dramatic, from 1.82 <strong>in</strong> 1976 to 3.42<strong>in</strong> 2007.14 See Atk<strong>in</strong>son <strong>and</strong> Piketty (2007, 2010).15 The stability <strong>of</strong> β coefficients (for a given country <strong>and</strong>a given year) only holds for top <strong>in</strong>comes, typically <strong>with</strong><strong>in</strong><strong>the</strong> top percentile. For <strong>in</strong>comes below <strong>the</strong> top percentile,<strong>the</strong> β coefficient takes much higher values (for very small<strong>in</strong>comes it goes to <strong>in</strong>f<strong>in</strong>ity). With<strong>in</strong> <strong>the</strong> top percentile, <strong>the</strong> βcoefficient varies slightly, <strong>and</strong> falls for <strong>the</strong> very top <strong>in</strong>comes(at <strong>the</strong> level <strong>of</strong> <strong>the</strong> s<strong>in</strong>gle richest taxpayer, β is by def<strong>in</strong>itionequal to 1), but generally not before <strong>the</strong> top 0.1 percentor top 0.01 percent threshold. In <strong>the</strong> example <strong>of</strong> table 2,one can easily compute that <strong>the</strong> β coefficient gradually fallsfrom 2.48 at <strong>the</strong> £5,000 threshold to 2.28 at <strong>the</strong> £10,000threshold <strong>and</strong> 1.85 at <strong>the</strong> £100,000 threshold (<strong>with</strong> onlysixty-six taxpayers left).

- Page 5 and 6: Atkinson, Piketty, and Saez: Top In

- Page 7 and 8: Atkinson, Piketty, and Saez: Top In

- Page 9 and 10: Atkinson, Piketty, and Saez: Top In

- Page 11: Atkinson, Piketty, and Saez: Top In

- Page 15 and 16: Atkinson, Piketty, and Saez: Top In

- Page 17 and 18: Atkinson, Piketty, and Saez: Top In

- Page 19 and 20: Atkinson, Piketty, and Saez: Top In

- Page 21 and 22: Atkinson, Piketty, and Saez: Top In

- Page 23 and 24: Atkinson, Piketty, and Saez: Top In

- Page 25 and 26: Atkinson, Piketty, and Saez: Top In

- Page 27 and 28: Atkinson, Piketty, and Saez: Top In

- Page 29 and 30: Atkinson, Piketty, and Saez: Top In

- Page 31 and 32: Atkinson, Piketty, and Saez: Top In

- Page 33 and 34: Atkinson, Piketty, and Saez: Top In

- Page 35 and 36: Atkinson, Piketty, and Saez: Top In

- Page 37 and 38: Atkinson, Piketty, and Saez: Top In

- Page 39 and 40: Atkinson, Piketty, and Saez: Top In

- Page 41 and 42: Atkinson, Piketty, and Saez: Top In

- Page 43 and 44: Atkinson, Piketty, and Saez: Top In

- Page 45 and 46: Atkinson, Piketty, and Saez: Top In

- Page 47 and 48: Atkinson, Piketty, and Saez: Top In

- Page 49 and 50: Atkinson, Piketty, and Saez: Top In

- Page 51 and 52: Atkinson, Piketty, and Saez: Top In

- Page 53 and 54: Atkinson, Piketty, and Saez: Top In

- Page 55 and 56: Atkinson, Piketty, and Saez: Top In

- Page 57 and 58: Atkinson, Piketty, and Saez: Top In

- Page 59 and 60: Atkinson, Piketty, and Saez: Top In

- Page 61 and 62: Atkinson, Piketty, and Saez: Top In

- Page 63 and 64:

Atkinson, Piketty, and Saez: Top In

- Page 65 and 66:

Atkinson, Piketty, and Saez: Top In

- Page 67 and 68:

Atkinson, Piketty, and Saez: Top In

- Page 69:

Atkinson, Piketty, and Saez: Top In