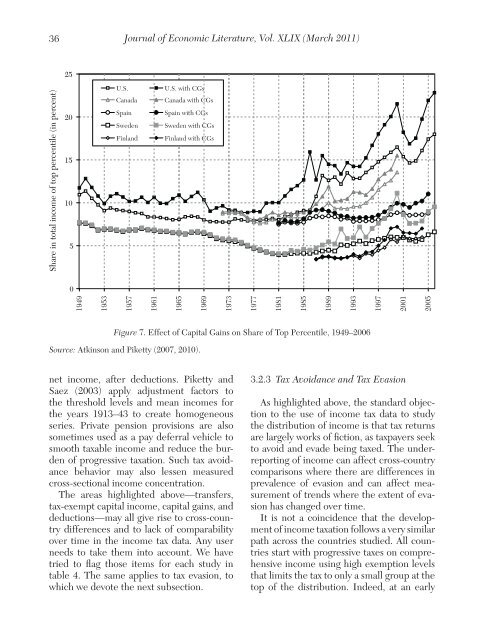

36Journal <strong>of</strong> Economic Literature, Vol. XLIX (March 2011)2520151050194919531957196119651969197319771981198519891993199720012005Share <strong>in</strong> total <strong>in</strong>come <strong>of</strong> top percentile (<strong>in</strong> percent)U.S.CanadaSpa<strong>in</strong>SwedenF<strong>in</strong>l<strong>and</strong>U.S. <strong>with</strong> CGsCanada <strong>with</strong> CGsSpa<strong>in</strong> <strong>with</strong> CGsSweden <strong>with</strong> CGsF<strong>in</strong>l<strong>and</strong> <strong>with</strong> CGsFigure 7. Effect <strong>of</strong> Capital Ga<strong>in</strong>s on Share <strong>of</strong> <strong>Top</strong> Percentile, 1949–2006Source: Atk<strong>in</strong>son <strong>and</strong> Piketty (2007, 2010).net <strong>in</strong>come, after deductions. Piketty <strong>and</strong>Saez (2003) apply adjustment factors to<strong>the</strong> threshold levels <strong>and</strong> mean <strong>in</strong>comes for<strong>the</strong> years 1913–43 to create homogeneousseries. Private pension provisions are alsosometimes used as a pay deferral vehicle tosmooth taxable <strong>in</strong>come <strong>and</strong> reduce <strong>the</strong> burden<strong>of</strong> progressive taxation. Such tax avoidancebehavior may also lessen measuredcross-sectional <strong>in</strong>come concentration.The areas highlighted above—transfers,tax-exempt capital <strong>in</strong>come, capital ga<strong>in</strong>s, <strong>and</strong>deductions—may all give rise to cross-countrydifferences <strong>and</strong> to lack <strong>of</strong> comparabilityover time <strong>in</strong> <strong>the</strong> <strong>in</strong>come tax data. Any userneeds to take <strong>the</strong>m <strong>in</strong>to account. We havetried to flag those items for each study <strong>in</strong>table 4. The same applies to tax evasion, towhich we devote <strong>the</strong> next subsection.3.2.3 Tax Avoidance <strong>and</strong> Tax EvasionAs highlighted above, <strong>the</strong> st<strong>and</strong>ard objectionto <strong>the</strong> use <strong>of</strong> <strong>in</strong>come tax data to study<strong>the</strong> distribution <strong>of</strong> <strong>in</strong>come is that tax returnsare largely works <strong>of</strong> fiction, as taxpayers seekto avoid <strong>and</strong> evade be<strong>in</strong>g taxed. The underreport<strong>in</strong>g<strong>of</strong> <strong>in</strong>come can affect cross-countrycomparisons where <strong>the</strong>re are differences <strong>in</strong>prevalence <strong>of</strong> evasion <strong>and</strong> can affect measurement<strong>of</strong> trends where <strong>the</strong> extent <strong>of</strong> evasionhas changed over time.It is not a co<strong>in</strong>cidence that <strong>the</strong> development<strong>of</strong> <strong>in</strong>come taxation follows a very similarpath across <strong>the</strong> countries studied. All countriesstart <strong>with</strong> progressive taxes on comprehensive<strong>in</strong>come us<strong>in</strong>g high exemption levelsthat limits <strong>the</strong> tax to only a small group at <strong>the</strong>top <strong>of</strong> <strong>the</strong> distribution. Indeed, at an early

Atk<strong>in</strong>son, Piketty, <strong>and</strong> Saez: <strong>Top</strong> <strong>Incomes</strong> <strong>in</strong> <strong>the</strong> <strong>Long</strong> <strong>Run</strong> <strong>of</strong> History37stage <strong>of</strong> <strong>in</strong>dustrial development, when a substantialfraction <strong>of</strong> economic activity takesplace <strong>in</strong> small <strong>in</strong>formal bus<strong>in</strong>esses, it is justnot possible for <strong>the</strong> government to enforcea comprehensive <strong>in</strong>come tax on a wide share<strong>of</strong> <strong>the</strong> population. 27 However, even <strong>in</strong> earlystages <strong>of</strong> economic development, Alvaredo<strong>and</strong> Saez (2009) note “<strong>the</strong> <strong>in</strong>comes <strong>of</strong> high<strong>in</strong>come <strong>in</strong>dividuals are identifiable because<strong>the</strong>y derive <strong>the</strong>ir <strong>in</strong>comes from large <strong>and</strong>modern bus<strong>in</strong>esses or f<strong>in</strong>ancial <strong>in</strong>stitutions<strong>with</strong> verifiable accounts, or from highly paid(<strong>and</strong> verifiable) salaried positions, or property<strong>in</strong>come from publicly known assets(such as large l<strong>and</strong> estates <strong>with</strong> regular rental<strong>in</strong>come).” 28 Therefore, it is conceivable that<strong>the</strong> early progressive <strong>in</strong>come taxes, uponwhich statistics those studies are based, capturedreasonably well most components <strong>of</strong>top <strong>in</strong>comes. If tax avoidance <strong>and</strong> evasion has<strong>in</strong>creased s<strong>in</strong>ce <strong>the</strong>n, <strong>the</strong> degree <strong>of</strong> equalizationmay be overstated.Williamson <strong>and</strong> L<strong>in</strong>dert (1980) confront<strong>the</strong> issue directly for <strong>the</strong> data for <strong>the</strong> UnitedStates. They ask whe<strong>the</strong>r “superior tax avoidance”can have accounted for <strong>the</strong> <strong>in</strong>comelevel<strong>in</strong>g over <strong>the</strong> period 1929–51 found byKuznets (1953). As <strong>the</strong>y note, <strong>the</strong> argument<strong>of</strong> spurious level<strong>in</strong>g depends on a doubledifferential: that tax avoidance/evasion has<strong>in</strong>creased, <strong>and</strong> that it has <strong>in</strong>creased faster for<strong>the</strong> top <strong>in</strong>comes. On <strong>the</strong> basis <strong>of</strong> comparisons<strong>of</strong> reported <strong>in</strong>come totals <strong>with</strong> nationalaccounts data, <strong>the</strong>y conclude that “evenunder a strong assumption about changes<strong>in</strong> <strong>the</strong> pattern <strong>of</strong> ly<strong>in</strong>g, most <strong>of</strong> <strong>the</strong> level<strong>in</strong>grema<strong>in</strong>s unobscured” (1980, p. 88).27 Even today <strong>in</strong> <strong>the</strong> most advanced economies, small<strong>in</strong>formal bus<strong>in</strong>esses may escape <strong>the</strong> <strong>in</strong>dividual <strong>in</strong>cometaxes.28 Indeed, before comprehensive taxation starts, mostcountries had already adopted schedular separate taxes onspecific <strong>in</strong>come sources such as wages <strong>and</strong> salaries, pr<strong>of</strong>itsfrom large bus<strong>in</strong>esses, rental <strong>in</strong>come from large estates.Such schedular taxes emerge when economic developmentmakes enforcement feasible.The extent <strong>of</strong> contemporary tax evasionis considered specifically <strong>in</strong> a number <strong>of</strong>studies. In <strong>the</strong> case <strong>of</strong> Sweden, Ro<strong>in</strong>e <strong>and</strong>Waldenström (2008) conclude that overallevasion is modest (around 5 percent <strong>of</strong>all <strong>in</strong>comes) <strong>and</strong> that <strong>the</strong>re is no reason tobelieve that underreport<strong>in</strong>g has changeddramatically over time. A speculative reasonfor this may be that while <strong>the</strong> <strong>in</strong>centives tounderreport have <strong>in</strong>creased as tax rates havegone up over time <strong>the</strong> adm<strong>in</strong>istrative controlover tax compliance has also been improved.The Nordic countries may well be different.In <strong>the</strong> case <strong>of</strong> Italy, Alvaredo <strong>and</strong> ElenaPisano (2010) note <strong>the</strong> widespread view <strong>of</strong>tax evasion be<strong>in</strong>g much higher than <strong>in</strong> o<strong>the</strong>rOECD countries. Audits <strong>and</strong> subsequentsc<strong>and</strong>als <strong>in</strong>volv<strong>in</strong>g show-bus<strong>in</strong>ess people,well-known fashion designers, <strong>and</strong> sportstars help support this idea among <strong>the</strong> generalpublic, even when <strong>the</strong>y also provide evidenceabout <strong>the</strong> fact that top <strong>in</strong>come earnersare very visible for <strong>the</strong> tax adm<strong>in</strong>istration.The evidence for Italy does <strong>in</strong>deed suggestthat evasion is important among small bus<strong>in</strong>esses<strong>and</strong> <strong>the</strong> self-employed (traditionallynumerous <strong>in</strong> Italy), for whom <strong>the</strong>re is nodouble report<strong>in</strong>g, but that, for wages, salaries,<strong>and</strong> pensions at <strong>the</strong> top <strong>of</strong> <strong>the</strong> distribution,<strong>the</strong>re is little room for evad<strong>in</strong>g those<strong>in</strong>come components that must be reported<strong>in</strong>dependently by employers or <strong>the</strong> pay<strong>in</strong>gauthorities. They conclude that <strong>the</strong> evasionfrom self-employment <strong>and</strong> small bus<strong>in</strong>ess<strong>in</strong>come is unlikely to account for <strong>the</strong> gap <strong>in</strong>top <strong>in</strong>comes between Italy <strong>and</strong> Anglo-Saxoncountries.Ano<strong>the</strong>r source <strong>of</strong> evidence is provided bytax amnesties, <strong>and</strong> Alvaredo (2010) discusses<strong>the</strong> results for Argent<strong>in</strong>a. Information from<strong>the</strong> 1962 tax amnesty (which attempted touncover all <strong>in</strong>come that had been evadedby taxpayers between 1956 <strong>and</strong> 1961) suggestedunderreport<strong>in</strong>g <strong>of</strong> between 27 <strong>and</strong>40 percent. However, it varied <strong>with</strong> <strong>in</strong>come.Evasion shows a lower impact at <strong>the</strong> bottom

- Page 5 and 6: Atkinson, Piketty, and Saez: Top In

- Page 7 and 8: Atkinson, Piketty, and Saez: Top In

- Page 9 and 10: Atkinson, Piketty, and Saez: Top In

- Page 11 and 12: Atkinson, Piketty, and Saez: Top In

- Page 13 and 14: Atkinson, Piketty, and Saez: Top In

- Page 15 and 16: Atkinson, Piketty, and Saez: Top In

- Page 17 and 18: Atkinson, Piketty, and Saez: Top In

- Page 19 and 20: Atkinson, Piketty, and Saez: Top In

- Page 21 and 22: Atkinson, Piketty, and Saez: Top In

- Page 23 and 24: Atkinson, Piketty, and Saez: Top In

- Page 25 and 26: Atkinson, Piketty, and Saez: Top In

- Page 27 and 28: Atkinson, Piketty, and Saez: Top In

- Page 29 and 30: Atkinson, Piketty, and Saez: Top In

- Page 31 and 32: Atkinson, Piketty, and Saez: Top In

- Page 33: Atkinson, Piketty, and Saez: Top In

- Page 37 and 38: Atkinson, Piketty, and Saez: Top In

- Page 39 and 40: Atkinson, Piketty, and Saez: Top In

- Page 41 and 42: Atkinson, Piketty, and Saez: Top In

- Page 43 and 44: Atkinson, Piketty, and Saez: Top In

- Page 45 and 46: Atkinson, Piketty, and Saez: Top In

- Page 47 and 48: Atkinson, Piketty, and Saez: Top In

- Page 49 and 50: Atkinson, Piketty, and Saez: Top In

- Page 51 and 52: Atkinson, Piketty, and Saez: Top In

- Page 53 and 54: Atkinson, Piketty, and Saez: Top In

- Page 55 and 56: Atkinson, Piketty, and Saez: Top In

- Page 57 and 58: Atkinson, Piketty, and Saez: Top In

- Page 59 and 60: Atkinson, Piketty, and Saez: Top In

- Page 61 and 62: Atkinson, Piketty, and Saez: Top In

- Page 63 and 64: Atkinson, Piketty, and Saez: Top In

- Page 65 and 66: Atkinson, Piketty, and Saez: Top In

- Page 67 and 68: Atkinson, Piketty, and Saez: Top In

- Page 69: Atkinson, Piketty, and Saez: Top In