You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

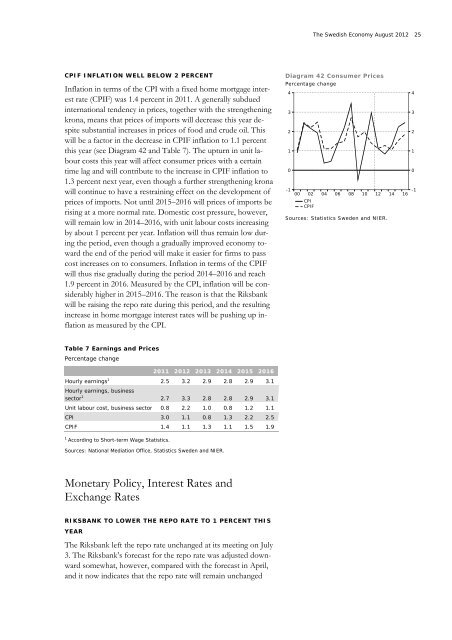

<strong>The</strong> <strong>Swedish</strong> <strong>Economy</strong> <strong>August</strong> <strong>2012</strong> 25CPIF INFLATION WELL BELOW 2 PERCENTInflation in terms of the CPI with a fixed home mortgage interestrate (CPIF) was 1.4 percent in 2011. A generally subduedinternational tendency in prices, together with the strengtheningkrona, means that prices of imports will decrease this year despitesubstantial increases in prices of food and crude oil. Thiswill be a factor in the decrease in CPIF inflation to 1.1 percentthis year (see Diagram 42 and Table 7). <strong>The</strong> upturn in unit labourcosts this year will affect consumer prices with a certaintime lag and will contribute to the increase in CPIF inflation to1.3 percent next year, even though a further strengthening kronawill continue to have a restraining effect on the development ofprices of imports. Not until 2015–2016 will prices of imports berising at a more normal rate. Domestic cost pressure, however,will remain low in 2014–2016, with unit labour costs increasingby about 1 percent per year. Inflation will thus remain low duringthe period, even though a gradually improved economy towardthe end of the period will make it easier for firms to passcost increases on to consumers. Inflation in terms of the CPIFwill thus rise gradually during the period 2014–2016 and reach1.9 percent in 2016. Measured by the CPI, inflation will be considerablyhigher in 2015–2016. <strong>The</strong> reason is that the Riksbankwill be raising the repo rate during this period, and the resultingincrease in home mortgage interest rates will be pushing up inflationas measured by the CPI.Diagram 42 Consumer PricesPercentage change43210-10002CPICPIF0406081012Sources: Statistics Sweden and NIER.141643210-1Table 7 Earnings and PricesPercentage change2011 <strong>2012</strong> 2013 2014 2015 2016Hourly earnings 1 2.5 3.2 2.9 2.8 2.9 3.1Hourly earnings, businesssector 1 2.7 3.3 2.8 2.8 2.9 3.1Unit labour cost, business sector 0.8 2.2 1.0 0.8 1.2 1.1CPI 3.0 1.1 0.8 1.3 2.2 2.5CPIF 1.4 1.1 1.3 1.1 1.5 1.91According to Short-term Wage Statistics.Sources: National Mediation Office, Statistics Sweden and NIER.Monetary Policy, Interest Rates andExchange RatesRIKSBANK TO LOWER THE REPO RATE TO 1 PERCENT THISYEAR<strong>The</strong> Riksbank left the repo rate unchanged at its meeting on July3. <strong>The</strong> Riksbank’s forecast for the repo rate was adjusted downwardsomewhat, however, compared with the forecast in April,and it now indicates that the repo rate will remain unchanged